Development Bank sets up minpaku fund

Some countries and international cities may be banning Airbnb-style accommodation in an attempt to alleviate a housing crisis, but not Japan. With inbound tourism expanding, the government-owned Development Bank of Japan has established a real estate fund to invest in ‘minpaku’ or Airbnb-style short-term accommodation in Japan. This is the first domestic bank to establish this initiative.Read more

Akasaka Garden City sells for 54.6 billion Yen

Sekisui House Reit is selling its share in Akasaka Garden City to an unnamed domestic special purpose company for 54.6 billion Yen (approx. US$365 million).Read more

Share of Kinshicho office tower to sell for 18.5 billion Yen

Global One Real Estate Investment Corp. is selling its ownership share in the 22-story Arca Central office building in Kinshicho for 18.5 billion Yen (approx. US$124 million). The buyer has not been publicly disclosed.Read more

Rising construction costs delay redevelopment of Nakano Sunplaza

Redevelopment of the Nakano Sunplaza is likely to be delayed as rising construction have resulted in a blow out in estimated project costs.Read more

Nogizaka talent agency HQ sold to real estate company

Real estate giant HULIC has emerged as the buyer of the disgraced former Johnny & Associates (now Smile-Up) headquarters in Akasaka. The sale took place in June 2024 at an undisclosed price.Read more

Standard Land Prices increase 1.4% thanks to semiconductors and tourists

Standard Land Prices were announced on September 17, and a small town of just 36,000 residents in Kyushu topped the nationwide ranking for commercial land price growth with a 33.3% increase. There’s a simple reason - semiconductors.Read more

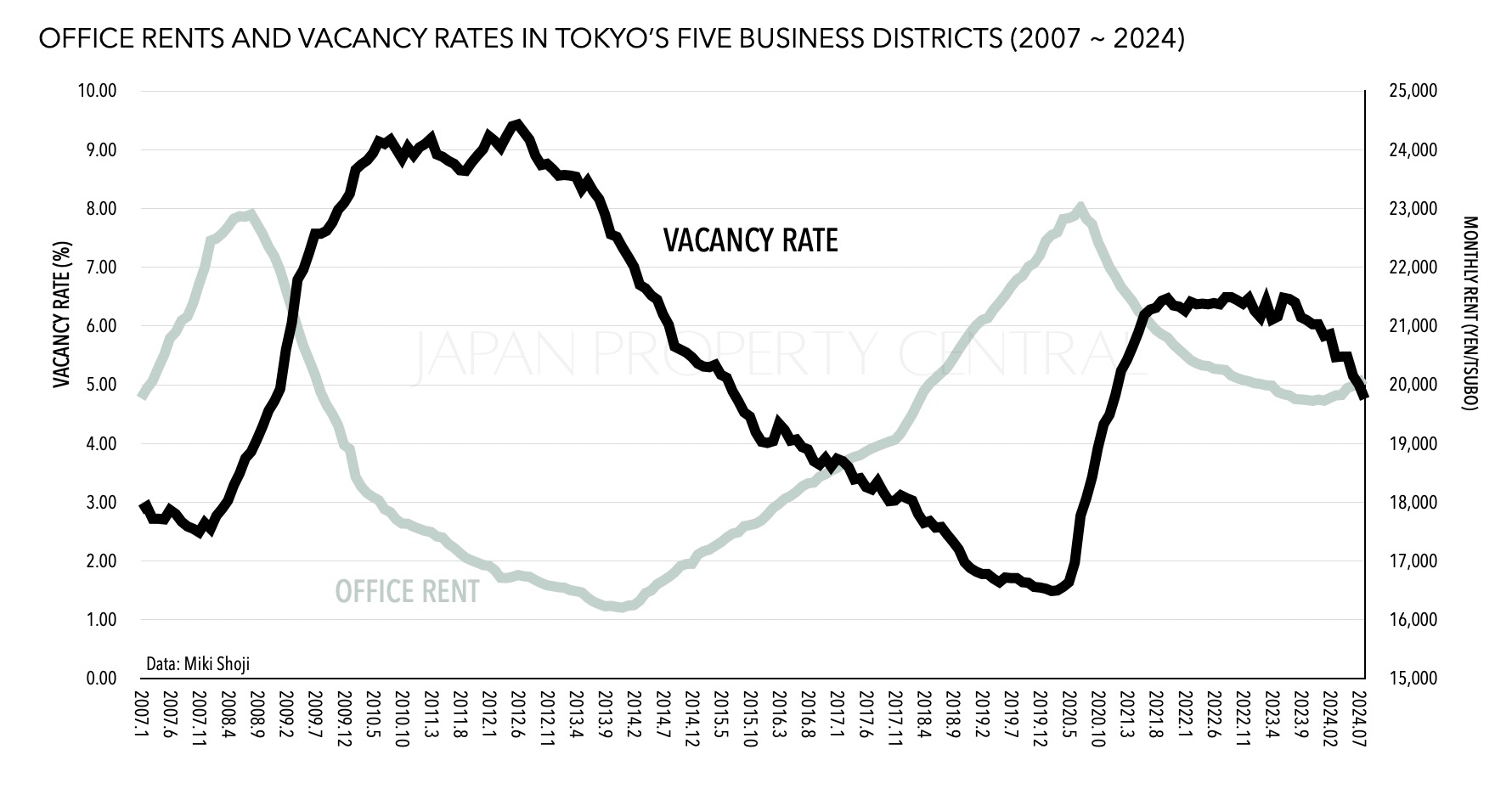

Central Tokyo's office vacancy rate drops to lowest level since Dec 2020

Central Tokyo’s office vacancy rate dropped to 4.76% in August, the lowest level seen since December 2020, according to brokerage Miki Shoji. For existing buildings, excluding new construction, the vacancy rate was 4.53%, down from 5.64% seen this time last year.Read more