More details on proposed changes to annual property taxes

More details have been released on the proposed revision to the annual fixed asset taxes for high-rise apartments.

More details have been released on the proposed revision to the annual fixed asset taxes for high-rise apartments.

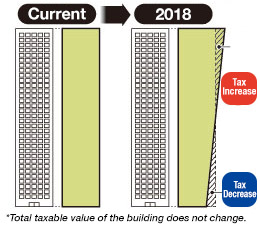

Current tax valuations for the building are based on the size of the apartment, which means an apartment on the 40th floor would have the same fixed asset value as the same-sized apartment on the 1st floor, despite market prices being vastly different.

Under the proposed revision, apartments on higher floors will be more heavily taxed, while apartments on lower floors will have lower taxes. For a 40-storey apartment building, the difference in tax value between a 1st floor and 40th floor apartment could be around 10%. If the annual tax was 200,000 Yen, the apartment on the 1st floor might end up with a tax bill of 190,000 Yen, and the apartment on the 40th floor might have a tax bill of 210,000 Yen. For a 50-storey building, the difference might be 12 ~ 13%.

If approved, the new tax calculation method would apply to brand-new apartment buildings delivered to buyers from 2018 onwards. The target of the tax revision is brand-new buildings over 60 meters tall (over 20 storeys). It will not apply to existing buildings delivered to buyers before this date.

Sources:

Jiji Press, November 25, 2016.

The Nikkei Shimbun, November 26, 2016.