Kyushu's tallest building to be built by 2019

Nishi-Nippon Railroad is planning a 46-storey apartment building for Fukuoka City. The 152 meter tall building will be the tallest* building in Kyushu when complete in 2019.

The high-rise will be 3 meters taller than Kyushu’s current tallest apartment building - I Tower - which was completed earlier this year and located on the same island. Apartments in I Tower were selling for around 375,000 Yen per square meter when new.Read more

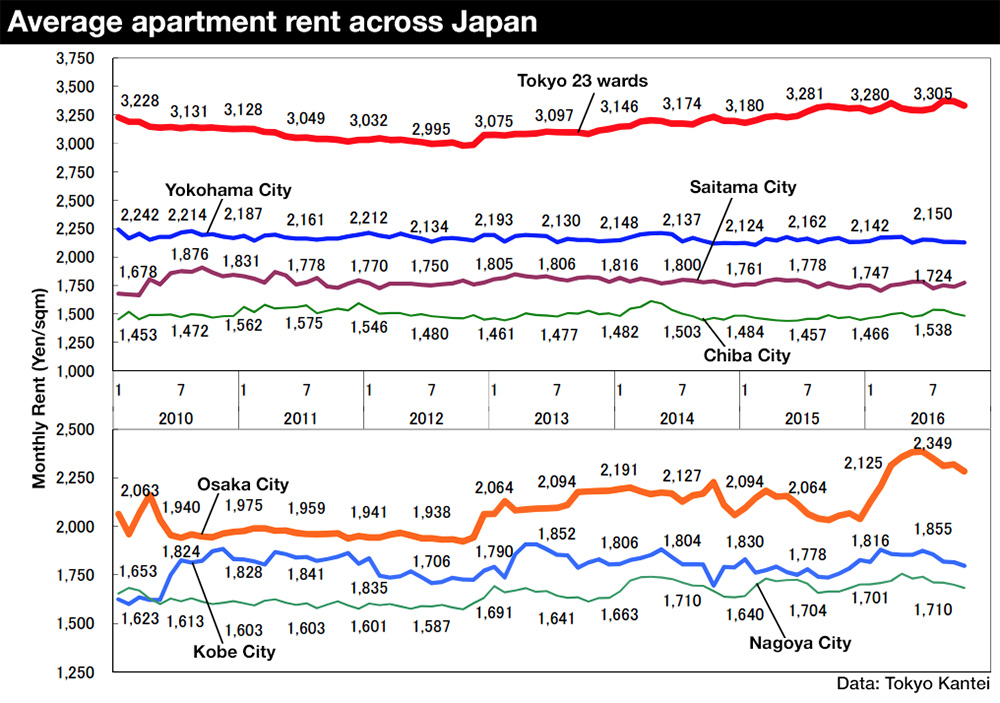

Average apartment rent in October 2016

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,697 Yen/sqm in October, up 1.3% from the previous month and up 0.6% from last year. The average apartment size was 59.29 sqm and the average building age was 20.1 years. In October, apartments in the Tokyo metropolitan area accounted for 66.5% of all listings across greater Tokyo, up from a 60.7% share in September. This contributed to the increase in rent from the previous month as prices in the Tokyo area are higher than surrounding prefectures.

In the Tokyo metropolitan area the average monthly rent was 3,153 Yen/sqm, down 2.4% from the previous month and down 1.0% from last year. The average apartment size was 56.99 sqm and the average building age was 18.4 years.Read more

New apartment sales in October 2016

Approximately 37,000 new apartments are estimated to be released for sale in greater Tokyo in 2016, resulting in the lowest supply since 2009. In an environment of rising construction costs and rising sale prices, developers are being cautious to keep a careful balance between supply and demand.

According to the Real Estate Economic Institute, 2,903 new apartments were offered for sale across greater Tokyo in October, down 15.2% from the previous month and down 0.6% from last year. 1,789 apartments were sold, resulting in a contract ratio of 61.6%, down 10.4 points from the previous month and down 7.2 points from last year.

153 apartments in high-rise buildings (over 20-storeys) were released for sale, down 67.8% from last year. The contract ratio was 52.3%, down 27.5 points from last year.

The average price of a new apartment across greater Tokyo was 54,060,000 Yen, down 3.1% from the previous month but up 0.8% from last year. The average price per square meter was 793,000 Yen, up 0.1% from the previous month and up 4.5% from last year.Read more

Ritz Carlton opening hotel in Nikko

Tobu Railway and Marriott International will be opening The Ritz Carlton Nikko on the shores of Lake Chuzenji in 2020. The two companies entered into an agreement on November 7. Marriott currently operates Ritz Carlton hotels in Tokyo, Osaka, Okinawa, and Kyoto. They are also planning to open one in the ski resort town of Niseko in Hokkaido.

The hotel will be built on the site of the former Nikko Lake Side Hotel. It is a 19,000 square meter block on the eastern side of Lake Chuzenji. The former hotel, which was built in 1968, will be demolished to make way for a new building.Read more

Median new apartment prices in Tokyo reach record while supply remains limited

According to the Real Estate Economic Institute, the median price of a brand new apartment in greater Tokyo between January and September 2016 was 50,800,000 Yen, up 5.9% from 2015 and up 37.7% from 10 years ago.

The median price for the Kinki region (Osaka, Hyogo, Kyoto, Shiga, Nara and Wakayama) was 37,300,000 Yen, up 3.1% from 2015 and up 18.4% from 10 years ago. In Osaka city, the median price was 33,100,000 Yen, down 3.5% from 2015. Kyoto city, meanwhile, recorded a 12.8% increase in the median price of new apartments over the past year. Prices are now up 69% from 2005.Read more

Tokyo apartment sale prices increase for 49th month

According to REINS, 3,339 second-hand apartments were sold across greater Tokyo in October, up 6.0% from the previous month and up 16.1% from last year. The average sale price was 31,360,000 Yen, up 0.3% from the previous month and up 6.4% from last year. The average price per square meter was 485,800 Yen, down 1.0% from the previous month but up 6.1% from last year. This is the 46th month in a row to see a year-on-year increase. The average building age was 19.73 years.

In the Tokyo metropolitan area, 1,683 second-hand apartments were sold, up 1.9% from the previous month and up 18.9% from last year. The average sale price was 38,270,000 Yen, down 0.2% from the previous month but up 3.8% from last year. The average price per square meter was 638,900 Yen, down 1.4% from the previous month but up 3.2% from last year. This is the 49th month in a row to see a year-on-year increase. The average building age was 18.87 years.

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 193 second-hand apartments were sold, up 1.6% from the previous month and up 7.8% from last year. The average sale price was 58,640,000 Yen, down 10.9% from the previous month but up 2.5% from last year. The average price per square meter was 1,020,500 Yen, down 6.7% from the previous month and down 1.9% from last year. The average building age was 14.64 years.

The most expensive addresses in Tokyo to buy an apartment

Tokyo Kantei ranked the most expensive neighbourhoods in Tokyo to buy a second-hand apartment. Central Tokyo’s prime areas dominated the rankings, with 17 of the areas located in Minato Ward, 13 in Shibuya and 11 in Chiyoda.

MOTOAZABU

In top spot was the Motoazabu address in Minato Ward with an average apartment price of 2,133,000 Yen/sqm (1,855 USD/sq.ft). The most expensive apartment in this neighbourhood was 3,063,000 Yen/sqm and the cheapest was 1,093,000 Yen/sqm.Read more