Tokyo apartment asking prices up for 17th month in a row

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) second-hand apartment in greater Tokyo in November was 32,740,000 Yen, up 2.4% from the previous month and up 13.6% from last year. This is the 15th month in a row to see a month-on-month increase. The increase was driven by a larger share of sales in the Tokyo metropolitan area, which pulled up the average. The average building age was 22.2 years.

In Tokyo’s 23 wards, the average asking price was 50,630,000 Yen, up 1.7% from the previous month and up 16.9% from last year. This is the 17th month in a row to see a month-on-month increase. The average building age was 21.8 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average asking price was 70,560,000 Yen, up 1.2% from the previous moth and up 15.1% from last year. The average building age was 20.1 years.Read more

Tokyo apartment rents slide for second month

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,624 Yen/sqm in November, down 2.1% from the previous month but up 2.5% from last year. The average apartment size was 59.76 sqm and the average building age was 19.6 years.

In the Tokyo metropolitan area, the average rent was 3,157 Yen/sqm, down 0.8% from the previous month but up 3.1% from last year. The average apartment size was 56.99 sqm and the average building age was 18.0 years.

In Tokyo’s 23 wards, the average rent was 3,306 Yen/sqm, down 0.3% from the previous month but up 3.3% from last year. The average apartment size was 56.26 sqm and the average building age was 17.5 years.

Sumitomo bans AirBnb-type rentals in new condominium

According to the Nikkei Shimbun, property developer Sumitomo Realty & Development has taken an unusual step by adding a clause to the management bylaws of a new condominium that outright bans any short-term letting by individual apartment owners.

This is in response to a growing number of complaints from buyers after moving into a building and finding that a number of units, even the guest suites usually reserved for residents and their guests, were being illegally rented out by investors as overnight accommodation to tourists.Read more

Historic Rokkosan Hotel to close

Hankyu Hanshin Hotels, part of Hankyu Hanshin Holdings, will close the historic 86-year old Rokkosan Hotel in Kobe on December 20. Hotel operations will continue in the newer 45-room main building located next door.

The original hotel was opened in 1929 as an annex to the Takarazuka Hotel, before later operating as an independent hotel. It was designed by architect Masaharu Furuzuka, one of the Osaka-Kobe area’s leading modernist architects. Furuzuka also designed the Takarazuka Hotel in 1926.Read more

New apartment prices in greater Tokyo exceed 60 million Yen for first time since 1991

According to the Real Estate Economic Institute, 3,496 brand new apartments were released for sale in greater Tokyo in November, up 19.7% from the previous month and up 4.8% from last year. 2,871 apartments were sold, making the contract ratio 82.1%, up 13.3 points from the previous month and up 3.7 points from last year.

The average price of a new apartment was 63,280,000 Yen, up 18.0% from the previous month and up 21.1% from last year. This is the first time that prices have exceeded 60 million Yen since June 1991. The average price per square meter was 871,000 Yen, up 14.8% from the previous month and up 18.2% from last year.Read more

Osaka's new short-term letting rules leave out Osaka City

On October 27, Osaka Prefecture became the first area in Japan to approve the new and relaxed rules regarding short-term accommodation.

Despite the changes, there are still strict requirements, including:

- Obtaining permission from local authorities before letting out the property.

- Having a signed fixed-term rental agreement with the host and the guest.

- A minimum room size of 25 sqm. Each room must have it’s own lockable bath, toilet and kitchen.

- The minimum stay must be 6 nights and 7 days.

- Hosts will be obligated to keep a guest book with guest names, passport numbers, and must check and confirm the identity of each guest.

- Local authorities will have the right to conduct physical inspections of the properties. If a problem is found, the operator will lose their permission to operate short-term letting.

- The following areas are not included in the relaxed rules: Osaka City, Sakai City, Takatsuki City, Higashi-osaka City, Toyonaka City, Hirakata City.

It is important to note that a large part of the urban area in Osaka is not part of the relaxed rules. Operators of properties in areas in white in the map below will require a hotel license to provide accommodation for less than 30 days.Read more

Tokyo apartment prices increase for 38th consecutive month

According to REINS, 2,971 second-hand apartments were sold across greater Tokyo in November, up 3.3% from the previous month and up 5.0% from last year. The average apartment sale price was 29,160,000 Yen, down 1.1% from the previous month but up 3.8% from last year. The average price per square meter was 459,800 Yen, up 0.4% from the previous month and up 4.2% from last year. The average building age was 20.45 years.

In the Tokyo metropolitan area, 1,500 second-hand apartments were sold, up 6.0% from the previous month and up 4.8% from last year. The average sale price was 36,110,000 Yen, down 2.0% from the previous month but up 6.0% from last year. The average price per square meter was 619,600 Yen, up 0.1% from the previous month and up 7.6% from last year. This is the 38th month in a row to see a year-on-year increase in the sale price per square meter. The average building age was 19.27 years.

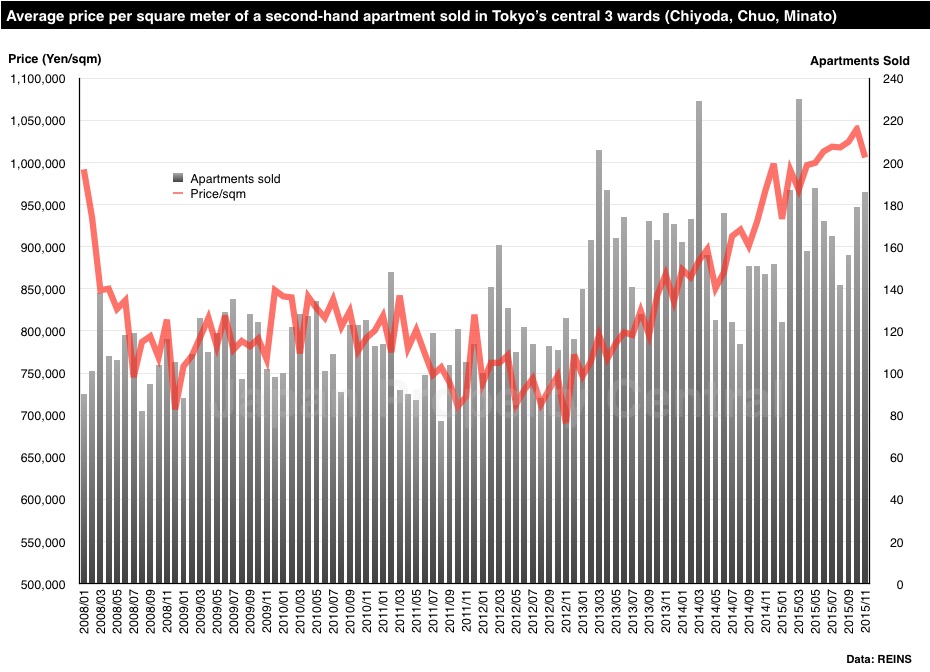

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 186 apartments were sold, up 3.9% from the previous month and up 26.5% from last year. This is the highest number of transactions recorded for the month of November since record-keeping began in 2008, and is 63% higher than the average transaction numbers seen between 2008 ~ 2012.

The average sale price was 53,770,000 Yen, down 6.0% from the previous month but up 8.3% from last year. The average price per square meter was 1,005,900 Yen, down 3.3% from the previous month but up 4.1% from last year. The average building age was 18.19 years.Read more