Price growth in Tokyo more subdued than the 2007 mini-bubble

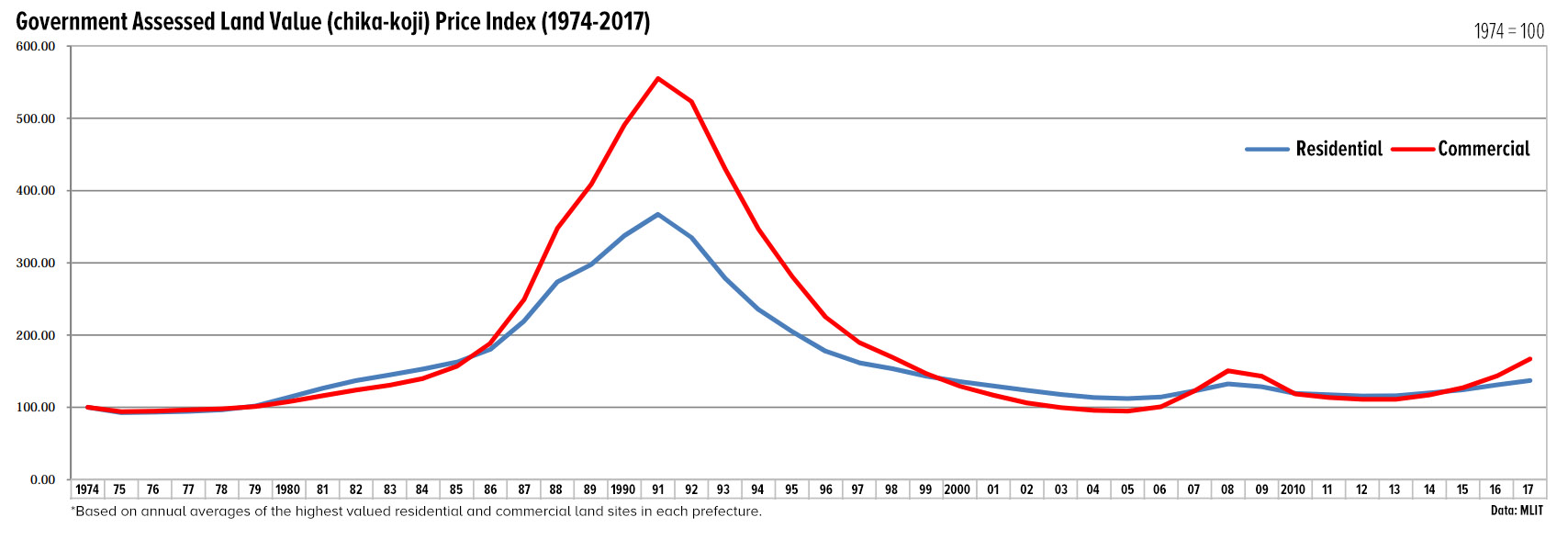

Earlier this year, rosenka tax values at a section of ultra-prime commercial land in Tokyo’s Ginza district increased by 26% from the previous year to a record high of 40,320,000 Yen per square meter, exceeding the previous high of 36,500,000 Yen/sqm in 1992 and causing some to warn of an impending bubble and overheating of the property market in the nation’s capital.

There is valid cause for concern in some sectors of the investment-property market due to potential over-construction and over-lending to landowners to build small blocks of 'apaato' type rental flats in suburban areas with low rental demand.

But are current conditions mimicking previous bubbles?

This time around Japan is getting more foreign tourists than ever before, boosting revenues for both hotels and retails shops, making the increase in commercial real estate values much more pronounced than the residential market which relies more on real domestic demand.