Rising construction costs causing suburban projects to be cancelled

- Apartment developments cancelled.

- Station-front redevelopment projects on hold.

- Slowdown in retail expansion.

Japan’s construction industry is facing an impending crisis as the construction boom brought about by the 2020 Summer Olympics and Tohoku reconstruction is causing construction costs to rise dramatically.

The rising costs and severe labour shortage is having a direct impact on apartment development in the greater Tokyo area.

In April, the Odakyu Electric Railway Company announced that they were cancelling their plans to develop a high-end residential neighbourhood on the site of the former Mukogaoka Amusement Park in Tama-ku, Kawasaki due to rising construction costs which no longer make the project profitable.

Other apartment developers are also taking a restrained approach. Some that have already acquired development sites are either holding off on construction, leaving the sites empty, or are changing their plans.Read more

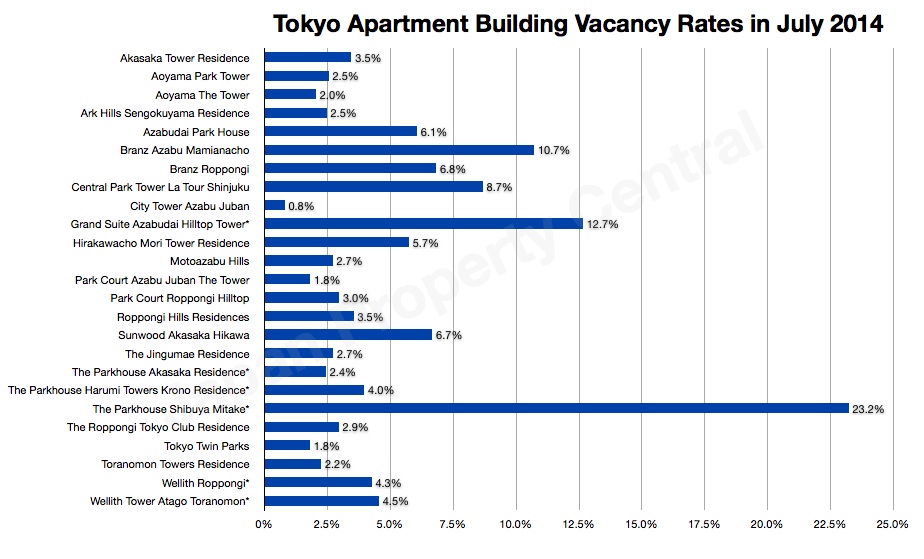

Vacancy rates by apartment building in Tokyo - July

The following is a list of popular apartment buildings in Tokyo and their estimated vacancy rates in July:

About the data:

- Vacancy rate = The number of apartments currently advertised for rent in that building as a percentage of the total number of apartments in the building.

- These figures are estimates only and Japan Property Central does not guarantee that they are 100% accurate. The data may include apartments that have already been leased but are still being advertised, and may not include apartments that are available for rent but not advertised publicly.

- In recently completed buildings you may see a large number of apartments up for rent in the first few months after completion. This indicates that a lot of the apartment buyers were investors, or that a large number of apartments were given to a landowner/s as part of the redevelopment. It may take a few months before these apartments are rented out.

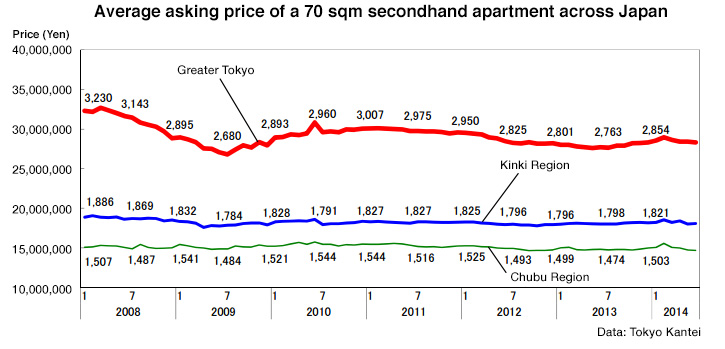

Secondhand apartment prices in June - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 41,630,000 Yen in June, down 0.3% from the previous month but up 4.8% from last year. This is the first time in 7 months that prices have fallen from the previous month, although they continue to remain above 2013 levels. The average apartment age was 22.0 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 57,570,000 Yen, down 0.1% from the previous month but up 7.7% from last year. The average apartment age was 22.0 years.

The average price across greater Tokyo was 28,310,000 Yen, down 0.4% from the previous month but up 2.2% from last year.Read more

An updated forecast of Tokyo real estate prices

The Japan Real Estate Institute published an updated forecast of real estate prices and rental values in Tokyo’s 23 wards from 2014 to 2020.

In 2013, apartment prices increased by around 4% due to a last minute buying rush before the hike in the consumption tax kicked in. Note: this tax applies to the sale of brand new apartments and applies to the building portion of the sale only. Anyone who signed a contract on a new apartment before the end of September 2013 could lock in the 5% tax rate.

2014

In 2014, apartment prices are forecast to fall by around 2% from the previous year to 804,000 Yen/sqm. This was attributed a drop in demand due to the increase in the consumption tax rate from April 2014.

Monthly apartment rent increased by 6.4% to 3,430 Yen/sqm.

2015

Office vacancy rates in June - Miki Shoji

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 6.45% in June, down 0.07 points from the previous month and down 2.01 points from last year.

The vacancy rate in brand new buildings was 18.09%, down 2.33 points from the previous month but up 6.49 points from last year.

It is not just large-scale office buildings that are experiencing better conditions, but mid-size buildings are also seeing a boost in demand. All 11 buildings developed under Nomura’s mid-size office brand ‘Premium Midsize Office (PMO)’ are almost fully occupied. Mitsubishi’s renovated small-to-mid sized office building in Kanda is also almost fully occupied. The building has attracted several IT-related tenants who want the freedom to design their own office space. Read more

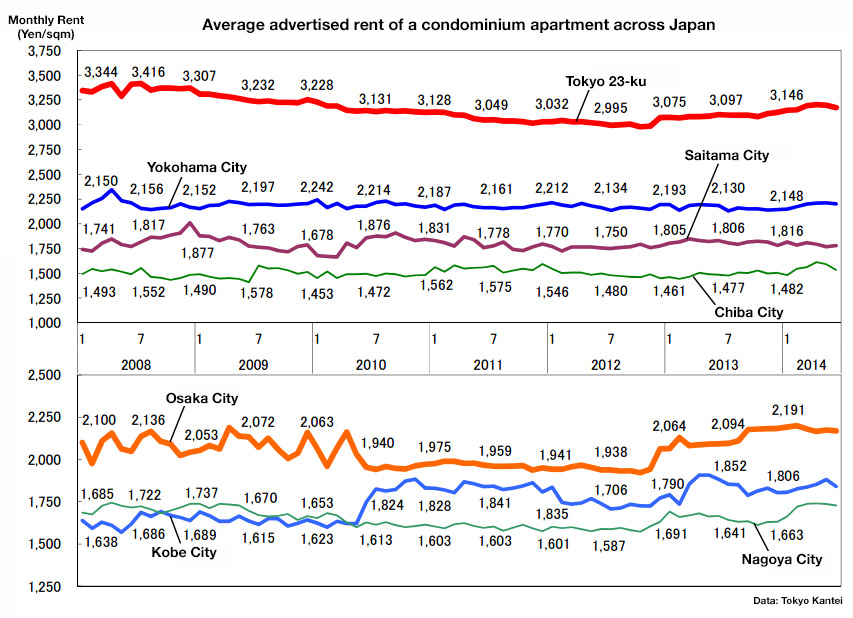

June rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,609 Yen/sqm in June, down 0.5% from the previous month but up 2.7% from last year. All areas within greater Tokyo saw rents decline from the previous month.

The average apartment size was 59.37 sqm and the average building age was 18.7 years.

The average rent in Tokyo’s 23-ku was 3,174 Yen/sqm, down 0.7% from the previous month but up 2.4% from last year. The average apartment size was 56.38 sqm and the average building age was 16.9 years.Read more

New apartment supply dwindling in Tokyo

According to the Real Estate Economic Institute, 3,503 brand new apartments were released for sale across greater Tokyo in June, down 18.5% from the previous month and down 28.3% from last year. This is the fifth month in a row to see a year-on-year decline.

2,683 new apartments were sold, making the contract rate 76.6%. This is 2.3 points lower than the previous month and 5.0 points lower than last year. A contract rate above 70% suggests a strong market. According to REINS, 2,812 second-hand apartments were sold in June, exceeding the number of new apartments sold.

The average new apartment price was 48,300,000 Yen, down 6.3% from the previous month and down 0.1% from last year. The average price per square meter was 683,000 Yen, down 5.4% from the previous month and down 0.4% from last year.Read more