Tokyo Apartment Sales in April 2020

The following is a selection of apartments that were reported to have sold in central Tokyo during the month of April 2020:

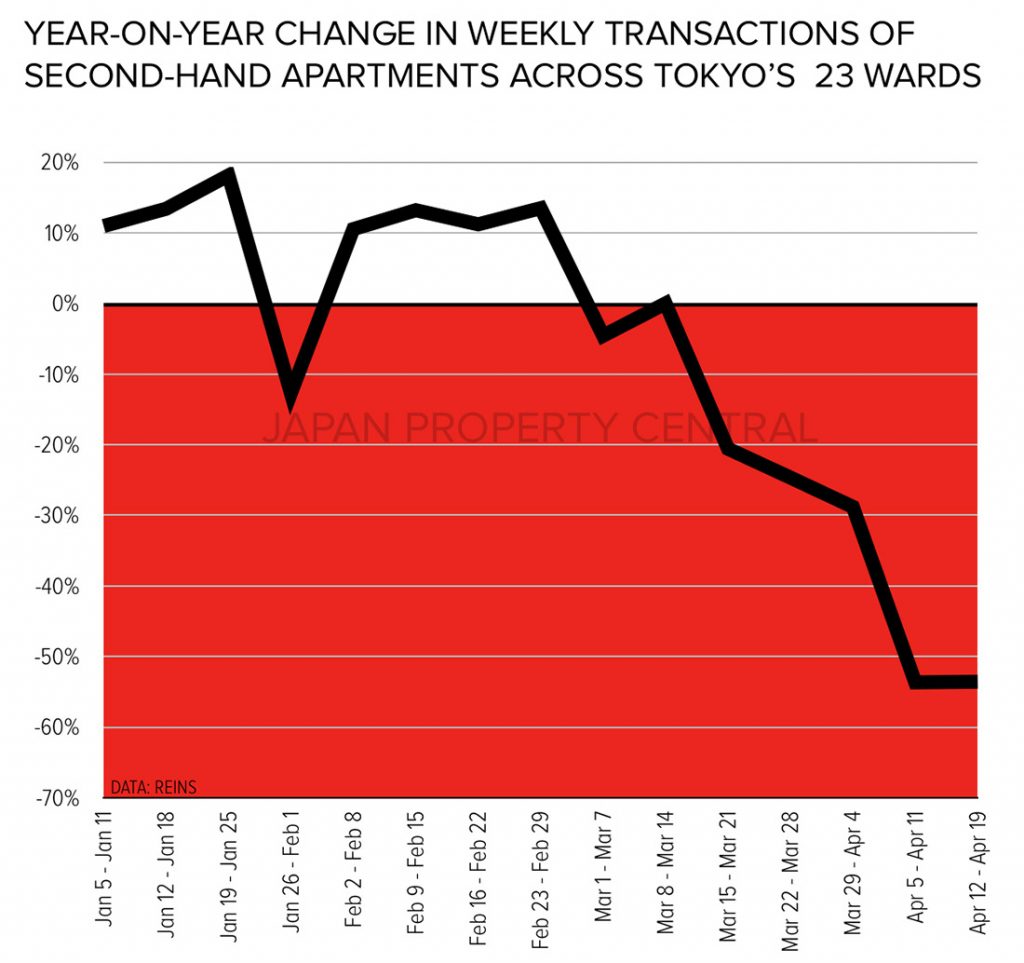

Tokyo apartment sales drop by over 50% as pandemic hits buyer sentiment

Reported sales of existing apartments across Tokyo’s 23 wards have sunk to record lows this month as the coronavirus panic and state of emergency scares buyers from making big purchases.

Airbnb hosts leaving in droves as coronavirus cancellations pile up

Short-term ‘minpaku’ accommodation hosts are starting to exit the short-term letting market. As of April 2020, the number of hosts that de-registered their properties topped 4,100 since the registration system was introduced in mid-2018. There are currently 25,000 registered minpaku properties across Japan.

New apartment supply drops 35.8% in March

According to the Real Estate Economic Institute, 2,142 brand-new apartments were released for sale across greater Tokyo in March, down 35.8% from last year. This is the lowest level seen for the month of March since 1992.

A total of 1,500 apartments sold within the first month of sales, resulting in a contract ratio of 70.0% - a 2.2 point decrease from last year.

Never waste a good crisis: Where are the current opportunities in Japan’s real estate market?

We have been receiving quite a few inquiries over the past couple of months from buyers looking to pick up some bargains amidst the current turmoil. After several years of being a strong sellers' market, the real estate market in Japan has made an abrupt about-turn and has shifted into a buyers' market from around mid-March onwards.

And yes, while there are some bargain sales out there, buyers need to know where to look.

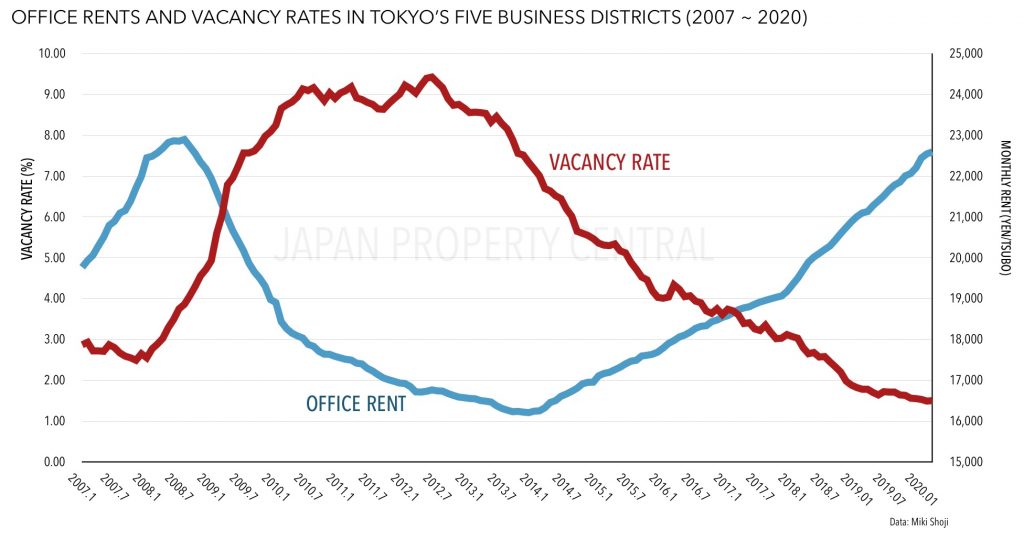

Tokyo office vacancy rate increases for first time in 9 months

In March, the office vacancy rate across Tokyo’s central five business districts increased for the first time in 9 months. The vacancy rate reported by Miki Shoji was 1.50%, up 0.01 points from the previous month, but down 0.28 points from last year.

Tokyo secondhand apartment prices see first drop in 15 months

According to REINS, 3,642 second-hand apartments were reported to have sold across greater Tokyo in March, down 2.9% from the previous month and down 11.5% from last year. The average sale price was 34,890,000 Yen, down 0.03% from last year. The average price per square meter was 540,500 Yen, up 0.2% from last year.