New apartment supply in greater Tokyo reaches 24-year low

The supply of new apartments in greater Tokyo in 2016 reached a 24-year low with 35,772 apartments offered for sale. This represented a decrease of 11.6% from 2015 and was the lowest level seen since 1992. Developers have been restricting supply amidst rising construction costs, rising land prices and stagnant wages of potential buyers. Development sites in prime locations once earmarked for residential are being converted to office and hotel projects which can provide better returns.

Existing properties that have been renovated are now proving popular with buyers who would have once only considered buying new, which is putting further pressure on new apartment sales. In fact, a record high number of second-hand apartments sold in greater Tokyo in 2016. There were 37,189 reported sales, up 6.9% from 2015. Second-hand apartment sales exceeded new apartment sales by over 50%.

The average contract ratio for the year was 68.8%, which is below the 70% line said to indicate positive market conditions, and is the lowest ratio seen since 2009.Read more

Average apartment rent in December 2016

According to Tokyo Kantei, the average monthly rent of a condominium-type apartment in greater Tokyo was 2,720 Yen/sqm in December 2016, down 0.7% from the previous month but up 3.5% from December 2015. The average apartment size was 59.84 sqm and the average building age was 20.2 years.

In the Tokyo metropolitan area, the average monthly rent was 3,198 Yen/sqm, down 0.4% from the previous month but up 1.0% from 2015. The average apartment size was 57.69 sqm and the average building age was 18.2 years.

In Tokyo’s 23 wards, the average monthly rent was 3,353 Yen/sqm, up 0.1% from the previous month and up 1.3% from last year. The average apartment size was 57.02 sqm and the average building age was 17.7 years.

Rents in Yokohama, Kobe and Nagoya are all down around 1% from 12 months prior.

Tokyo apartment sale prices increase for 51st month

According to REINS, 2,993 second-hand apartments were sold across greater Tokyo in December, up 0.3% from the previous month and up 17.7% from December 2015. This is the fourth month in a row to see an increase in transactions from 12 months prior. The average sale price was 31,220,000 Yen, down 1.6% from the previous month but up 9.0% from the previous year. The average price per square meter was 497,800 Yen, up 0.2% from the previous month and up 9.5% from the previous year. This is the 51st month in a row to see a year-on-year increase. The average building age was 20.73 years.

In the Tokyo metropolitan area 1,542 second-hand apartments were sold, down 0.7% from the previous month but up 19.8% from the previous year. This is the 9th month in a row to see a year-on-year increase in transactions. The average sale price was 39,080,000 Yen, down 0.3% from the previous month but up 9.3% from the previous year. The average price per square meter was 670,200 Yen, up 1.5% from the previous month and up 9.9% from the previous year. The average building age was 19.37 years.

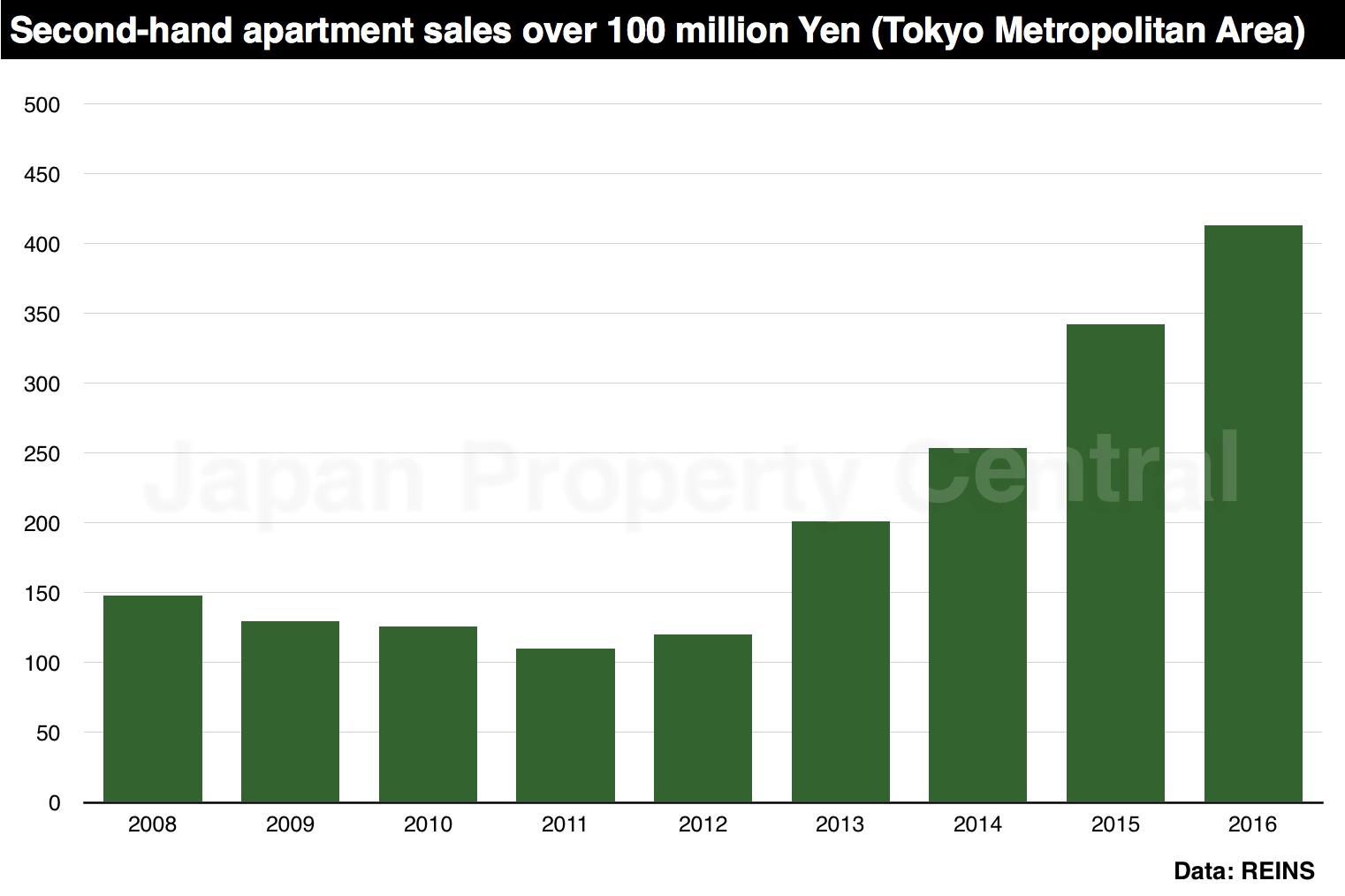

In the last quarter of 2016, 129 apartments priced over 100 million Yen were reported to have sold in the Tokyo metropolitan area, up 41.8% from the last quarter of 2015, and a record for the year of 2016. Total sales for the 2016 year were up 20.8% from 2015 and almost four times the number of transactions in 2011.

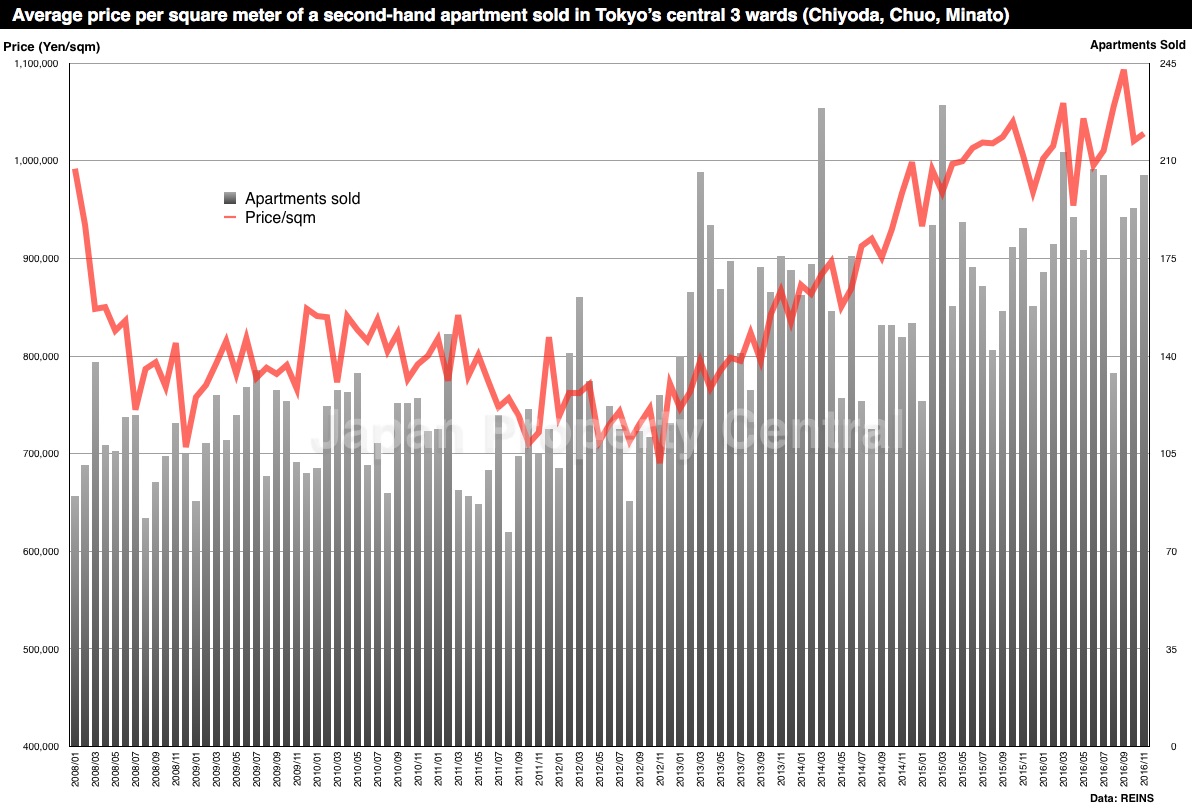

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato) 230 second-hand apartments were sold, up 12.2% from the previous month and up 45.6% from the previous year. This is the highest number of recorded transaction for the month of December since record-keeping began in 2008, and is double the average seen between 2008 and 2012.

Past transactions in central Tokyo’s 3 wards in December:

- 2016: 230

- 2015: 158

- 2014: 152

- 2013: 171

- 2012: 116

- 2011: 114

- 2010: 123

- 2009: 98

- 2008: 105

The residential vacancy rate situation in Tokyo

According to the Statistics Bureau and the Tokyo Shimbun, the number of towns, cities and wards within the greater Tokyo area with vacancy rates below 10% has halved in the 10 years since 2003. In 2013, there were 56 districts with vacancy rates below 10% and 65 districts with vacancy rates over 15%.

Growing vacancy rates are caused by a variety of factors, including decline population in regional areas, an increase in the supply of housing, as well as an increase in the number of abandoned or uninhabitable homes that are left to rot instead of being demolished.

Highest vacancy rates

| TOKYO METROPOLITAN AREA | |

|---|---|

| [1] Toshima-ku | 15.8% |

| [2] Ota-ku | 14.8% |

| [3] Musashino City | 14.1% |

| [4] Nakano-ku | 13.7% |

| [5] Chiyoda-ku | 13.3% |

| GREATER TOKYO AREA | |

| [1] Nasu Town, Tochigi | 50.5% |

| [2] Katsuura City, Chiba | 36.8% |

| [3] Yugawara Town, Kanagawa | 33.4% |

| [4] Isumi City, Chiba | 28.6% |

| [5] Kamogawa City, Chiba | 26.3% |

Beware of relying on this data

Investors should not rely on this data as it is far from accurate for the rental market.Read more

Vacancy rates for apaato-type buildings reach 30% in Tokyo

Vacancy rates in Tokyo and Kanagawa have been steadily climbing due to an oversupply of ‘apaato’-type rental buildings (low-rise blocks of rental flats usually built from wood or light-weight steel) in recent years.

According to TAS Corp, vacancy rates for wood-frame or light-steel-frame apartment buildings are over 30% in the greater Tokyo area, and as high as 37% in Kanagawa Prefecture. In other words, 1 in 3 units in ‘apaato’-type rental buildings are vacant.Read more

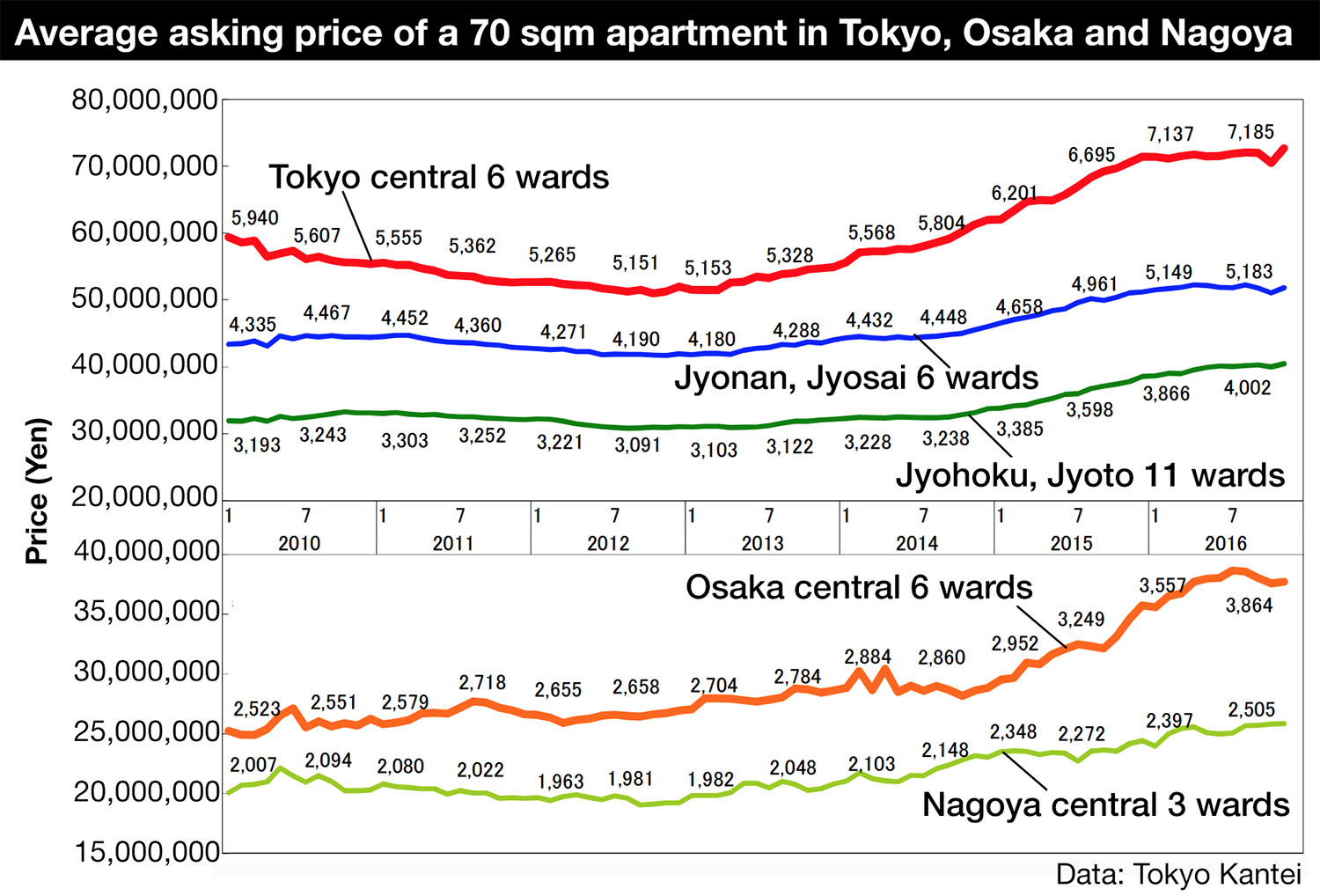

Tokyo apartment asking prices in November 2016

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) second-hand apartment in greater Tokyo was 35,470,000 Yen in November 2016, down 2.0% from the previous month but up 8.3% from 2015. The average building age was 22.5 years.

In the Tokyo metropolitan area, the average asking price was 48,090,000 Yen, down 0.9% from the previous month but up 5.7% from 2015. The average building age was 22.1 years.

In Tokyo’s 23 wards, the average asking price was 52,810,000 Yen, up 0.7% from the previous month and up 4.3% from 2015. This is the first time in 5 months to see an increase in asking prices from the previous month. The average building age was 22.1 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average asking price was 72,660,000 Yen, up 3.1% from the previous month and up 3.0% from 2015. The average building age was 20.1 years.

Steep increase in house prices in central Tokyo

We are often asked how the Tokyo property market is moving. Is it slowing down or showing signs of steadying? We are still seeing some big price increases occurring, particularly in the detached house market. Compared to apartments, houses in central Tokyo are in extremely short supply and are difficult to find comparisons for, making it easier for sellers to ask bolder prices.

In some cases the properties have been given a quick makeover to justify a higher price, but in other cases the price has been increased to match recent market conditions.

Case 1: A 4-Bedroom house in the Azabu area

In mid-2016 we managed to negotiate a price of 180 million Yen for our client, who passed on the deal. It was re-listed in December 2016 for approximately 240 million Yen, a 30% increase in 6 months.Read more