Price-earnings ratio for apartments in Tokyo reaches record high in 2016

According to Tokyo Kantei, the price-earnings ratio (PER) for brand new apartments in the greater Tokyo area reached a record high of 28.66 in 2016, up 1.36 points from 2015 and the highest level seen since reporting began in 2002. A PER of 28.66 indicates a gross yield of approximately 3.51%.

Price growth of new apartments has far exceeded the change in rental prices, resulting in yields dropping to record lows. The average price of a brand new 70 sqm (753 sq.ft) apartment in greater Tokyo was 59,980,000 Yen in 2016, up 26.3% from 2012. The average rent of a 70 sqm apartment in 2016 was 175,551 Yen/month, up 4.8% from 2012.

The greater Osaka and Nagoya regions also had PERs of around 28 in 2016.

Toranomon area most profitableRead more

Tokyo apartment sales in October 2016

The following is a selection of apartments that were sold in central Tokyo during the month of October 2016:Read more

Second-hand apartment price growth slows in first half of 2016

According to Tokyo Kantei, the half-yearly rate of growth in the price of second-hand apartments in Tokyo has slowed in the first half of 2016 after seeing strong and likely unsustainable gains over the past three years.

Second-hand apartment prices in central Tokyo have increased by 32.7% from the bottom seen in the second half of 2012, and are up 6.1% from the first half of 2015. However, prices have only increased by 0.06% between the second half of 2015 and the first half of 2016.Read more

Average apartment rent in September 2016

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,663 Yen/sqm in September, up 0.1% from the previous month and up 0.6% from last year. The average apartment size was 60.05 sqm and the average building age was 20.0 years.

In the Tokyo metropolitan area, the average monthly rent was 3,230 Yen/sqm, up 0.2% from the previous month and up 1.5% from last year. The average apartment size was 57.39 sqm and the average building age was 18.0 years.Read more

New apartment supply increases for first time in 10 months

According to the Real Estate Economic Institute, 3,424 brand-new apartments were released for sale across greater Tokyo in September, up 74.2% from the previous month and up 40.9% from last year. This is the first time in 10 months to see a year-on-year increase in supply, and is the highest supply seen in the month of September since 2013 when 5,970 apartments were released for sale.

2,466 apartments were sold, resulting in a contract ratio of 72.0%, up 5.4 points from the previous month and up 6.0 points from last year.Read more

Central Tokyo apartment sale prices break new record in September

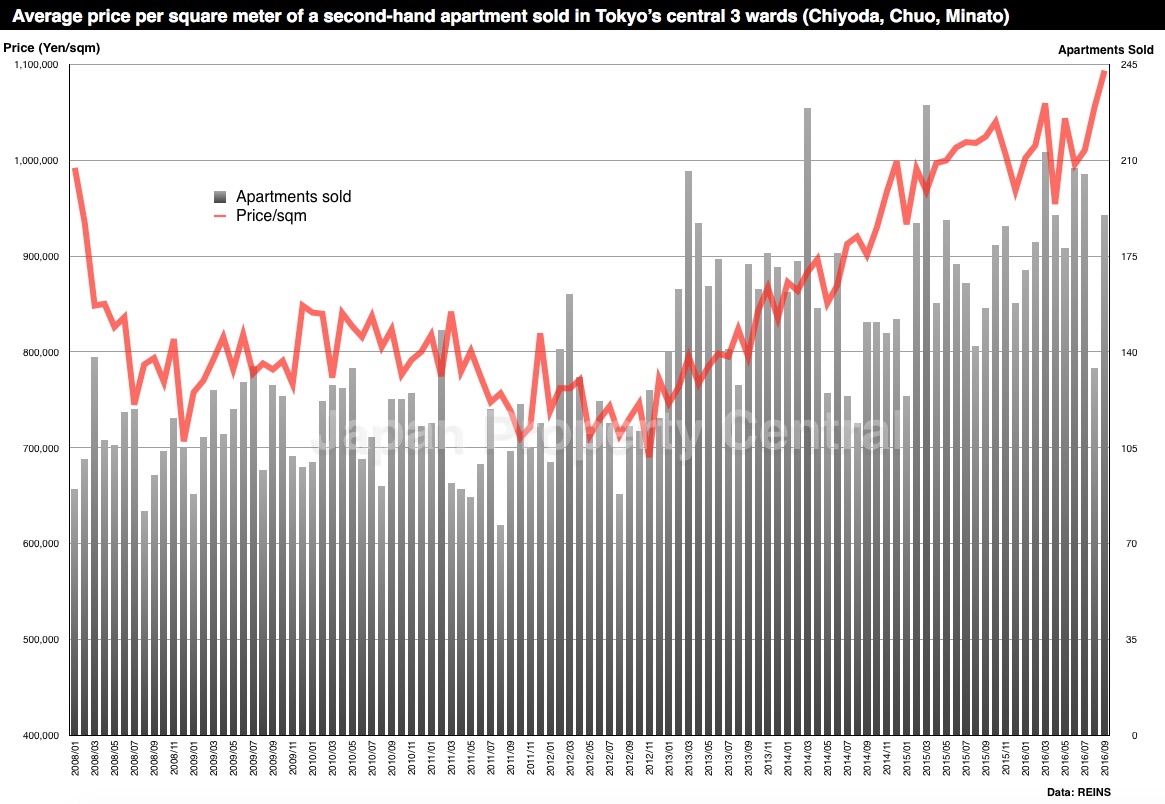

Second-hand apartment sale prices in central Tokyo reached a record high in September, while prices across the metropolitan area saw a year-on-year increase for the 48th month in a row.

According to REINS, 3,150 second-hand apartments were sold across greater Tokyo in September, up 32.1% from the previous month and up 13.6% from last year. The average sale price was 31,260,000 Yen, up 3.9% from the previous month and up 5.7% from last year. The average price per square meter was 490,600 Yen, up 2.9% from the previous month and up 6.0% from last year. This is the 45th month in a row to see a year-on-year increase in the sale price per square meter. The average building age was 20.15 years.

In the Tokyo metropolitan area, 1,651 second-hand apartments were sold, up 37.6% from the previous month and up 18.9% from last year. The average sale price was 38,350,000 Yen, up 2.3% from the previous month and up 6.3% from last year. The average sale price per square meter was 647,700 Yen, up 1.7% from the previous month and up 5.8% from last year. This is the 48th month in a row to see a year-on-year increase. The average building age was 19.14 years.

In the Tokyo metropolitan area, transactions on apartments over 100 million Yen in the third quarter of 2016 were up 18.8% from 2015.

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 190 second-hand apartments were sold, up 41.8% from the previous month and up 21.8% from last year. This is the highest number of recorded transactions for the month of September in over 9 years.

The average sale price was 65,810,000 Yen, up 22.6% from the previous month and up 23.9% from last year. The average price per square meter was 1,093,300 Yen, up 3.6% from the previous month and up 6.7% from last year. This is the highest level seen since record-keeping began in January 2008, and is 58.3% higher than the low seen in November 2012 when the market bottomed out. The average building age was 16.62 years.

Read more

Behind Tokyo’s brisk resale market for apartments

The second-hand apartment market in Tokyo continues to grow with the average asking price of a 70 square meter apartment in the Tokyo metropolitan area reaching 48,090,000 Yen in August 2016, up 10.5% from the previous year. In Tokyo’s 23 wards, the average price increased by 8.5% over 12 months to 52,790,000 Yen.

The second-hand apartment market in Tokyo continues to grow with the average asking price of a 70 square meter apartment in the Tokyo metropolitan area reaching 48,090,000 Yen in August 2016, up 10.5% from the previous year. In Tokyo’s 23 wards, the average price increased by 8.5% over 12 months to 52,790,000 Yen.

Ebisu Garden Terrace Ichibankan, a 32-storey, 290 unit tower south of Ebisu Station, is a prime example of capital appreciation. In late 2015, an apartment on a high floor sold for 2,194,000 Yen/sqm, making it the highest resale reported in this building in the past 27 years, and similar to the current price of brand new apartments. Sale prices slumped to a low of 1,300,000 Yen/sqm in 2013, but increased to 1,670,000 Yen/sqm in 2015 (up 48%). Recent prices have exceeded previous prices last seen in the mini-bubble in 2007. Despite having 290 apartments, there were just two listed for sale in October 2016, with asking prices ranging from 1,640,000 ~ 1,790,000 Yen/sqm.Read more