Tokyo office vacancy rate increases for first time in 9 months

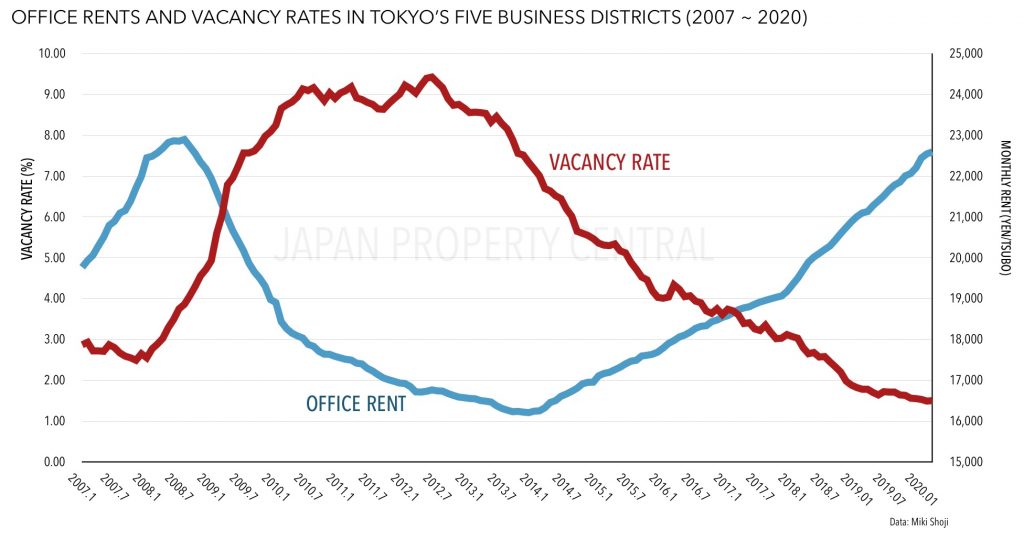

In March, the office vacancy rate across Tokyo’s central five business districts increased for the first time in 9 months. The vacancy rate reported by Miki Shoji was 1.50%, up 0.01 points from the previous month, but down 0.28 points from last year.

Tokyo secondhand apartment prices see first drop in 15 months

According to REINS, 3,642 second-hand apartments were reported to have sold across greater Tokyo in March, down 2.9% from the previous month and down 11.5% from last year. The average sale price was 34,890,000 Yen, down 0.03% from last year. The average price per square meter was 540,500 Yen, up 0.2% from last year.

How to follow Japan's real estate market in a rapidly changing environment

Real estate price indexes tend to be published 3 months after the fact, so anyone looking for up-to-the-minute details on the impact that the coronavirus is having on Japan’s real estate market needs to consider other sources of information.

70% of real estate companies report impact from coronavirus fears

Earlier in March, real estate information provider Lifull conducted a survey of 925 real estate companies to see how the coronavirus situation was affecting them. Over 70% reported that their operations were already being impacted, while 91.9% were concerned about the future effects that this virus would have on their business activities.

Business mood in real estate sector sees biggest drop since 2011 earthquake

The general business mood in March has worsened for the six month in a row according to credit research firm Teikoku Databank. The diffusion index (DI) of confidence from a survey of 11,330 companies across various industries dropped 6.2 points from February to 32.5. A month-on-month drop of this magnitude has not been seen since April 2014 which recorded a 4.2 point decline.

Tokyo Apartment Sales in March 2020

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of March 2020:

New apartment supply in February hits 45-year low

The number of brand-new apartments released for sale across greater Tokyo reached the lowest level seen for the month of February since 1975.

According to the Real Estate Economic Institute, February’s figures were not the direct result of the recent worldwide outbreak of the novel coronavirus. However, should economic conditions and consumer outlook worsen as a result of the unprecedented global slowdown, it is likely that Japan’s developers will continue to limit the supply of new apartments in the coming months.