Why the registered land size may differ from the actual size

When buying land it is important to be aware that registered land sizes can often differ from actual measured or surveyed sizes. This dates back to the Land Tax Reform introduced by the Meiji government in 1873 that coincided with the establishment of private land ownership. Read more

When buying land it is important to be aware that registered land sizes can often differ from actual measured or surveyed sizes. This dates back to the Land Tax Reform introduced by the Meiji government in 1873 that coincided with the establishment of private land ownership. Read more

Negotiating the price on real estate in Japan

A question every buyer asks us is how negotiable is the price? The short answer is ‘it depends’.

A question every buyer asks us is how negotiable is the price? The short answer is ‘it depends’.

Every single transaction is different, so there is not one-size-fits-all tactic to negotiating. In the current market, the majority of real estate transactions that take place in Tokyo sell at full asking price or at a minimum discount (somewhere between 0 ~ 3%). Some buyers get too obsessed with the percentage discount and miss out on properties that were already priced in line with the market, and even some great deals. If getting the biggest discount is your priority, you may end up buying something no one else wanted or something that was overpriced to begin with.Read more

Got a big car? Parking might be a challenge

It has become increasingly difficult to find monthly car parking spaces for lease in central Tokyo, according to an article in Kuruma News earlier this month. And that may be due to more people buying cars during the pandemic.

How much are the monthly building fees for an apartment?

Curious about the typical monthly building fee charges that come with owning an apartment in Tokyo?

Government to collate real estate info on one website

The Japanese government is working on creating an online resource that will provide information on land values (government assessed values, not market values), town planning, and risk maps all in one place.

What happens to an old building that doesn't meet current fire codes?

On January 28, NHK published a piece on old ‘non-compliant’ buildings that don’t meet current fire codes. A ‘kison-futeki-kaku’ (既存不適格) or non-compliant building is one that was built to the correct codes at the time of construction, but as codes were updated over the years, would not meet current standards and could not be re-built to the exact same specifications today.

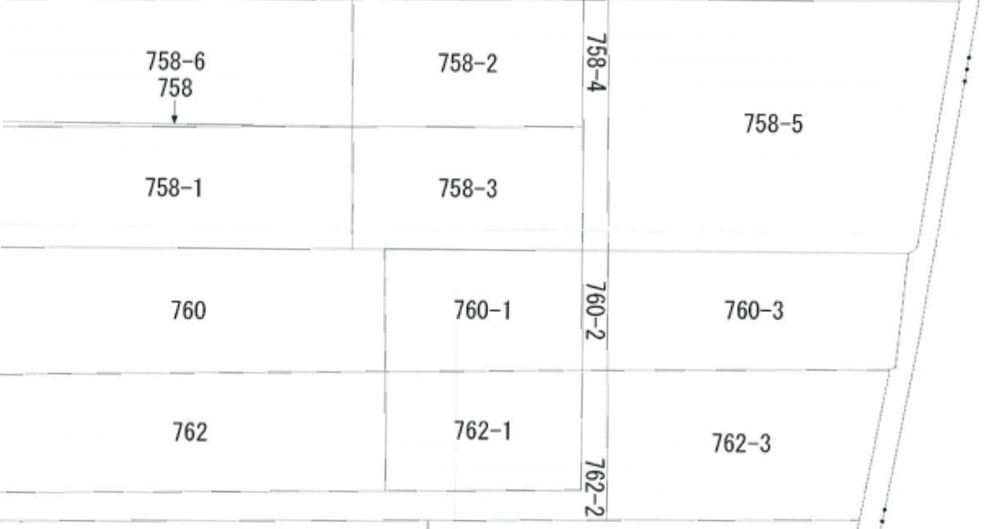

Japan's two-address systems for land and buildings

Did you know that buildings and land in Japan can have two addresses? One for registration identification purposes and another to be used as the postal address. While this won't affect your day-to-day life, it always comes up as a question from buyers when going over the contract of sale documents, so it may be worth explaining it in detail below.