Tokyo Apartment Sales in September 2016

The following is a selection of apartments that were sold in central Tokyo during the month of September 2016:Read more

Tokyo apartment asking prices in August 2016

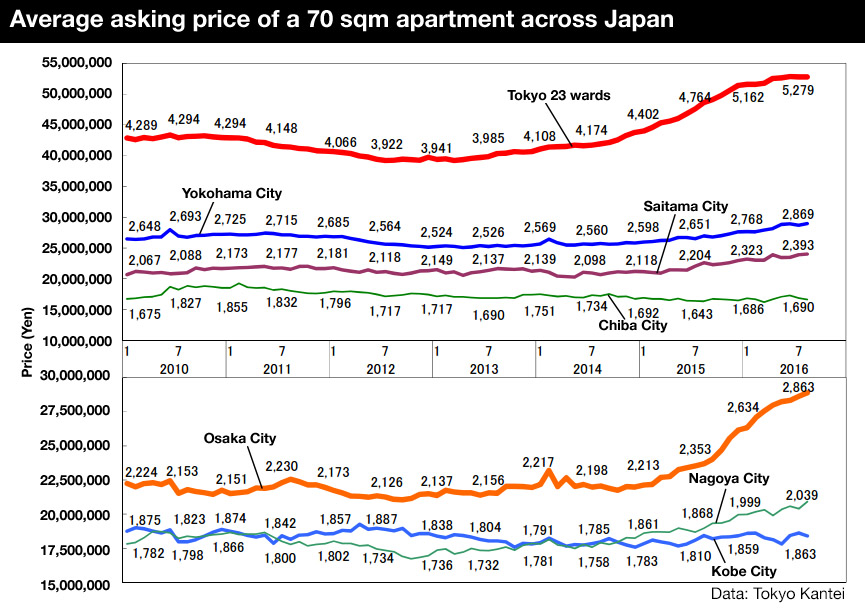

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) second-hand apartment in greater Tokyo in August 2016 was 35,210,000 Yen, up 0.8% from the previous month and up 13.0% from last year. This is the 8th month in a row to record an increase from the previous month. The average building age was 22.4 years.

In the Tokyo metropolitan area, the average asking price was 48,090,000 Yen, up 0.5% from the previous month and up 10.5% from last year. The average building age was 22.0 years.

In Tokyo’s 23 wards, the average asking price was 52,790,000 Yen, showing no change from the previous month but up 8.5% from last year. The average building age was 21.9 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average asking price was 72,030,000 Yen, up 0.3% from the previous month and up 5.5% from last year. This is the 3rd month in a row to record an increase from the previous month.

Commercial standard land prices in Japan’s big cities increase for 4th year in a row

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced this year’s Standard Land Prices on September 20.

Nationwide, land prices declined for the 25th year in a row with a 0.6% decrease, although the rate of decline is slowing. Meanwhile, commercial land prices stopped their downwards trend for the first time in 9 years.

Land prices in Japan’s urban centres of Tokyo, Osaka and Nagoya continued to benefit from booming foreign tourist numbers, redevelopment and infrastructure projects, shrinking office vacancy rates, and monetary easing.

Commercial land prices in these three cities increased by 2.9%, representing a fastening pace after 2.3% growth in 2015 and 1.7% growth in 2014. In the Tokyo metropolitan area, commercial land prices increased by 4.1% in 2016, after a 3.3% increase in 2015. In Osaka city, they were up 4.7% this year.Read more

Average apartment rent in August 2016

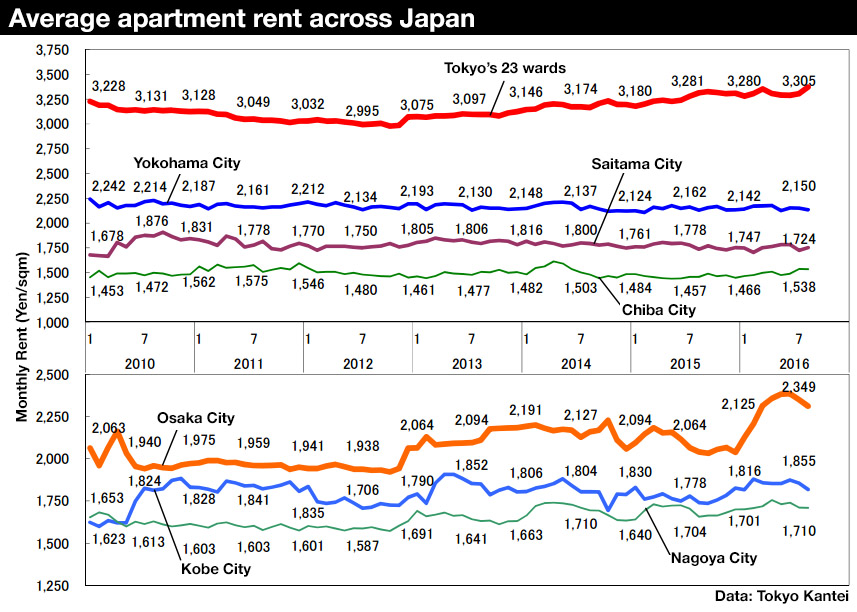

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,661 Yen/sqm in August, up 0.3% from the previous month and up 2.7% from last year. The average apartment size was 60.26 sqm and the average building age was 19.7 years.

In the Tokyo metropolitan area, the average monthly rent was 3,223 Yen/sqm, up 2.5% from the previous month and up 1.4% from last year. In the Tokyo metropolitan area, the average apartment age decreased from 18.3 years to 17.6 years, which contributed to the increase in the average rent from the previous month. The average apartment size was 57.73 sqm.Read more

New apartment supply in Tokyo down for 9th month

According to the Real Estate Economic Institute, 1,966 new apartments were released for sale in greater Tokyo in August, down 40.7% from the previous month and down 24.7% from last year. This is the 9th month in a row to see a year-on-year decline in supply.

1,310 apartments were sold, resulting in a contract ratio of 66.6%, up 3.3 points from the previous month but down 7.7 points from last year. 435 apartments in high-rise buildings (over 20-storeys) were released for sale, down 1.6% from last year. The contract ratio was 73.1%, down 12.2 points from last year.

The average price of a new apartment across greater Tokyo was 56,620,000 Yen, up 0.1% from the previous month but down 3.6% from last year. The average price per square meter was 798,000 Yen, down 1.0% from the previous month and down 3.2% from last year.Read more

Declining yields sought by investors are pushing up property prices

In late 2013, Masayoshi Son, CEO of SoftBank, purchased the Kengo Kuma-designed Tiffany Ginza Building for 32 billion Yen, resulting in a cap rate of just 2.6%. This sale arguably triggered the onset of lower cap rates. Back in 2006, Japan’s REITs had expected returns in the 2% range. They had increased to the 4% range by early 2013, but are now back to the 2 ~ 3% range.Read more

Tokyo metro apartment prices increase for 47th consecutive month

According to REINS, 2,384 second-hand apartments were sold across greater Tokyo in August, down 25.3% from the previous month and down 1.3% from last year. The average sale price was 30,090,000 Yen, up 0.4% from the previous month and up 6.3% from last year. The average price per square meter was 476,900 Yen, up 0.8% from the previous month and up 6.4% from last year. This is the 44th month in a row to see a year-on-year increase in the sale price per square meter. The average building age was 20.26 years.

In the Tokyo metropolitan area, 1,200 second-hand apartments were sold, down 24.6% from the previous month but up 1.3% from last year. This is the fifth month in a row where transactions have exceeded those from 12 months prior. The average sale price was 37,480,000 Yen, up 0.03% from the previous month and up 7.0% from last year. The average price per square meter was 637,000 Yen, up 0.3% from the previous month and up 5.8% from last year. This is the 47th month in a row to see a year-on-year increase in the sale price per square meter. The average building age was 18.97 years.

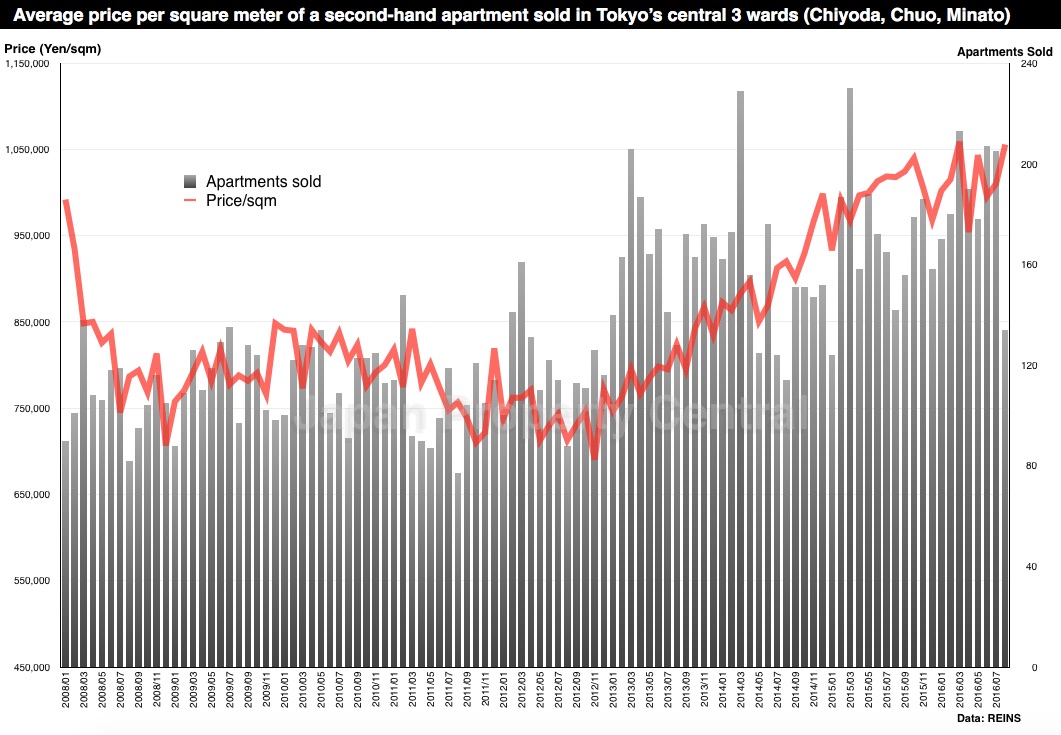

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 134 second-hand apartments were sold, down 34.6% from the previous month and down 5.6% from last year. The average sale price was 53,690,000 Yen, down 0.6% from the previous month but up 3.9% from last year. The average sale price per square meter was 1,055,700 Yen, up 4.5% from the previous month and up 3.7% from last year. The average building age was 17.29 years.

Read more