JREIT trades Tokyo office for multi-family

ORIX JREIT and Osaka Gas Urban Development are trading several properties between each other this month, including some multi-family at appraised cap rates in the low-to-mid 3% range.Read more

ORIX JREIT and Osaka Gas Urban Development are trading several properties between each other this month, including some multi-family at appraised cap rates in the low-to-mid 3% range.Read more

Semiconductor boom pushes rents and land values up by 30% in one Hokkaido City

Semiconductor factories are driving several localized property booms in otherwise quiet parts of Japan. One of those is in Chitose City, located about a 45-minute drive from Sapporo, where construction of the Rapidus factory is now underway.Read more

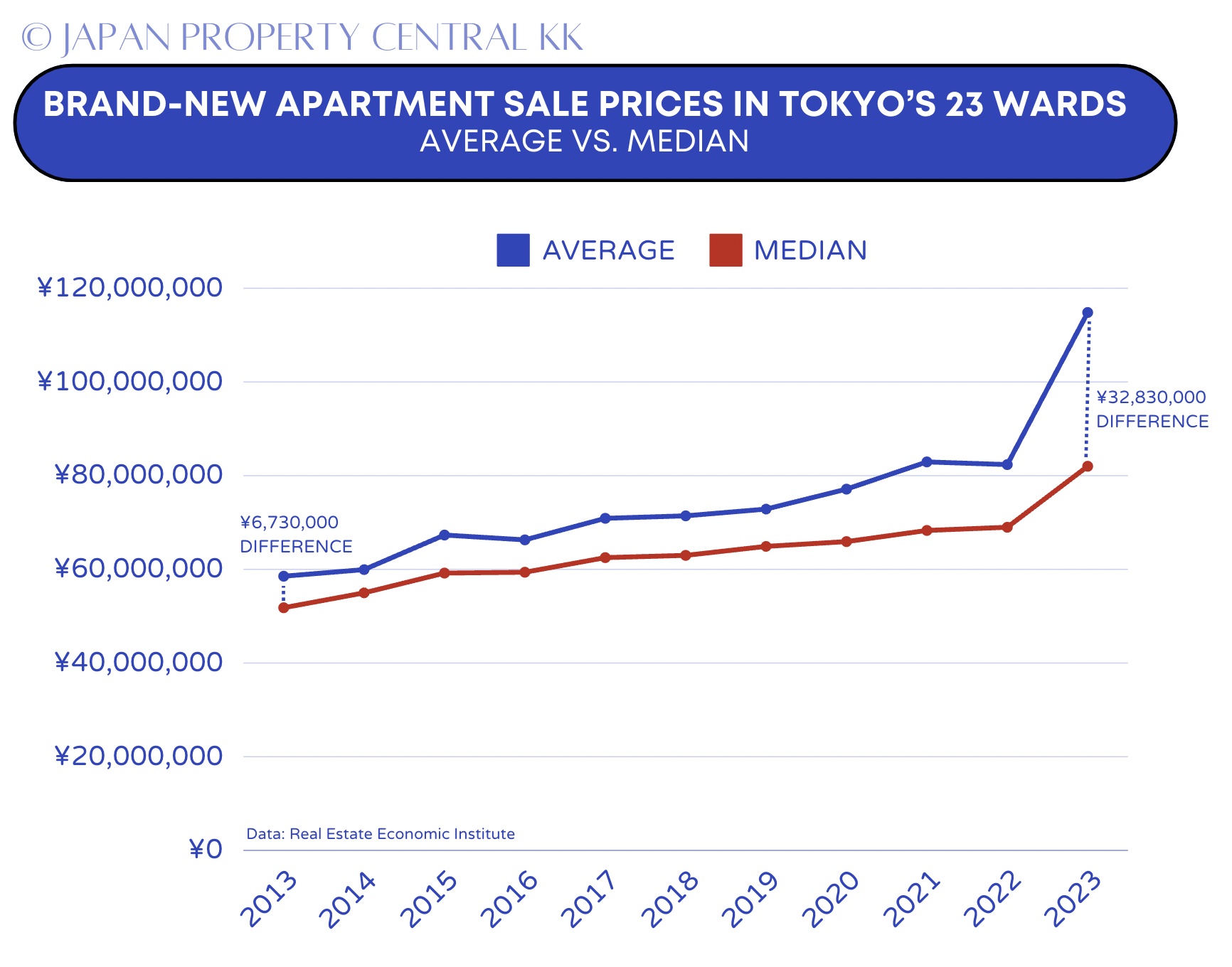

Tokyo's median apartment price is almost 30% lower than its average

You might recall some recent headlines about surging property prices in Tokyo. And while that maybe true, the numbers reported by most of the research companies tend to be averages rather than median pricing. Some of those headlines are also referring solely to the cost of brand-new condos, not properties on the resale market. Again, another number that is not representative of the market as a whole.Read more

Developer aims to fill gap in group-stay and long-term hotel market

Just 4% of the hotels in Japan’s major cities have rooms that can accommodate three or more guests. Meanwhile, approximately half of the foreign travelers visiting Japan are coming in groups of three or more. Only a small number of hotel developers have picked up on this mismatch.Read more

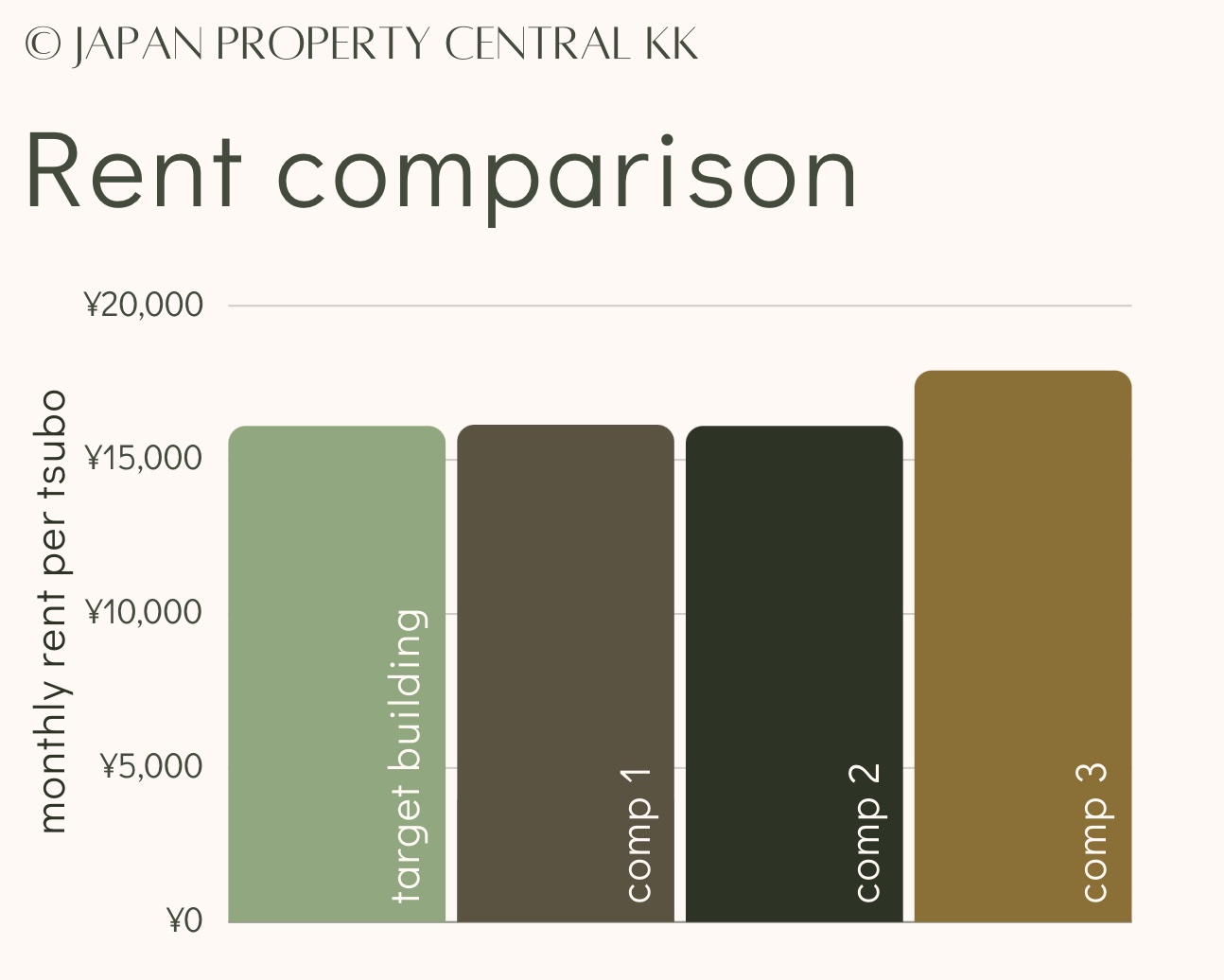

Market overview of a Shinjuku multi-family building for sale

Let’s do a bit of a dive into a multi-family property listed for sale in central Tokyo recently.Read more

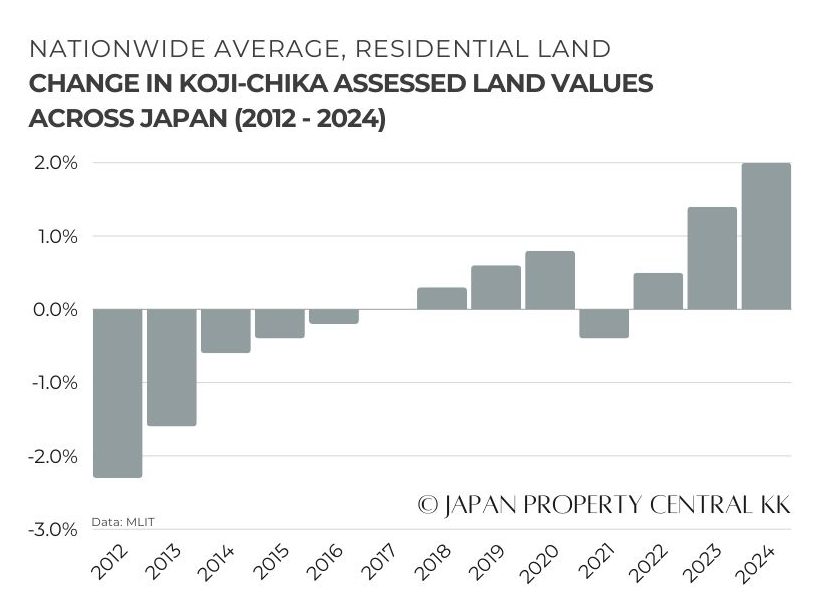

Japan's land values reach highest level since 1991

Annual land values were announced on Tuesday and the return-to-work trend, recovery in inbound tourism, and a dispersal of attention away from Niseko and towards other cheaper ski resort destinations is apparent.Read more

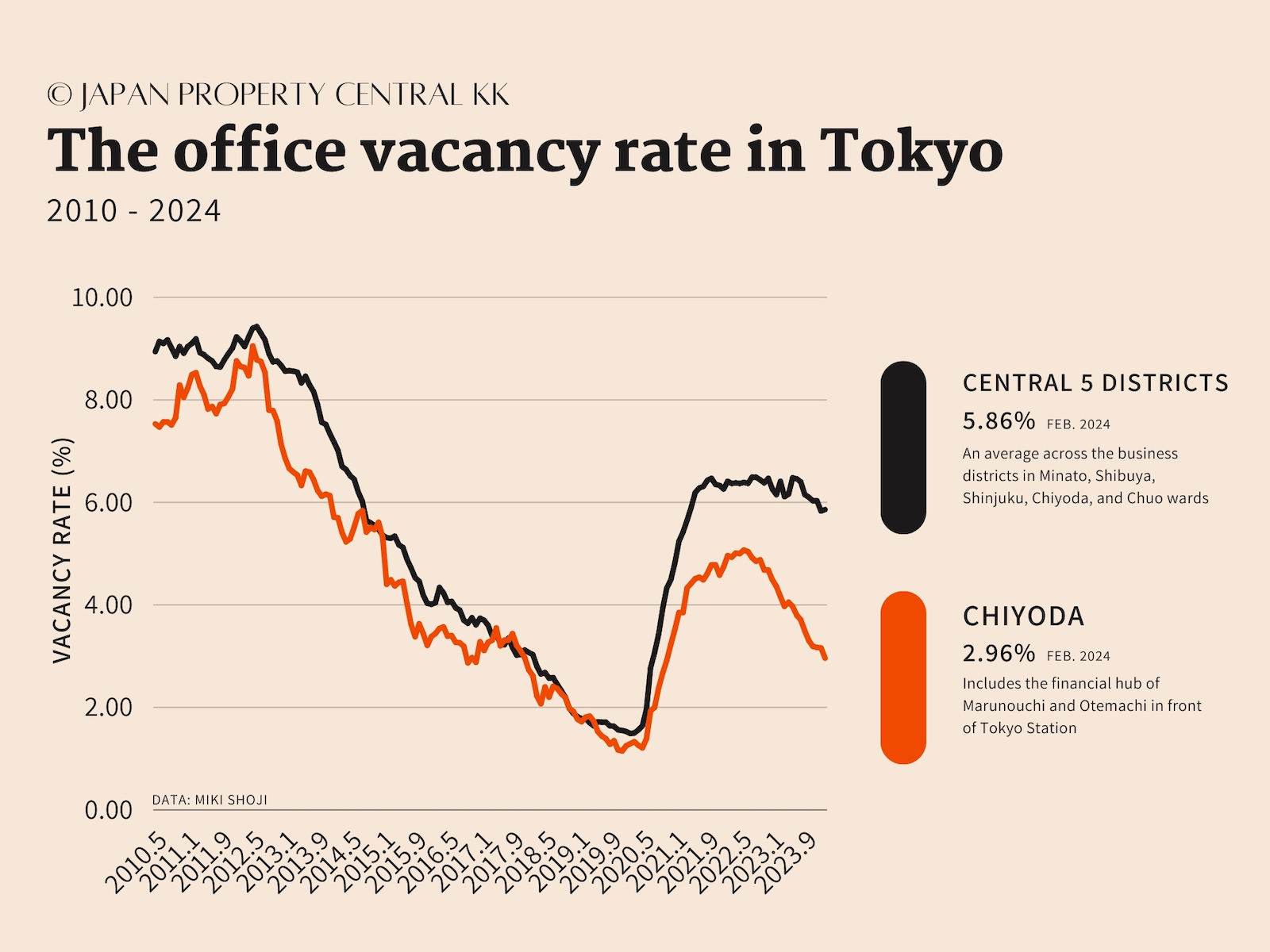

Chiyoda office vacancy rate reaches 39-month low

In February, the office vacancy rate in the Chiyoda business district in Tokyo reached the lowest level in 39 months. According to office brokerage Miki Shoji, the vacancy rate dropped by 0.2 points from the previous month to 2.96%. This is 1.4 points lower than 12 months ago.Read more

In February, the office vacancy rate in the Chiyoda business district in Tokyo reached the lowest level in 39 months. According to office brokerage Miki Shoji, the vacancy rate dropped by 0.2 points from the previous month to 2.96%. This is 1.4 points lower than 12 months ago.Read more