Greater Tokyo's largest apartment development announced

Chiba Prefecture announced the three developers that have been chosen to work on a large-scale apartment project in Makuhari New City in Chiba. Mitsui Fudosan, Mitsubishi Jisho and Nomura Real Estate will begin work on a 180 billion Yen (1.5 billion USD) residential complex with approximately 4,300 apartments. When complete, it will be the largest apartment complex in the greater Tokyo area.

To appeal to young family buyers, prices will kept at affordable levels, with some suggesting they could be around the 40 million Yen (335,000 USD) range. The complex will house as many as 10,000 residents when complete.Read more

Town in West Tokyo offering free homes to new residents

Okutama Town in the far western outskirts of Tokyo is offering free homes to entice younger residents. Under the scheme, selected families will be provided with accommodation for 15 years, after which they will receive ownership of the house for free. They will not be charged rent for the duration of the term, although they will be required to pay annual property taxes (around 30,000 Yen per year) and will have to bear any renovation and repair costs.

Okutama Town in the far western outskirts of Tokyo is offering free homes to entice younger residents. Under the scheme, selected families will be provided with accommodation for 15 years, after which they will receive ownership of the house for free. They will not be charged rent for the duration of the term, although they will be required to pay annual property taxes (around 30,000 Yen per year) and will have to bear any renovation and repair costs.

This is the second time that the town has offered free housing. In January and February, the town received over 250 inquiries and 24 applications on a house offered under the scheme.Read more

Toranomon fast becoming a hotspot of development

The 2020 Summer Olympics and 2027 opening of the new maglev line have helped to spur along some major construction projects in Tokyo, in particular the Toranomon area.

Since the opening of Toranomon Hills in 2014, the Toranomon area is quickly emerging as Tokyo’s newest hub for international business. It is not just an office area, as nearby hotels, hospitals, and serviced apartments are also in the process of being built. There are also plans for a new station along the Hibiya Line that will connect with Toranomon Hills.

Mori Building is the major player in this district, and plans to invest over a trillion Yen in projects in the Toranomon and Roppongi area over the next 10 years.Read more

High-rise apartment trends from 2015 onwards

According to data compiled by the Real Estate Economic Institute, there are currently 262 super high-rise* residential buildings containing 101,450 apartments planned for completion across Japan from 2015 onwards. This is an increase of 75 buildings and 25,910 apartments from last year.

77,824 of the apartments, comprising 76.7% of the total, are located in the greater Tokyo area, and 50,371 apartments (49.7%) are within Tokyo’s 23 wards.

The planning and construction of super high-rise apartment buildings began to increase in the late 1990s. High-rise apartment buildings have remained steadily popular with buyers, and have retained relatively strong re-sale values.

However, the downturn in the property market following the collapse of Lehman Brothers in late 2008 saw developers limit the supply of new construction. As a result, the annual supply of apartments went from 35,609 in 2009 to 17,967 in 2010. The Tohoku tsunami and earthquake in 2011 saw a number of projects in the Tohoku and Kanto regions delayed, and new supply dropped to 13,321 apartments.Read more

Historic Yokohama building to be converted into shared office

The historic former Kanto Local Finance Bureau building in downtown Yokohama will re-open in 2016 as a restaurant and shared office space after undergoing restoration and renovations.

The heritage listed property was built in 1928 and was originally the Yokohama ranch office of Nihon Menka - a raw cotton importer that is now Sojitz Corporation. It was temporarily confiscated by the US during the occupation in 1952, before being sold to the national government in 1954. From 1960 it was used as the Yokohama branch of the Ministry of Finance. Yokohama City acquired the 4-storey concrete building in 2003.

In August 2014, Yokohama City started an appeal to find suitable uses for the building. The Yokohama DeNA BayStars baseball team were selected out of nine applicants to manage and operate the building.Read more

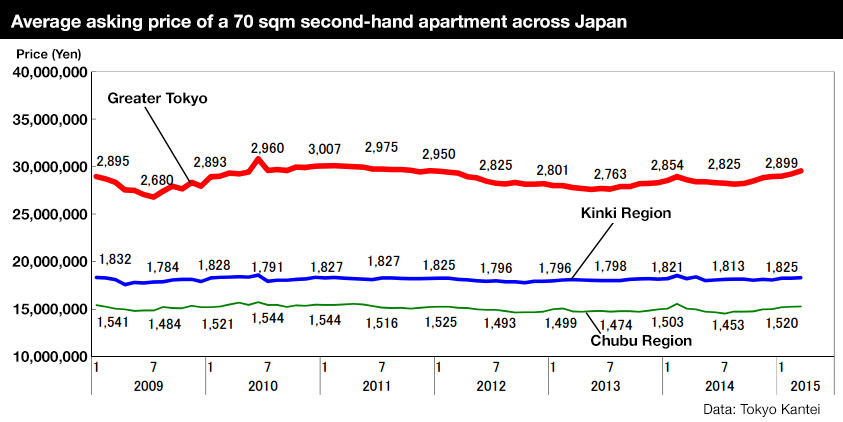

Apartment asking prices up for 7th month in a row

Second-hand apartment prices in greater Tokyo continue to rise this month with the average asking price of a 70 sqm (753 sq ft) apartment up 1.1% from February and up 3.3% from last year. This is the 7th month in a row to see a month-on-month increase. According to Tokyo Kantei, the average apartment asking price greater Tokyo in March was 29,560,000 Yen.

In Tokyo’s 23 wards, the average asking price was 45,360,000 Yen, up 1.7% from the previous month and up 9.4% from last year. The average building age was 22.1 years. The property market in Tokyo is far-outperforming Yokohama City (+1.5% from March 2014), Saitama City (+2.5%), Chiba City (-2.3%) and Osaka City (+3.1%).

Prices continue to reach new highs in central Tokyo’s six wards with the average asking price reaching 64,680,000 Yen, an increase of 2.1% from February and and increase of 13.0% from last year. This is the 9th month in a row to see a month-on-month increase. The gap between price rises in central Tokyo and other wards is becoming more apparent.

Asking prices are being supported by an increase in actual contracted prices. Sellers and real estate brokers are also setting higher and higher asking prices. The market for second-hand properties in Tokyo has been strengthening as a shrinking supply of new apartments is causing buyers to consider older apartments which are typically less expensive. Demand from investors is also strong, and properties that have been set at high prices are starting to sell without any discounting.Read more

Luxury ryokans seeing surge in investment

With expectations of growing demand from travellers and foreign tourists, luxury ryokans (traditional Japanese inns) and hotels across Japan are now a highly sought-after target by funds and major real estate companies. This means foreign investors looking to get into the hotel market in Japan will be facing increasingly tough competition from domestic investors.

This month, real estate giant HULIC will acquire two hotel properties in Hakone and Atami from Kato Pleasure Group. HULIC’s main business is office leasing and management, but with a declining population, they have been expanding their operations to other areas of the property market.Read more