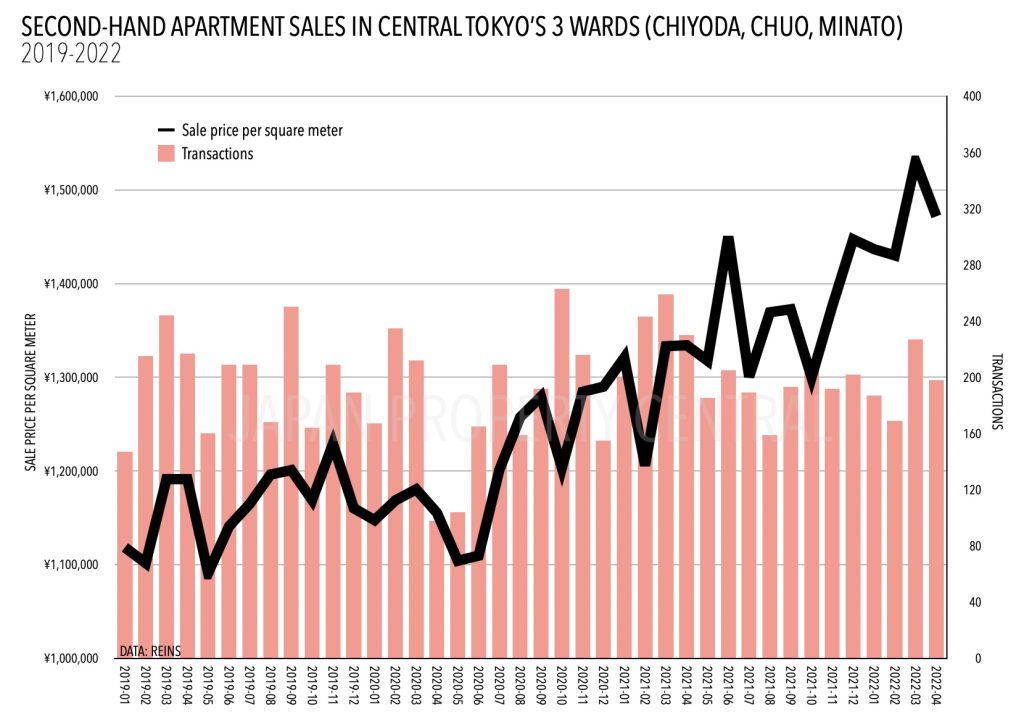

Central Tokyo apartment resale values have increased by as much as 111%

According to Tokyo Kantei, an apartment in greater Tokyo has seen a 19.8% increase in its resale price over the past 10 years. That’s the average across a wide-spanning region that includes suburban areas in Saitama, Chiba and Kanagawa. In central Tokyo, the rate of growth has been much more staggering with some locations seeing prices increase by between 70 ~ 111%.

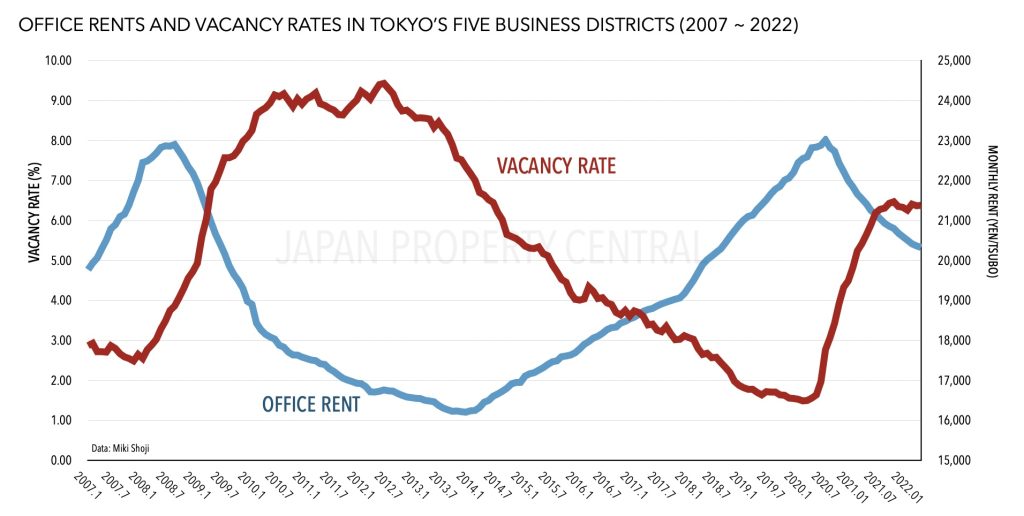

Tokyo’s office vacancy rate flattens in April

Tokyo’s office vacancy rate increased only slightly by 0.01 points to 6.38% in April as large-scale leases continued to be filled in existing buildings in the city center. Some tenants were relocating to be better located in Tokyo’s business districts. Vacant office space, too, saw little change from the previous month.

New data center planned for Nihonbashi

Real estate giant HULIC is embarking on a redevelopment project that will see an older office building demolished to make way for a new data center in Nihonbashi.

Price-earnings ratios for Tokyo apartments in 2021

With rental growth exceeding the increase in sale prices, the average price-earnings ratio (PER) for a brand-new apartment across greater Tokyo in 2021 was 24.56, down slightly from 2020 (24.69) but up from 2019 (24.36). A high PER means a low rental yield.

Government to collate real estate info on one website

The Japanese government is working on creating an online resource that will provide information on land values (government assessed values, not market values), town planning, and risk maps all in one place.

Tokyo apartment prices increase for 24th month

The average reported sale price of a second-hand apartment in the Tokyo metropolitan area reached 919,400 Yen/sqm in April. This is a 4.2% increase from March and a 14.1% increase from last year. It’s also the 24th month in a row to see a year-on-year increase in sale prices.

US fund buys 1,200 share houses

U.S. investment fund Lone Star is acquiring approximately 1,200 share houses from debtors that fell for a failed investment scam operated under the Kabocha-no-basha brand. The total acquisition price is estimated to be around 70 billion Yen (approx. US$536 million).