New apartment supply in first half of 2020 hits 47-year low

According to the Real Estate Economic Institute, the supply of new apartments across greater Tokyo in the first half of 2020 (counted from April to September) dropped below 10,000 units for the first time since record-keeping began in 1973. A total of 8,851 new apartments were released for sale, down 26.2% from the first half of 2019.

Secondhand apartment transactions in 3rd quarter reach 30-year high

According to REINS, the number of secondhand apartments reported to have sold across Greater Tokyo in the third quarter of 2020 reached the highest level seen since record-keeping began in 1990. A total of 9,537 apartments had sold between July and September, up 1.4% from the same period in 2019.

Canadian firm to invest US$9.5 billion in Japanese real estate

On October 12, the Nikkei newspaper reported that Canadian investment firm BentallGreenOak (BGO) plans to invest up to 1 trillion Yen (approx. US$9.5 billion) in Japanese real estate over the next two to three years. The company is anticipating that corporations will start selling off their office and hotel real estate holdings as the global pandemic continues, creating buying opportunities.

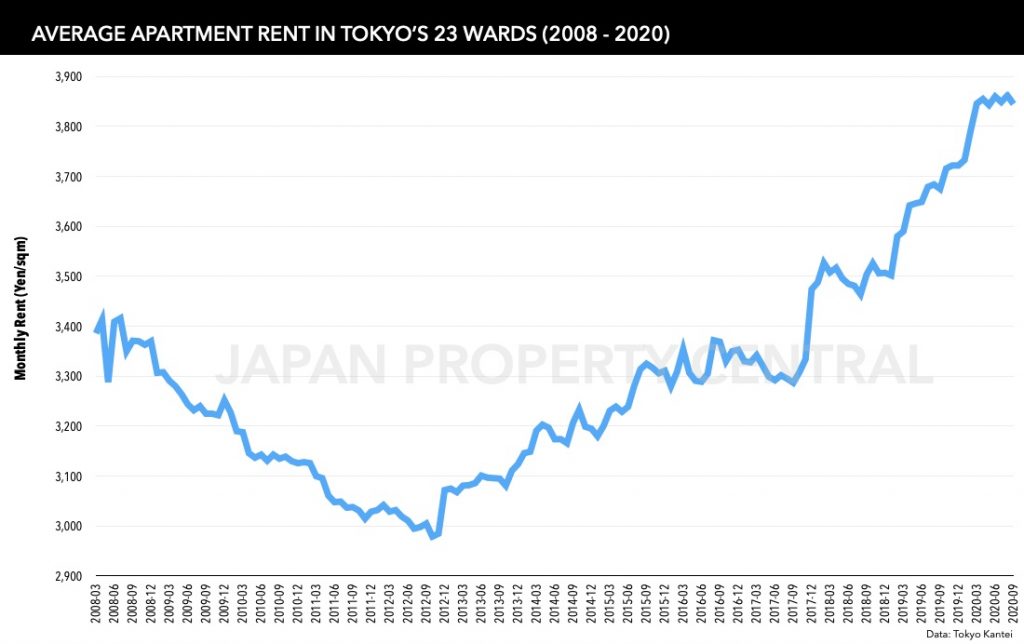

Tokyo Apartment rents hit ceiling

According to Tokyo Kantei, the average advertised monthly rent of a condominium in Tokyo’s 23 wards was 3,845 Yen/sqm in September 2020, down 0.4% from the previous month but up 4.6% from last year.

Quick real estate news summary for the week

Office vacancies worsen, Nippon Building Fund makes a US$2 billion acquisition in Tokyo, and a potential extension to the home loan tax deduction. Below is a quick weekly summary of some of the recent goings-on in the Japanese real estate market.

Demand returns to Tokyo’s once-overlooked suburbs

If you think the residential real estate industry is suffering at the moment, think again. Data shows that brokerages and developers are just as busy now as they were last year.

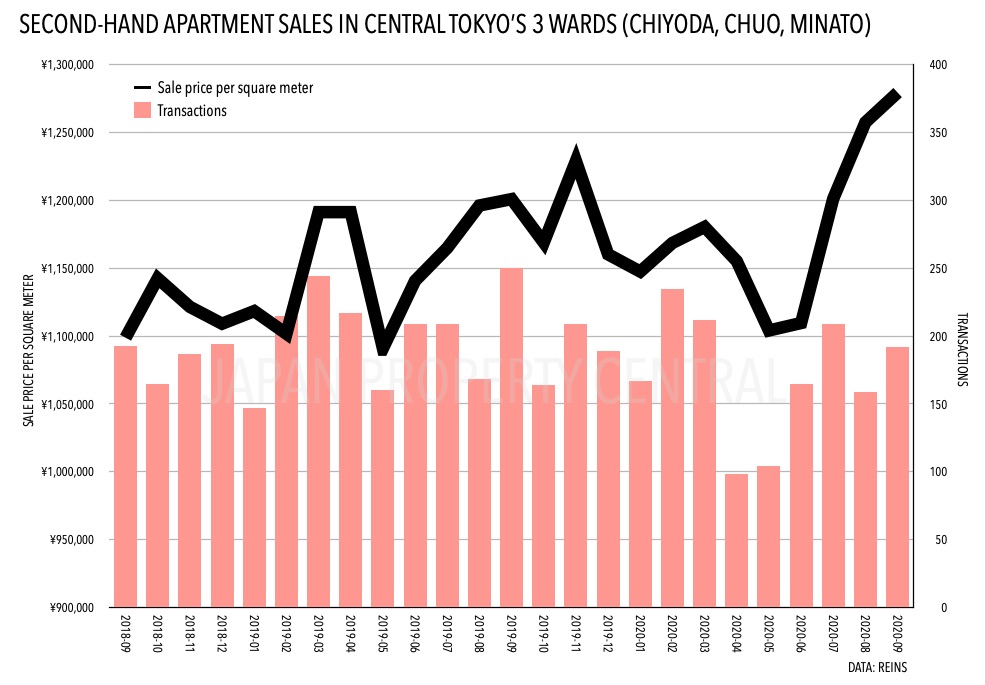

Apartment sale price in central Tokyo jumps 18% in September

Second-hand apartment transactions across greater Tokyo dropped 7.3% from last year to 3,328 units in September. This comes a month after double-digit year-on-year increases were recorded across all four prefectures. The average sale price increased by 1.3% from the previous month and 6.6% from last year to 36,930,000 Yen. The average price per square meter increased by 2.1% from the previous month and 4.1% from last year to 559,800 Yen.