Tokyo apartment sales in May 2015

The following is a selection of apartments that were sold in central Tokyo during the month of May 2015:Read more

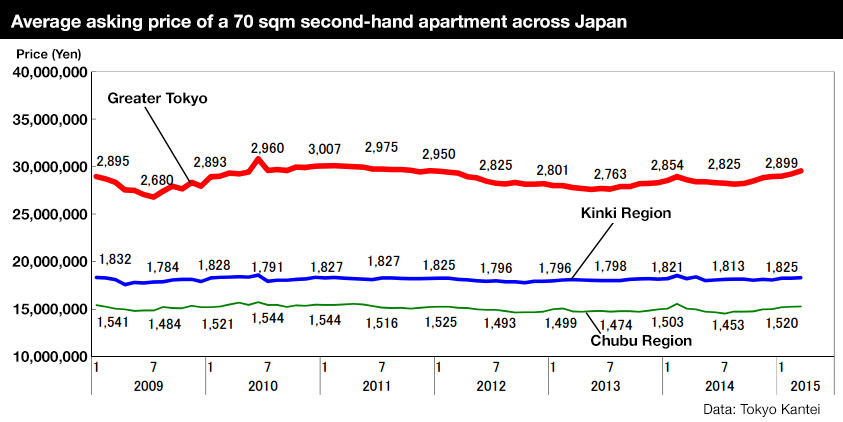

Secondhand apartment prices remain bullish in April

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) apartment in greater Tokyo in April was 29,690,000 Yen, up 0.4% from the previous month and up 4.5% from last year. This is the 8th month in a row to see a month-on-month increase. The average building age was 21.9 years.

The rising cost of brand new apartments is thought to be a contributing cause to the increase in the price of second-hand apartments. Rising prices in central Tokyo are pulling up the average, while suburban areas fall behind. In Chiba City, for example, the average apartment price is down 4.1% from last year.

In Tokyo’s 23 wards, the average asking price was 45,630,000 Yen, up 0.6% from the previous month and up 10.0% from last year. This is the 10th month in a row to see a month-on-month increase and is 3.5% below the previous peak in February 2008. The average building age was 22.2 years.

In central Tokyo’s six wards, the average price was 64,920,000 Yen, up 0.4% from the previous month and up 13.4% from last year. The average building age was 21.5 years.

In Chiyoda-ku, the average asking price was 89,720,000 Yen, up 1.6% from the previous month and up 10.5% from last year.

Supply in central areas is very limited which is putting more pressure on prices. Tokyo Kantei believes prices will continue to increase in central Tokyo. One trend that is becoming particularly noticeable is that sellers, such as developers, are holding off on selling properties now in anticipating of selling them in the future for even higher prices.Read more

New apartment supply in April at 23-year low

According to the Real Estate Economic Institute, 2,286 brand new apartments were released for sale in greater Tokyo in April, down 48.6% from the previous month and down 7.6% from last year. This is the lowest level recorded for the month of April since 1992, when just 1,365 apartments were released for sale. It is also the fourth month in a row to see a decline.

One of the contributing factors to the drop in supply was a delay in sales offerings by some developers. The sale of as many as 500 ~ 600 units were postponed until May to appeal to buyers during the Golden Week holidays.

1,727 apartments were sold, making the contract rate 75.5%, down 4.1 points from the previous month but up 0.8 points from last year.

The average new apartment price was 53,050,000 Yen, up 2.3% from the previous month and up 9.5% from last year. The average price per square meter was 758,000 Yen, up 3.0% from the previous month and up 7.8% from last year.Read more

Secondhand apartment transactions up for first time in 13 months

According to REINS, 2,808 second-hand apartments were sold across greater Tokyo in April, down 24.7% from the previous month but up 0.8% from last year. This is the first time in 13 months to see an increase in transactions from the year before. February and March are typically the busiest months of the year for sales, so it is not surprising to see transactions down from March.

The average apartment sale price was 28,280,000 Yen, down 3.2% from the previous month but up 5.2% from last year. The average price per square meter was 445,500 Yen, down 1.7% from the previous month but up 5.1% from last year. The average building age was 20.11 years.

1,377 apartments were sold in the Tokyo metropolitan area, down 25.3% from March but up 1.0% from April 2014. This is also the first time in 13 months to see a year-on-year increase in transactions. The average sale price was 34,900,000 Yen, down 1.9% from the previous month but up 3.6% from last year. The average price per square meter was 597,400 Yen, down 1.9% from the previous month but up 3.6% from last year. The average building age was 18.95 years.

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 158 apartments were sold, down 31.3% from the previous month but up 1.3% from last year. The average sale price was 53,600,000 Yen, down 1.3% from the previous month but up 11.3% from last year. The average price per square meter was 996,800 Yen, up 3.0% from the previous month and up 11.1% from last year. The average building age was 16.24 years.Read more

Residential yields in Minato-ku - May 2015

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in May was 4.7%, down 0.1 points from the previous month and down 0.6 points from last year. The average gross yield across Tokyo was 6.6%, showing no change from the previous month but down 0.5 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 869,700 Yen/sqm as of May 1, down 1.1% from the previous month but up 9.8% from last year. The average asking price for land was 1,211,818 Yen/sqm, up 0.5% from the previous month and up 5.7% from last year.Read more

High-rise apartment trends from 2015 onwards

According to data compiled by the Real Estate Economic Institute, there are currently 262 super high-rise* residential buildings containing 101,450 apartments planned for completion across Japan from 2015 onwards. This is an increase of 75 buildings and 25,910 apartments from last year.

77,824 of the apartments, comprising 76.7% of the total, are located in the greater Tokyo area, and 50,371 apartments (49.7%) are within Tokyo’s 23 wards.

The planning and construction of super high-rise apartment buildings began to increase in the late 1990s. High-rise apartment buildings have remained steadily popular with buyers, and have retained relatively strong re-sale values.

However, the downturn in the property market following the collapse of Lehman Brothers in late 2008 saw developers limit the supply of new construction. As a result, the annual supply of apartments went from 35,609 in 2009 to 17,967 in 2010. The Tohoku tsunami and earthquake in 2011 saw a number of projects in the Tohoku and Kanto regions delayed, and new supply dropped to 13,321 apartments.Read more

Apartment asking prices up for 7th month in a row

Second-hand apartment prices in greater Tokyo continue to rise this month with the average asking price of a 70 sqm (753 sq ft) apartment up 1.1% from February and up 3.3% from last year. This is the 7th month in a row to see a month-on-month increase. According to Tokyo Kantei, the average apartment asking price greater Tokyo in March was 29,560,000 Yen.

In Tokyo’s 23 wards, the average asking price was 45,360,000 Yen, up 1.7% from the previous month and up 9.4% from last year. The average building age was 22.1 years. The property market in Tokyo is far-outperforming Yokohama City (+1.5% from March 2014), Saitama City (+2.5%), Chiba City (-2.3%) and Osaka City (+3.1%).

Prices continue to reach new highs in central Tokyo’s six wards with the average asking price reaching 64,680,000 Yen, an increase of 2.1% from February and and increase of 13.0% from last year. This is the 9th month in a row to see a month-on-month increase. The gap between price rises in central Tokyo and other wards is becoming more apparent.

Asking prices are being supported by an increase in actual contracted prices. Sellers and real estate brokers are also setting higher and higher asking prices. The market for second-hand properties in Tokyo has been strengthening as a shrinking supply of new apartments is causing buyers to consider older apartments which are typically less expensive. Demand from investors is also strong, and properties that have been set at high prices are starting to sell without any discounting.Read more