New apartment prices in Tokyo down 7% in December but annual average reaches record high

According to the Real Estate Economic Institute, 9,389 brand new apartments were released for sale in greater Tokyo in December, up 181.4% from the previous month and up 13.9% from December 2013.

6,567 apartments were sold, making the contract rate 69.9%, down 8.5 points from the previous month and down 6.2 points from the previous year. This is just below the 70% level which is said to be the line between positive and negative market conditions.

The average new apartment price was 50,220,000 Yen, down 3.9% from the previous month and down 5.9% from the previous year. The average price per square meter was 710,000 Yen, down 3.7% from the previous month and down 4.4% from the previous year.

1,940 apartments in high-rise buildings (over 20-storeys) were offered for sale, up 63.9% from the previous year. The contract rate was 63.7%, down 15 points from the previous year and also below the 70% market indicator.Read more

December rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condomonium apartment in greater Tokyo was 2,562 Yen/sqm in December, up 0.1% from the previous month and up 1.9% from the previous year. The average apartment size was 59.62 sqm and the average building age was 19.7 years.

In Tokyo’s 23-ku, the average monthly rent was 3,195 Yen/sqm, down 0.1% from the previous month but up 2.3% from the previous year.

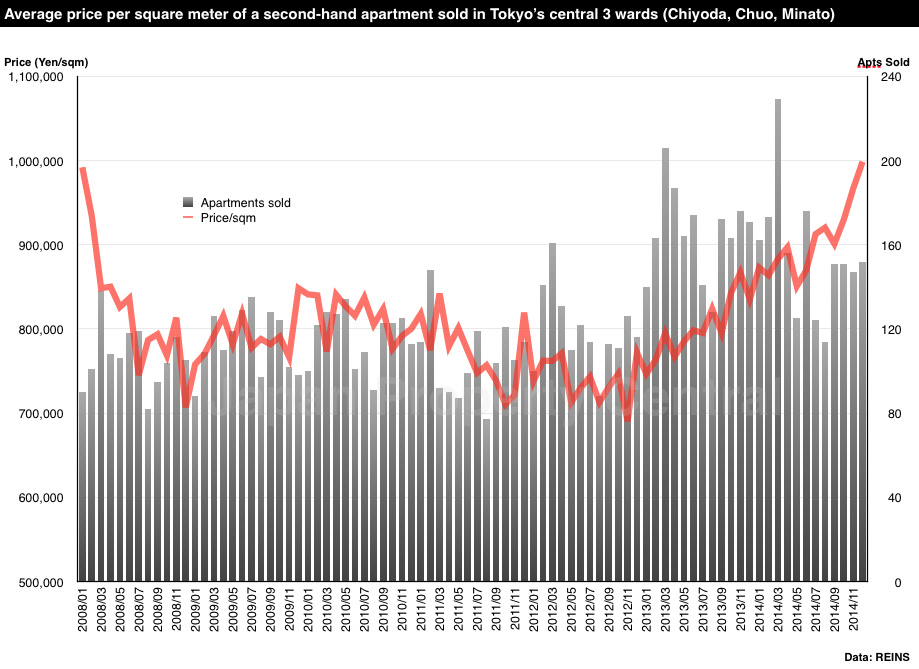

Second-hand apartment prices in central Tokyo up 19% over the year

According to REINS, 2,497 second-hand apartments were sold across greater Tokyo in December 2014, down 11.8% from the previous month and down 13.9% from December 2013. This is the 9th month in a row to see a year-on-year decline.

The average apartment sale price was 28,470,000 Yen, up 1.4% from the previous month and up 11.2% from the previous year. The average price per square meter was 448,700 Yen, up 1.6% from the previous month and up 10.9% from the previous year. The average building age was 19.85 years.

1,250 second-hand apartments were sold in the Tokyo Metropolitan Area, down 12.6% from the previous month and down 12.1% from the previous year. The average sale price was 35,070,000 Yen, up 2.9% from the previous month and up 12.7% from the previous year. The average price per square meter was 593,400 Yen, up 3.1% from the previous month and up 10.7% from the previous year. The average building age was 18.93 years.

Luxury sales are rising in the metropolitan area with 79 apartments priced over 100 million Yen selling in the 4th quarter of 2014, up 31.7% from the same quarter in 2013.

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), the average sale price was 57,310,000 Yen, up 15.4% from the previous month and up 28.5% from the previous year. The average price per square meter was 998,600 Yen/sqm, up 3.3% from the previous month and up 19.6% from the previous year. It has now exceeded the level seen in January 2008 when REINS began keeping records for central Tokyo sale prices.Read more

Office vacancy rates in Tokyo down for 18th consecutive month

According to Miki Shoji’s office report, the office vacancy rate in Tokyo’s five central business districts (Chiyoda, Chuo, Minato, Shinjuku and Shibuya) was 5.47% in December 2014, down 0.08 points from the previous month and down 1.87 points from last year. This is the 18th month in a row to see a month-on-month decrease in vacancy rates.

In Minato-ku, vacancy rates dropped to the 5% range for the first time since January 2009.

The vacancy rate in brand new office buildings was 13.40%, down 0.33 points from the previous month and down 1.10 points from last year. Only one office building was completed in December and was fully leased at the time of completion.Read more

Demand from local and foreign buyers continues to push prices higher

Recently, both new and secondhand apartments have seen a steep rise in prices, yet rental prices have remained relatively flat. As a result, yields have been falling with the typical gross yield across greater Tokyo dropping to the 4 ~ 5% range.

The increase in demand from wealthy Japanese looking to reduce their inheritance tax burden as well as renewed interest from foreign investors is thought to be the main driver behind the jump in prices.

Domestic investors looking to reduce inheritance taxes

High-rise apartments have been in high demand as their inheritance tax value is a fraction of their actual market value, offering a potentially large decrease in the tax burden for heirs. While there might be a 20 ~ 30% difference in the market price of an apartment on a high floor versus a low floor, both apartments (assuming they are the same size) are given the same value by the tax office. Buying an apartment on a higher floor, therefore, could provide a bigger deduction than one on a low floor. Compared to cash and other financial assets which are taxed based on their face value, the value of a high-rise apartment for tax purposes might be reduced by as much as 80% from its market value*. Wealthy Japanese have been actively buying up high-rise apartments, including those that might seem comparatively expensive.Read more

Residential yields in Minato-ku - January 2015

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in January was 5.3%, down 0.6 points from the previous month and down 0.5 points from last year. The average gross yield across Tokyo was 6.8%, showing no change from the previous month but down 0.7 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 843,128 Yen/sqm as of January 1, up 1.2% from the previous month and up 14.1% from last year. The average asking price for land was 1,262,424 Yen/sqm, up 0.3% from the previous month and up 50.5% from last year.(*Note: January 2014 saw a temporary dip in land prices. Since the prices are based on listings on the Homes site, it is possible that some comparatively cheap land was listed which may have pulled the average down for that month.)Read more

Tokyo apartment sales in December 2014

The following is a selection of apartments that were sold in central Tokyo during the month of December 2014:Read more