Tokyo Apartment Sales in November 2017

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of November 2017:Read more

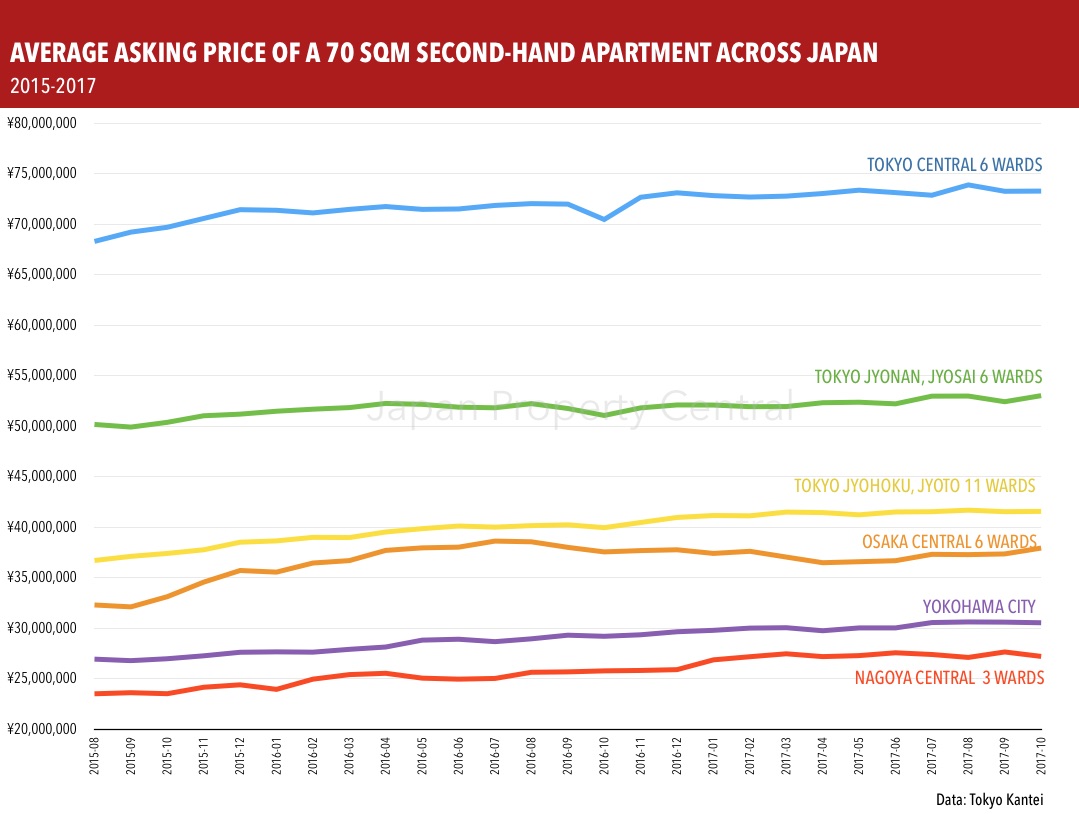

Apartment asking prices in Tokyo in October 2017

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) apartment across Greater Tokyo was 35,810,000 Yen in October 2017, up 0.7% from the previous month but down 1.1% from last year. The average building age was 23.0 years.

In Tokyo’s 23 wards the average asking price was 52,920,000 Yen, showing no change from the previous month but up 0.9% from last year. The average building age was 22.6 years.Read more

Roppongi has the lowest rental yields in Tokyo

According to Tokyo Kantei, brand new apartments within walking distance of Roppongi Station had the lowest rental yields in greater Tokyo with an estimated gross return of 2.34%. Across greater Tokyo the average gross yield on a new apartment was 4.44%, and as high as 6.19% for 30 year old apartments.

Yields reflect risk and tend to be lower in areas with high rental and sales demand. They also tend to be higher for older buildings to reflect a variety of factors such as higher maintenance costs, lower rental demand and rents that decline at a slower rate than property values.Read more

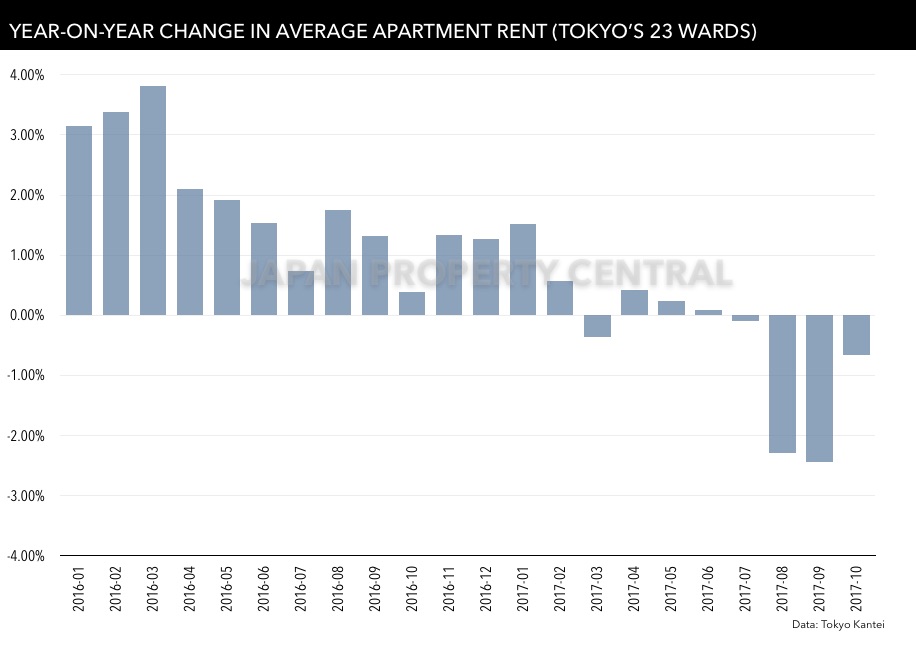

Average rent in Tokyo drops for 4th month in a row

According to Tokyo Kantei, the average monthly rent of a condominium in Tokyo’s 23 wards was 3,308 Yen/sqm in October, up 0.6% from the previous month but down 0.7% from last year. This is the 4th month in a row to record a year-on-year decline in rents.Read more

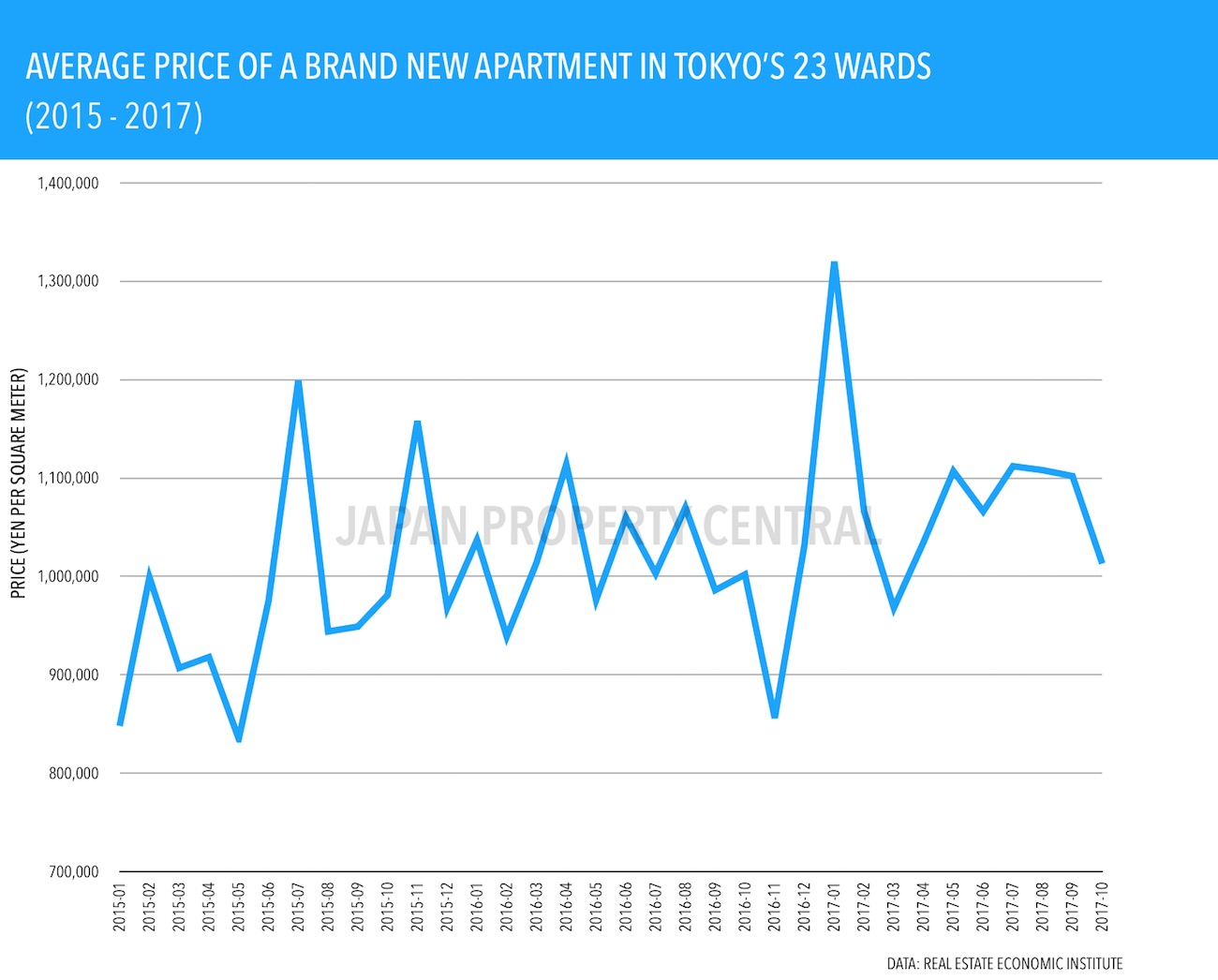

New apartment prices in Tokyo increase for 7th month

According to the Real Estate Economic Institute, 2,817 brand new apartments were released for sale across greater Tokyo in October, down 5.4% from the previous month and down 3.0% from last year.

The average sale price was 55,860,000 Yen, down 4.1% from the previous month but up 3.3% from last year. The average price per square meter was 811,000 Yen, down 4.1% from the previous month but up 2.3% from last year. This is the 7th month in a row to record a year-on-year increase.

The contract ratio across greater Tokyo was 60.7%, down 0.9 points from last year.

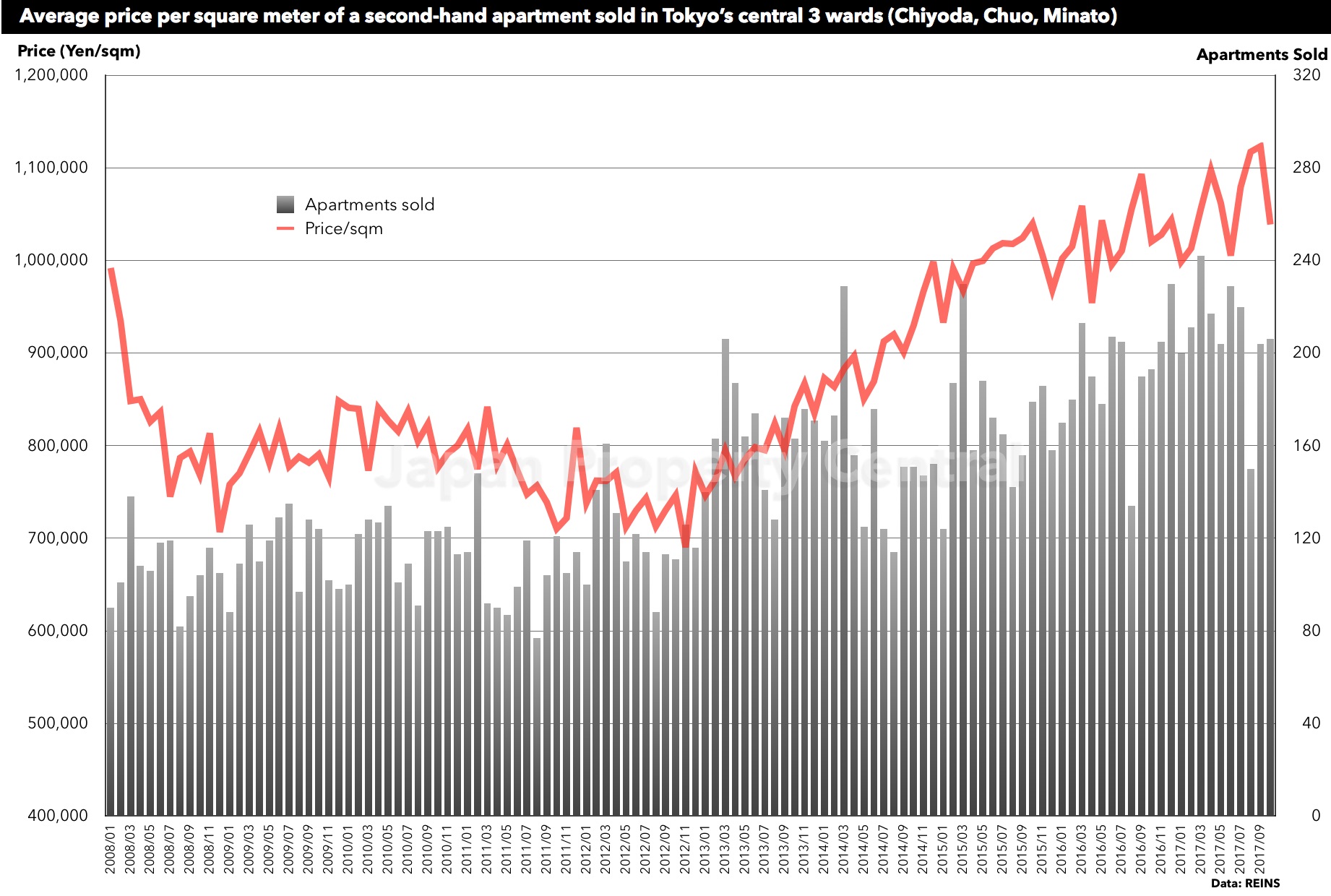

Tokyo apartment sale prices increase for 61st month

According to REINS, 3,103 second-hand apartments were sold across greater Tokyo in October, down 3.7% from the previous month and down 7.1% from last year. The average sale price was 32,090,000 Yen, down 0.5% from the previous month but up 2.3% from last year. The average sale price per square meter was 501,600 Yen, down 1.0% from the previous month but up 3.3% from last year. This is the 58th month in a row to see a year-on-year increase in sale prices. The average building age was 20.80 years.

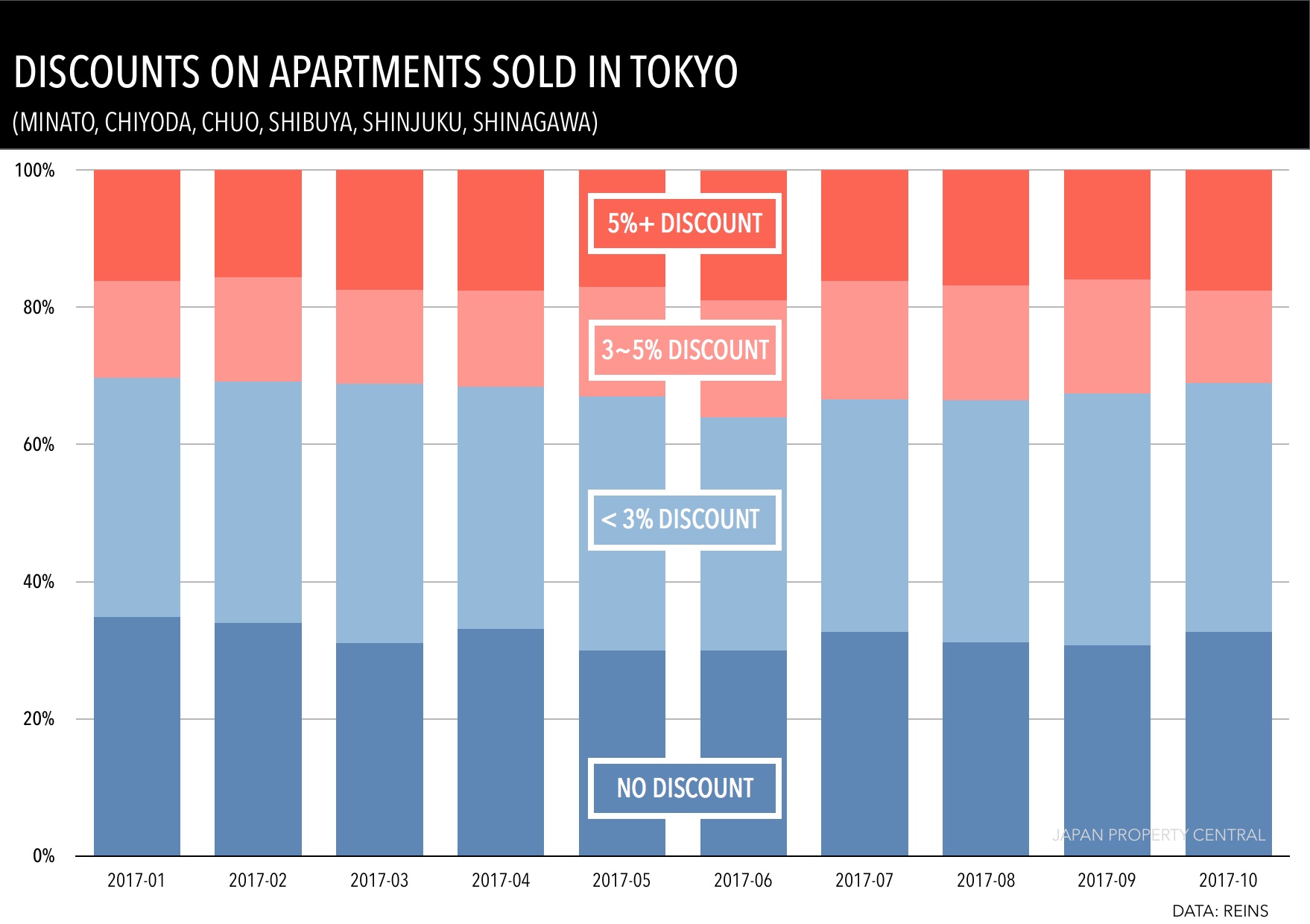

A third of apartments in central Tokyo sell at full asking price

A common question we get from buyers is how much of a discount can they get on the asking price of a property. The honest answer is that it varies. Some properties will sell at their full asking price, while others may sell at a discount. Typically two-thirds of all reported apartment sales in central Tokyo (Minato, Chiyoda, Chuo, Shibuya, Shinjuku and Shinagawa) sell at a discount of less than 3%, while a third sell at their full asking price.