Our Japan Property Market Report for 2017

Our annual property market report for the past year can be downloaded in PDF format below.

We continued to see property prices rise in 2017, while transactions hit new highs. The luxury residential market in Tokyo has been a star performer and developers are starting to increase their offerings of high-end apartments to cater to demand.

Supporting the real estate market this year were record high foreign tourist numbers, record low office vacancy rates, a surging share market, improving economic conditions and low unemployment figures.

We have compiled our market insights into the following report:Read more

Supply of new apartments in greater Tokyo to increase in 2018

According to a forecast by the Real Estate Economic Institute, a total of 38,000 brand new apartments are expected to be released for sale across greater Tokyo in 2018, up 4.4% from 2017 and the second year in a row to see an increase. Depending on demand for buyers eager to purchase before the consumption tax rate increase in October 2019, supply could reach as high as 40,000 units.Read more

Tokyo Apartment Sales in December 2017

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of December 2017:Read more

Apartment asking prices in Tokyo in November 2017

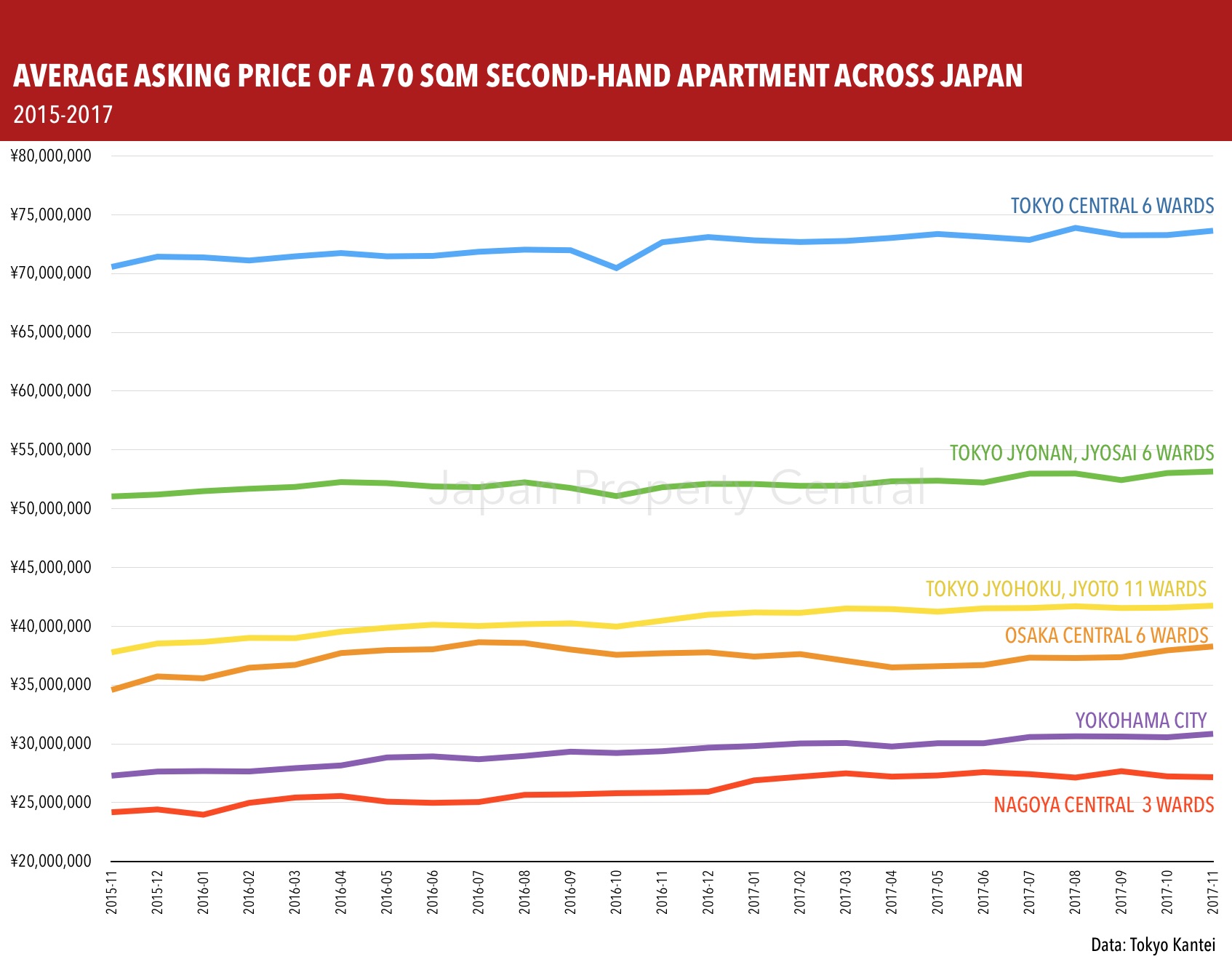

According to Tokyo Kantei the average asking price of a 70 sqm (753 sq ft) apartment across greater Tokyo was 36,210,000 Yen in November, up 1.1% from the previous month and up 2.1% from last year. The average building age was 23.1 years.

In Tokyo’s 23 wards the average asking price was 53,320,000 Yen, up 0.8% from the previous month and up 1.0% from last year. The average building age was 22.7 years.Read more

Tokyo facing office space shortage in prime buildings

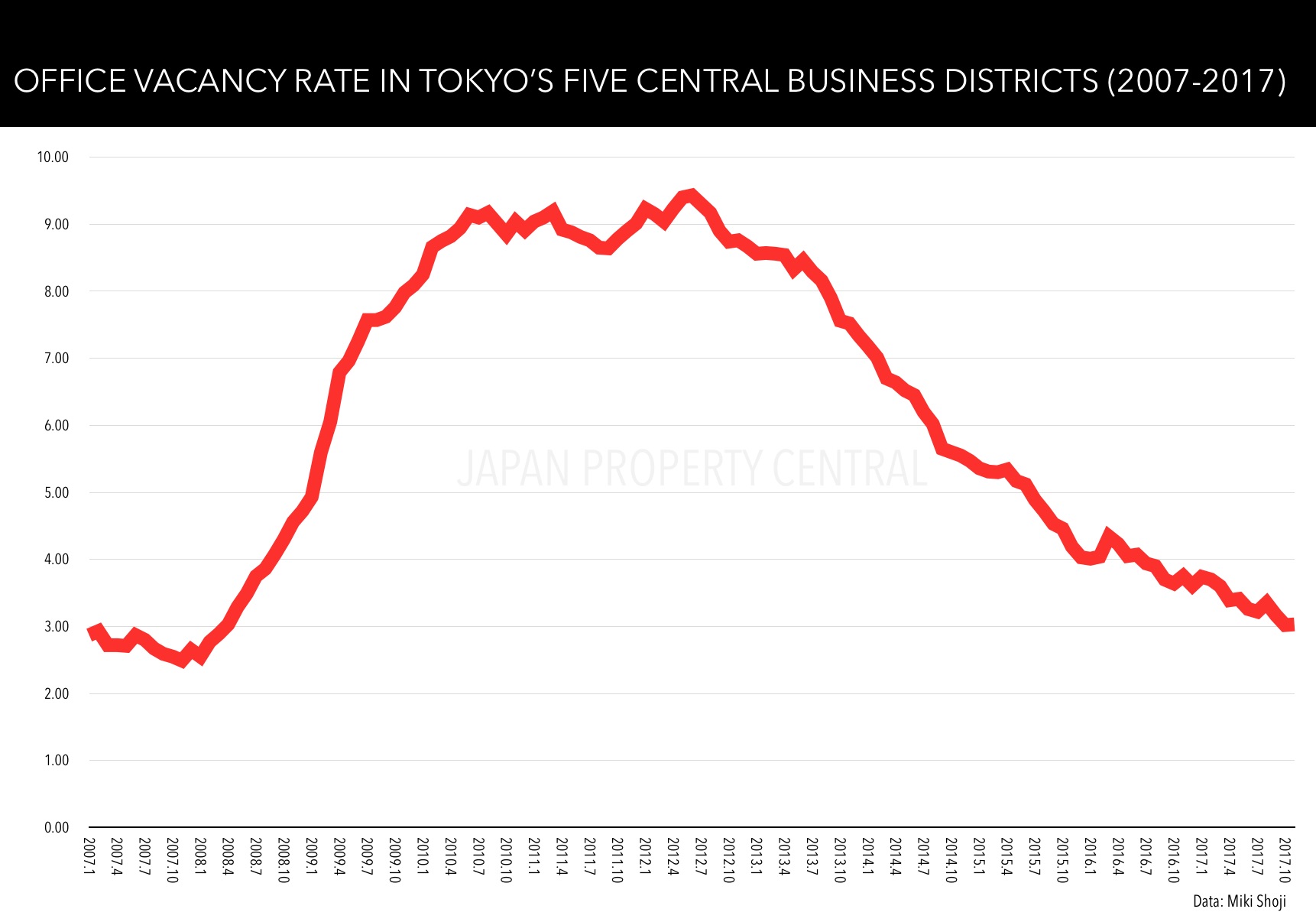

Office vacancy rates in central Tokyo’s business districts continue to shrink with Jones Lang Lasalle reporting almost no vacancies in the main office buildings in the Marunouchi district. After reaching a high of 9.43% in mid-2012, vacancy rates in Tokyo’s central five business districts were down to 3.03% last month - a level last seen in April 2008.

It’s not just Marunouchi that is suffering from a dire shortage in available office space, with prime high-rise buildings in Nihonbashi, Shinjuku and Shibuya also seeing demand outstrip supply. Tenant demand is being supported by improved business earnings and company growth, resulting in a need for larger office space to accommodate growing staff numbers.Read more

New apartment prices in Tokyo increase for 8th month

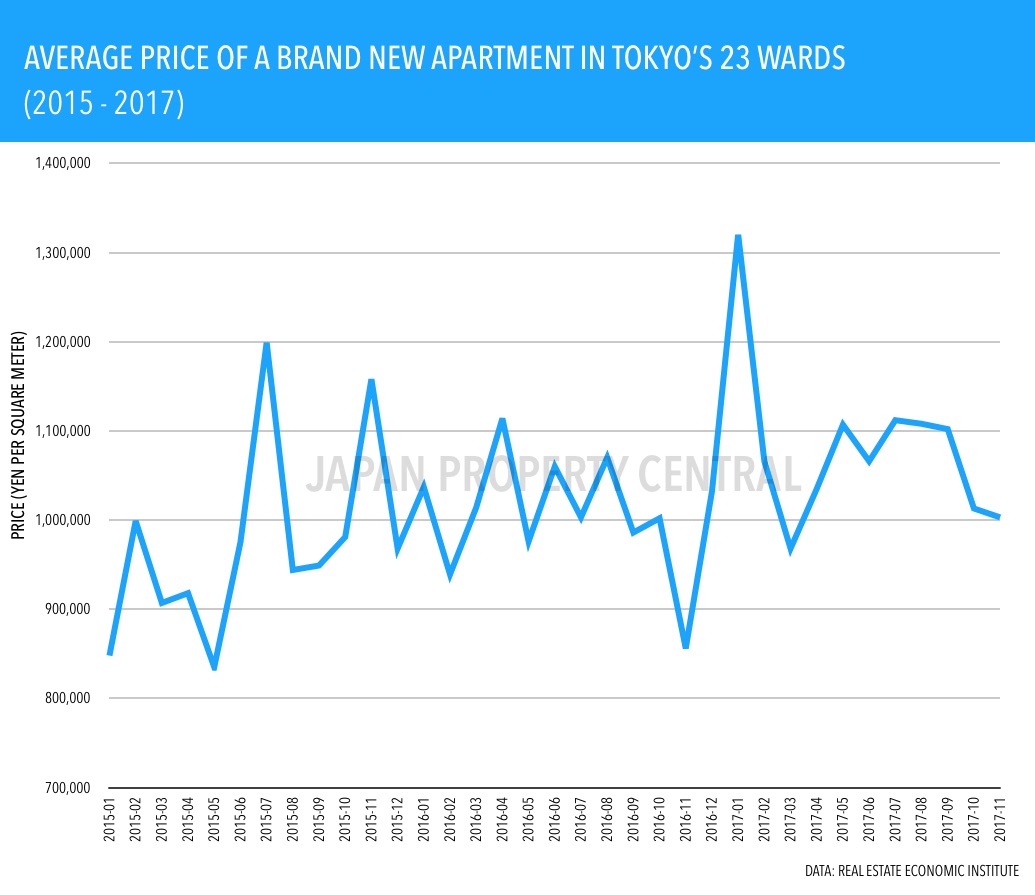

According to the Real Estate Economic Institute, 3,366 brand new apartments were released for sale across greater Tokyo in November, up 19.5% from the previous month and up 24.6% from last year.

The average sale price was 55,510,000 Yen, down 0.6% from the previous month but up 7.6% from last year. The average price per square meter was 835,000 Yen, up 3.0% from the previous month and up 11.5% from last year. This is the 8th month in a row to record a year-on-year increase in sale prices.Read more

Tokyo apartment sale prices increase for 62nd month

According to REINS, 2,904 second-hand apartments were sold across greater Tokyo in November, down 6.4% from the previous month and down 2.7% from last year. The average sale price was 32,020,000 Yen, down 0.2% from the previous month but up 1.6% from last year. The average price per square meter was 502,000 Yen, up 0.1% from the previous month and up 1.7% from last year. This is the 59th month in a row to see a year-on-year increase in sale prices. The average building age was 21.21 years.

In the Tokyo metropolitan area, 1,512 second-hand apartments were sold, down 4.7% from the previous month and down 2.6% from last year. The average sale price was 39,610,000 Yen, up 1.3% from the previous month and up 2.1% from last year. The average price per square meter was 673,000 Yen, up 2.6% from the previous month and up 2.9% from last year. This is the 62nd month in a row to record a year-on-year increase in sale prices. The average building age was 19.61 years.Read more