What’s in store for Tokyo’s residential real estate market in 2015?

Let’s take a look at what some analysts are predicting for the Tokyo residential property market in 2015.

Unfavourable conditions for new apartment market?

In 2013, the supply of new apartments reached 56,000 units in greater Tokyo. However, several factors caused the supply to drop by as much as 24% in 2014. An increase in the consumption tax rate to 8% in April 2014 led to a boost in demand from buyers looking to lock-in the lower tax rate (this tax applies to the building portion of new apartment sales). In addition, reconstruction efforts in Tohoku, redevelopment projects for the 2020 Summer Olympics and a weakening Yen have led to a steep rise in construction costs and a shortage in labour. This has reduced the profit margins for developers and has caused some projects to be delayed or cancelled.Read more

Secondhand apartment prices in November 2014 - Tokyo Kantei

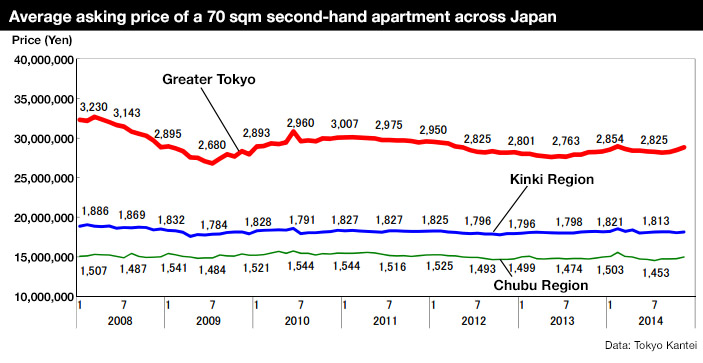

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sqft) second-hand apartment in Tokyo’s 23 wards was 43,300,000 Yen in November, up 1.7% from the previous month and up 6.6% from last year. The average building age was 22.3 years.

In central Tokyo’s six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average apartment asking price was 61,280,000 Yen, up 1.8% from the previous month and up 12.0% from last year. The rate of increase has been expanding since August 2014. The average building age was 21.6 years.Read more

New apartment prices in Tokyo up 10.3%

According to the Real Estate Economic Institute, 3,337 brand new apartments were released for sale in greater Tokyo in November, up 6.8% from the previous month but down 33.3% from last year. This is the 10th month in a row to see a year-on-year decline. It is also lower than the Institute’s forecast of 4,000 apartments. This is the lowest level for November since 2008 and is thought to be due to developers postponing sales in major projects until the new year.

2,617 apartments were sold, making the contract rate 78.4%, up 15.1 points from the previous month but down 1.2 points from last year.

The average new apartment price was 52,240,000 Yen, up 14.6% from the previous month and up 5.2% from last year. The average price per square meter was 737,000 Yen, up 15.5% from the previous month and up 6.2% from last year.Read more

November rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,560 Yen/sqm in November, down 1.6% from the previous month but up 0.3% from last year. This is the first time in five months to see a month-on-month decline in rent. The average apartment size was 59.90 sqm and the average building age was 19.5 years.

The average monthly rent in Tokyo’s 23-ku was 3,199 Yen/sqm, down 1.1% from the previous month but up 2.8% from last year. The average apartment size was 56.76 sqm and the average building age was 17.7 years. Although rents across all areas within Tokyo have started to weaken, they are still hovering around the 3,200 Yen/sqm range.Read more

Central Tokyo apartment sale prices reach highest level in 7 years

According to REINS, 2,830 second-hand apartments were sold across greater Tokyo in November, up 6.6% from the previous month but down 9.3% from last year. This is the 8th month in a row to see a year-on-year decline. The average apartment sale price was 28,080,000 Yen, down 0.1% from the previous month but up 5.6% from last year. The average price per square meter was 441,500 Yen, up 1.4% from the previous month and up 7.1% from last year. This is the 23rd month in a row to see a year-on-year increase. The average building age was 20.04 years.

1,431 second-hand apartments were sold in the Tokyo metropolitan area, up 10.2% from the previous month but down 7.1% from last year. This is also the 8th month in a row to see a year-on-year decline. The average sale price was 34,080,000 Yen, down 2.0% from the previous month but up 5.2% from last year. The average price per square meter was 575,800 Yen, down 1.5% from the previous month but up 6.3% from last year. The average building age was 19.20 years.

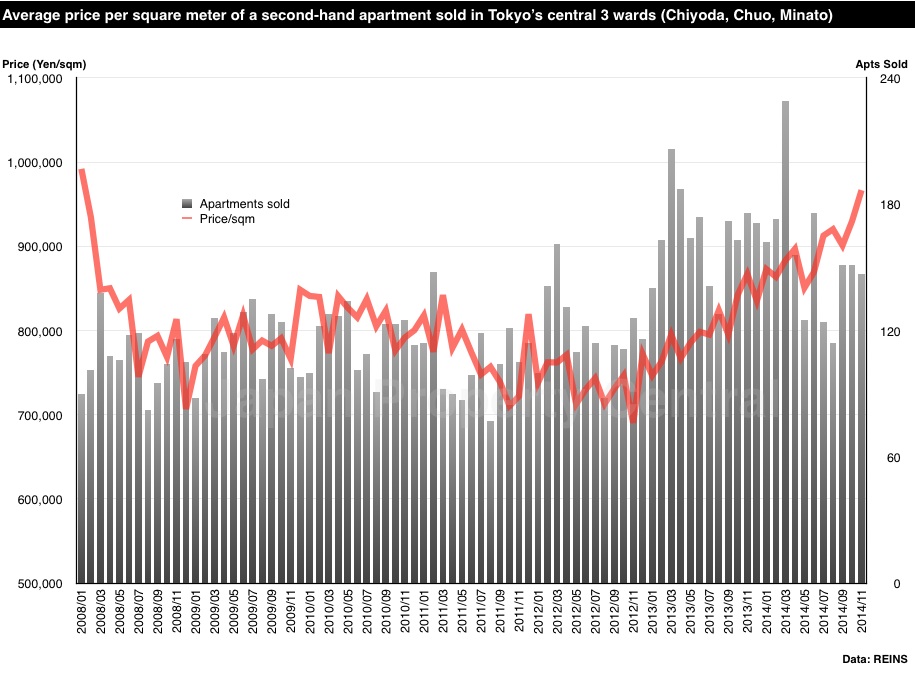

In central Tokyo's 3 wards (Chiyoda, Chuo and Minato), the average sale price was 966,600 Yen/sqm, up 4.0% from the previous month and up 11.5% from last year. This is the highest price seen since January 2008 when prices were 991,900 Yen/sqm.Read more

Supply shortage in central Tokyo sees apartment prices up 40% from market bottom

The price of secondhand apartments in Tokyo is rising, with prices in some areas exceeding those seen in the mini-bubble in 2007. In Tokyo’s 23 wards, the average asking price of a 70 sqm in October 2014 was 42,560,000 Yen, up 8.5% from the low of 39,220,000 Yen seen in July 2012.

One of the main drivers behind the rising prices is the shortage in the supply of brand new apartments. Following the Lehman Shock (or global financial crisis), a number of small-to-medium sized developers filed for bankruptcy. This has left the market controlled by a small number of Japan’s top developers. Prior to the Lehman Shock, the annual supply of brand new apartments reach 80,000 units. In 2014, it has almost halved to around 40,000 units. Buyers, who have not been able to find new apartments in their desired area, have turned to the secondhand market which has reduced supply even further. In the central Tokyo area, there are only half as many apartments on the re-sale market than there were in 2011. Read more

Residential yields and vacancy rates in Minato-ku - December 2014

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in December was 5.9%, up 0.6 points from the previous month but down 0.1 points from last year. The average gross yield across Tokyo was 6.8%, down 0.1 points from the previous month and down 0.8 points from last year.

The vacancy rate remains unchanged at 9.9% in Minato-ku and 11.0% across Tokyo.

The average asking price of a secondhand apartment in Minato-ku was 833,542 Yen/sqm as of December 1, up 3.8% from the previous month and up 16.5% from last year. The average asking price for land was 1,258,787 Yen/sqm, down 1.1% from the previous month but up 17.5% from last year.Read more