Secondhand apartment prices in September 2014 - Tokyo Kantei

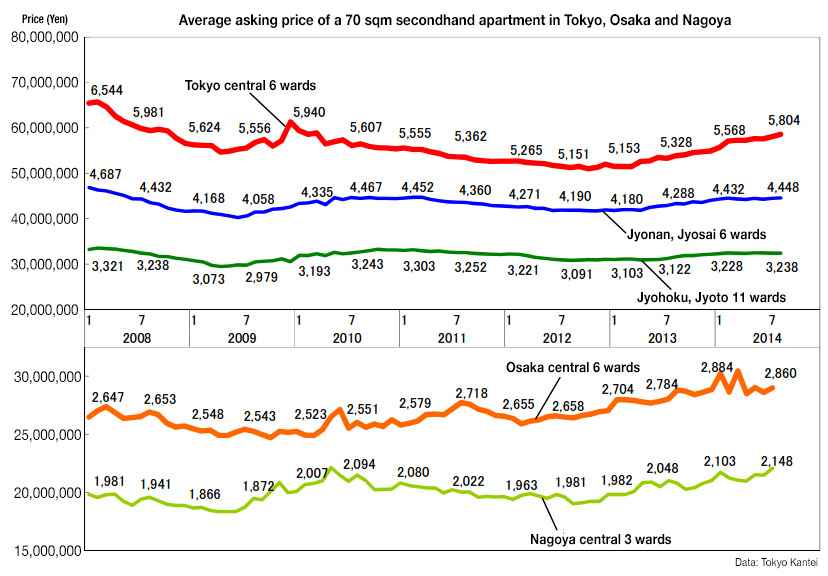

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 42,160,000 Yen in September, up 0.5% from the previous month and up 4.3% from last year. The average apartment age was 22.5 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 59,160,000 Yen, up 1.0% from the previous month and up 9.5% from last year. The average apartment age was 21.8 years.

The average price across greater Tokyo was 28,230,000 Yen, up 0.3% from the previous month and up 1.2% from last year. The average apartment age was 21.8 years.Read more

September rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,575 Yen/sqm in September, up 0.5% from the previous month and up 1.2% from last year. The average apartment size was 60.01 sqm and the average building age was 19.3 years.

The average rent in Tokyo’s 23-ku was 3,207 Yen/sqm, up 1.3% from the previous month and up 3.6% from last year. The average apartment size was 57.02 sqm and the average building age was 17.4 years.Read more

Secondhand apartment prices in August 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 41,930,000 Yen in August, up 0.5% from the previous month and up 3.9% from last year. The average apartment age was 22.4 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 58,570,000 Yen, up 0.9% from the previous month and up 8.7% from last year. The average apartment age was 24.4 years.

The average price across greater Tokyo was 28,140,000 Yen, down 0.4% from the previous month but up 0.9% from last year. The average building age was 21.7 years.Read more

August rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,561 Yen/sqm in August, up 0.1% from the previous month and up 0.5% from last year. The average apartment size was 59.71 sqm and the average building age was 19.2 years.

The average rent in Tokyo’s 23-ku was 3,166 Yen/sqm, down 0.3% from the previous month but up 2.3% from last year. The average apartment size was 56.65 sqm and the average building age was 17.5 years.Read more

Office vacancy rates in August 2014 - Miki Shoji

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 6.08% in August, down 0.18 points from the previous month and down 2.14 points from last year.

The vacancy rate in brand new office buildings was 18.17%, up 0.76 points from the previous month and up 0.24 points from last year.Read more

Secondhand apartment prices in July 2014 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 41,740,000 Yen in July, up 0.3% from the previous month and up 4.7% from last year. The average apartment age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 58,040,000 Yen, up 0.8% from the previous month and up 8.9% from last year. The average apartment age was 22.2 years.

The average price across greater Tokyo was 28,250,000 Yen, down 0.2% from the previous month but up 2.2% from last year. The average building age was 21.6 years.Read more

July rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,558 Yen/sqm in July, down 2.0% from the previous month but up 1.0% from last year. The average apartment size was 59.92 sqm and the average building age was 18.9 years.

The average rent in Tokyo’s 23-ku was 3,174 Yen/sqm, showing no change from the previous month and up 2.5% from last year. The average apartment size was 56.38 sqm and the average building age was 17.1 years.Read more