2011 disaster victims may soon see a hike in property taxes

Owners of vacant land in disaster-hit areas following the 2011 Tohoku earthquake and tsunami, and Fukushima Daiichi nuclear disaster may see a steep hike in their property taxes from 2022 onwards.

It’s tax time for property owners in Japan

If you currently own property in Japan, you should be receiving your annual property tax bill this month or next. These taxes are owed by anyone who owns real estate in Japan, be it residential, commercial or otherwise. Those living overseas are taxed the same as those living in the country.

New tax revision to allow 2% of building purchase price to be deducted

The government has decided to extend the home loan tax deduction program for new home buyers to allow a three-year period whereby a home owner could deduct up to 2% of the building portion of their purchase price from their income tax. This is an effort to help support the housing market this year when the consumption tax rate is scheduled to increase to 10% from October 2019.

Kyoto may impose hefty tax on short-term accommodation hosts

Kyoto City is firming up plans to impose a nightly tax on providers of short-term accommodation, or ‘minpaku’-type rentals. If approved, it could go into effect from October 2018.

Under the proposal, hosts or providers may be taxed at 200 Yen per night on accommodation that is priced at under 20,000 Yen per person, per night, 500 Yen on nightly accommodation that is between 20,000 ~ 50,000 Yen, and 1,000 Yen on nightly accommodation that is over 50,000 Yen.Read more

Kyoto is considering a tax on holiday home owners

Kyoto City is looking into introducing a tax on holiday home owners. In recent years, the number of out-of-town buyers of homes and apartments in the historic city has grown. The homes sit empty for most of the year while the owners do not provide much in the way of tax revenue, leaving locals to carry the costs of maintaining the city's infrastructure, and various local activities and programs.

Furthermore, increasing tourist numbers have led to intense competition for hotel development sites, pushing up real estate prices in the inner city areas to levels that are now unaffordable for the younger population.Read more

More details on proposed changes to annual property taxes

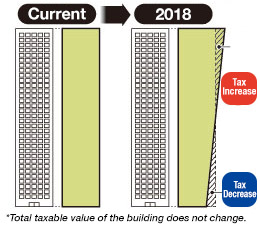

More details have been released on the proposed revision to the annual fixed asset taxes for high-rise apartments.

More details have been released on the proposed revision to the annual fixed asset taxes for high-rise apartments.

Current tax valuations for the building are based on the size of the apartment, which means an apartment on the 40th floor would have the same fixed asset value as the same-sized apartment on the 1st floor, despite market prices being vastly different.

Under the proposed revision, apartments on higher floors will be more heavily taxed, while apartments on lower floors will have lower taxes. For a 40-storey apartment building, the difference in tax value between a 1st floor and 40th floor apartment could be around 10%. If the annual tax was 200,000 Yen, the apartment on the 1st floor might end up with a tax bill of 190,000 Yen, and the apartment on the 40th floor might have a tax bill of 210,000 Yen. For a 50-storey building, the difference might be 12 ~ 13%.

If approved, the new tax calculation method would apply to brand-new apartment buildings delivered to buyers from 2018 onwards. The target of the tax revision is brand-new buildings over 60 meters tall (over 20 storeys). It will not apply to existing buildings delivered to buyers before this date.

Sources:

Jiji Press, November 25, 2016.

The Nikkei Shimbun, November 26, 2016.

Annual property taxes may soon change for high-rise apartments

In Japan, annual property taxes on apartments are based simply on the floor area and the size of the land ownership share underneath the building, with no consideration given to the height of the floor. This means that the owner of a 100 sqm apartment on the top floor of a high-rise would pay the same annual property taxes as the owner of a 100 sqm apartment on the ground or second floor of the building, despite both units having considerably different market values.

The government is looking at adjusting the tax calculation methods for apartments to allow for some consideration to be given to floor height. Although details have yet to be ironed out, current discussions suggest that the new tax methods may apply to brand-new apartment buildings over 60 meters tall (approx. 20 storeys and above).Read more