Tokyo Apartment Sales in November 2015

The following is a selection of apartments that were sold in central Tokyo during the month of November 2015:Read more

Apartment asking prices in Tokyo increase for 16th month but supply-demand balance starts to shift

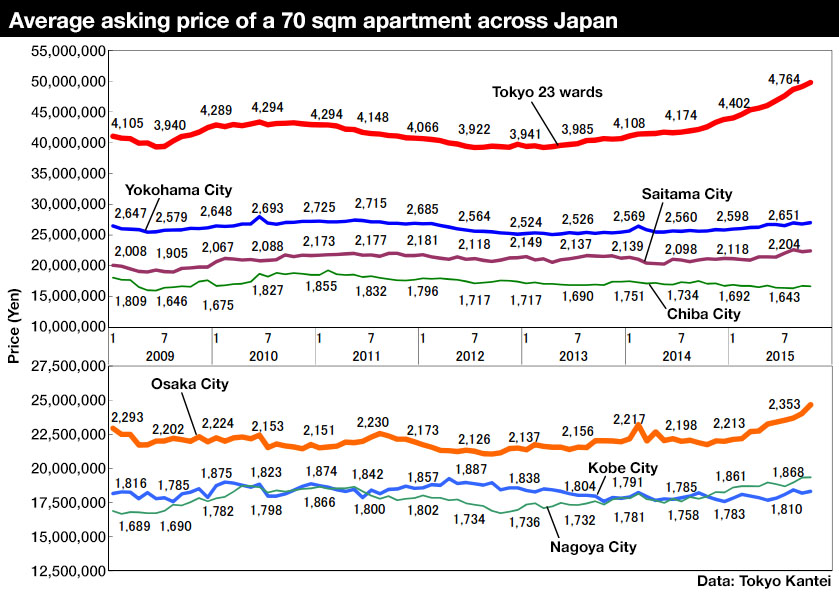

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq.ft) second-hand apartment in greater Tokyo in October was 31,970,000 Yen, up 1.2% from the previous month and up 12.3% from last year. This is the 14th month in a row to see a month-on-month increase in asking prices. The average building age was 22.3 years.

In Tokyo’s 23 wards, the average asking price was 49,780,000 Yen, up 1.3% from the previous month and up 17.0% from last year. This is the 16th month in a row to see a month-on-month increase. The average building age was 22.0 years.

In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya), the average asking price was 69,690,000 Yen, up 0.7% from the previous month and up 15.8% from last year. This is the fifth month in a row to see an increase, although the rate of increase has slowed.Read more

Residential rental growth slows in Tokyo

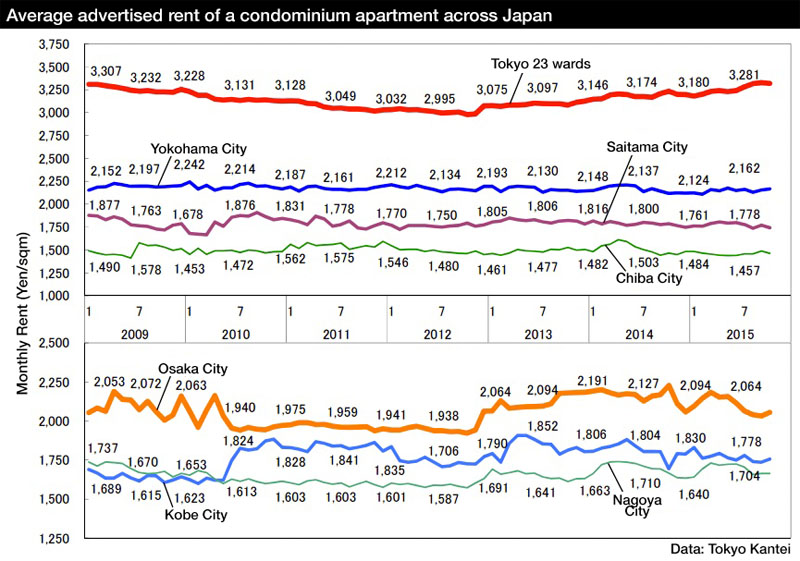

According to Tokyo Kantei, the average monthly rent of a condominium in greater Tokyo was 2,681 Yen/sqm in October, up 1.3% from the previous month and up 3.0% from last year. The increase is due to a larger share of transactions in the Tokyo metropolitan area, which is pulling up the average. The average apartment size was 59.65 sqm and the average building age was 19.2 years.

In the Tokyo metropolitan area, the average rent was 3,184 Yen/sqm, up 0.1% from the previous month and up 2.7% from last year. The average apartment size was 57.08 sqm and the average building age was 17.4 years.

In Tokyo’s 23 wards, the average rent was 3,317 Yen/sqm, down 0.3% from the previous month but up 2.6% from last year. The average apartment size was 56.49 sqm and the average building age was 17.0 years.Read more

Tokyo apartment prices increase for 37th consecutive month

According to REINS, 2,877 second-hand apartments were sold across greater Tokyo in October, up 3.8% from the previous month and up 8.4% from last year. The average apartment sale price was 29,480,000 Yen, down 0.4% from the previous month but up 4.8% from last year. The average price per square meter was 458,000 Yen, down 1.0% from the previous month but up 5.2% from last year. The average building age was 20.32 years.

In the Tokyo metropolitan area, 1,415 second-hand apartments were sold, up 1.9% from the previous month and up 8.9% from last year. The average sale price was 36,860,000 Yen, up 2.2% from the previous month and up 6.0% from last year. The average price per square meter was 619,100 Yen, up 1.1% from the previous month and up 5.9% from last year. This is the 37th month in a row to see a year-on-year increase in the sale price per square meter. The average building age was 19.30 years.

Central Tokyo’s 3 wards

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 179 second-hand apartments were sold, up 14.7% from the previous month and up 14.7% from last year. The average sale price was 57,220,000 Yen, up 7.8% from the previous month and up 10.3% from last year. The average price per square meter was 1,039,800 Yen, up 1.5% from the previous month and up 11.8% from last year. The average building age was 16.55 years.

Sale prices per square meter in central Tokyo are now up 50.6% from the most recent bottom seen in November 2012. Read more

Park Court Akasaka Hinokicho The Tower sells-out despite record-high pricing

All apartments initially offered for sale in the Kengo Kuma-designed Park Court Akasaka Hinokicho The Tower, currently under construction near Tokyo Midtown, have sold out during the first stage of sales held over the past weekend. The building is now 93% sold. Over 1,000 bookings were made to visit the sales office's showroom in the lead up to the first round of sales.

Prices started from 155.6 million Yen (1.26 million USD) for a 57 sqm (613 sq.ft) 1-Bedroom unit, up to 1.5 billion Yen (12.2 million USD) for a 203 sqm (2,184 sq.ft), 3-Bedroom penthouse apartment. With a price of 7,354,000 Yen/sqm (5,500 USD/sq.ft), the 203 sqm apartment could possibly be the most expensive apartment to go on sale in Japan since the bubble era of the 1980s. Even penthouse apartments in Roppongi Hills have only reached 4 ~ 5 million Yen/sqm in recent years, while apartments in the Toranomon Hills complex are around 4 million Yen/sqm. Despite the strong pricing in the building, only the 203 sqm penthouse unit has two full bathrooms, while the rest of the apartments in the building have 1 bathroom each.Read more

Residential yields in Minato-ku - November 2015

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in Tokyo was 4.7% in November, up 0.2 points from the previous month but down 0.6 points from last year. The average gross yield across Tokyo was 6.3%, down 0.2 points from the previous month and down 0.6 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 877,700 Yen/sqm as of November 1, 2015, up 0.7% from the previous month and up 9.3% from last year. The average asking price for land was 1,280,909 Yen/sqm, up 0.9% from the previous month and up 0.6% from last year.Read more

Tokyo apartment sales in October 2015

The following is a selection of apartments that were sold in central Tokyo during the month of October 2015:Read more