Inheritance tax changes, not Abenomics, behind recent rise in apartment rent?

According to the Real Estate Economic Institute, the average price of a brand new apartment in greater Tokyo was 49,290,000 Yen in 2013, up 8.6% from the year before and higher than the average of 47,750,000 Yen seen during the ‘mini bubble’ in 2008. Sales of apartments priced over 100 million Yen have also increased, as has investment from domestic and foreign funds.

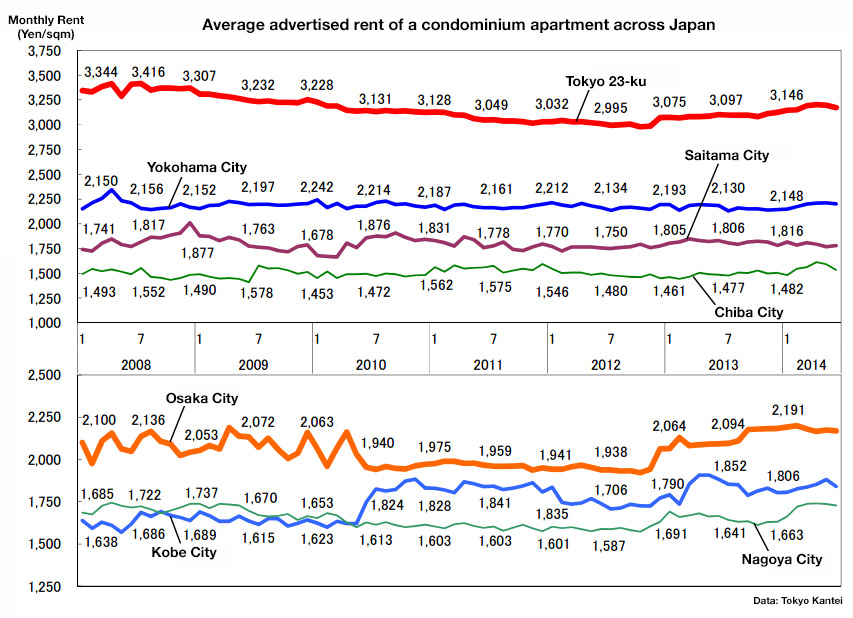

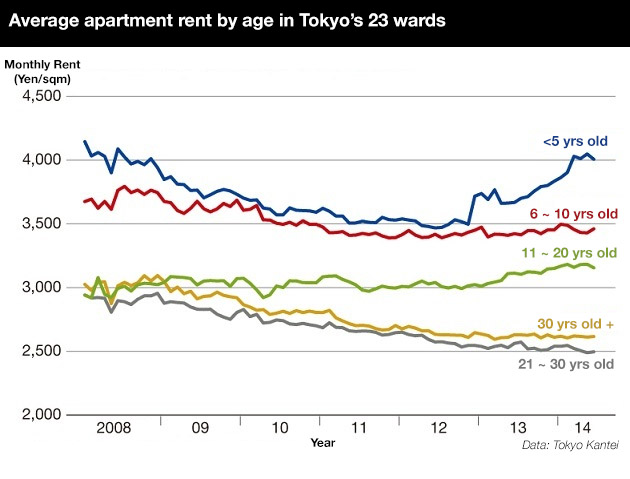

Apartment rent, however, has not shown the same trajectory. According to Tokyo Kantei, the average monthly rent of a family-sized apartment less than 5 years old in Tokyo’s 23 wards was 4,007 Yen/sqm in June 2014, up 9.2% from the previous year. For apartments between 6 ~ 10 years old, the average monthly rent was 3,461 Yen/sqm, showing almost no change from 12 months prior. For apartments aged between 21 ~ 30 years old, average rents dropped by 2.6% to 2,496 Yen/sqm, while rents for apartments over 30 years old had fallen by 0.5% to 2,616 Yen/sqm. Masayuki Takabashi, a researcher from Tokyo Kantei, said that the recent increase in the consumption tax rate has reduced the real income of consumers, which has made conditions difficult for landlords who want to achieve strong rental returns.Read more

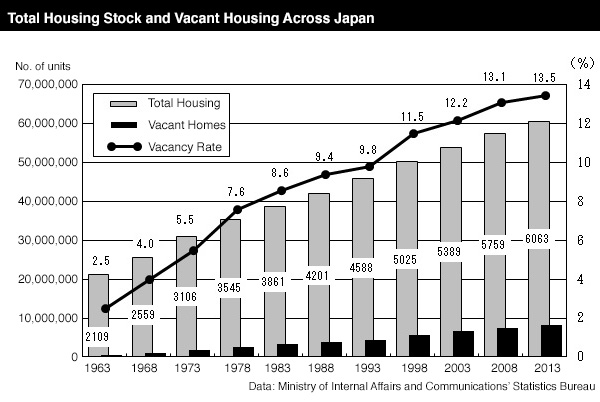

Japan’s nationwide residential vacancy rate hits record high of 13.5%

According to the latest data from the Ministry of Internal Affairs and Communications’ Statistics Bureau, the total housing stock across Japan increased by 3,050,000 units to 60,630,000 units in 2013, up 5.3% from the previous survey in 2008.

Vacancy rates

The number of unoccupied residential properties increased by 630,000 units to 8,200,000 units, up 8.3% from 2008. The nationwide vacancy rate increased by 0.4 points to 13.5% - the highest level seen since record-keeping began in 1963. It is important to realise that these figures include homes that are vacant for a number of reasons. For example, 5.0% of the vacant properties are vacation homes, 3.8% are empty because they are currently for sale, and 38.8% of homes were vacant for other reasons (eg. due to the residents transferring for work, being hospitalised, or because the homes are in the process of being demolished). 52.4% of the vacant homes were rental properties that were sitting empty.

Risk of over-supply

From 2015, inheritance tax deductions will be reduced. As a result, investors have been actively purchasing or building rental apartments as a way to reduce their future inheritance taxes (inheritance tax on real estate is calculated on the tax value of the building and land, which is usually lower than its true market value, while the tax on assets such as cash or stocks is based on its face value. There are also deductions for real estate that is currently rented to a tenant). There is a risk that this trend could lead to an over-supply of rental properties in central areas. Read more

Building age vs. distance from station - which has the biggest impact on rent?

According to data released by Tokyo Kantei, an apartment building’s age has a bigger influence on rent than the distance from the nearest train station.

The difference in rent between an apartment less than 3 years old and a 30-yr old apartment is about 30 ~ 40%. Meanwhile, the difference in rent between an apartment less than a 3 minute walk from the nearest station compared to one 11 ~ 15 minutes away is around 20%.Read more

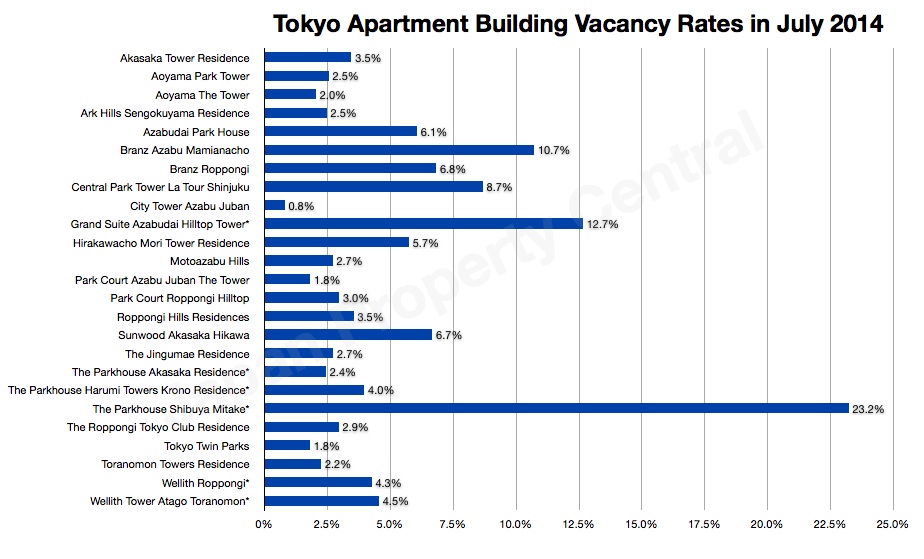

Vacancy rates by apartment building in Tokyo - July

The following is a list of popular apartment buildings in Tokyo and their estimated vacancy rates in July:

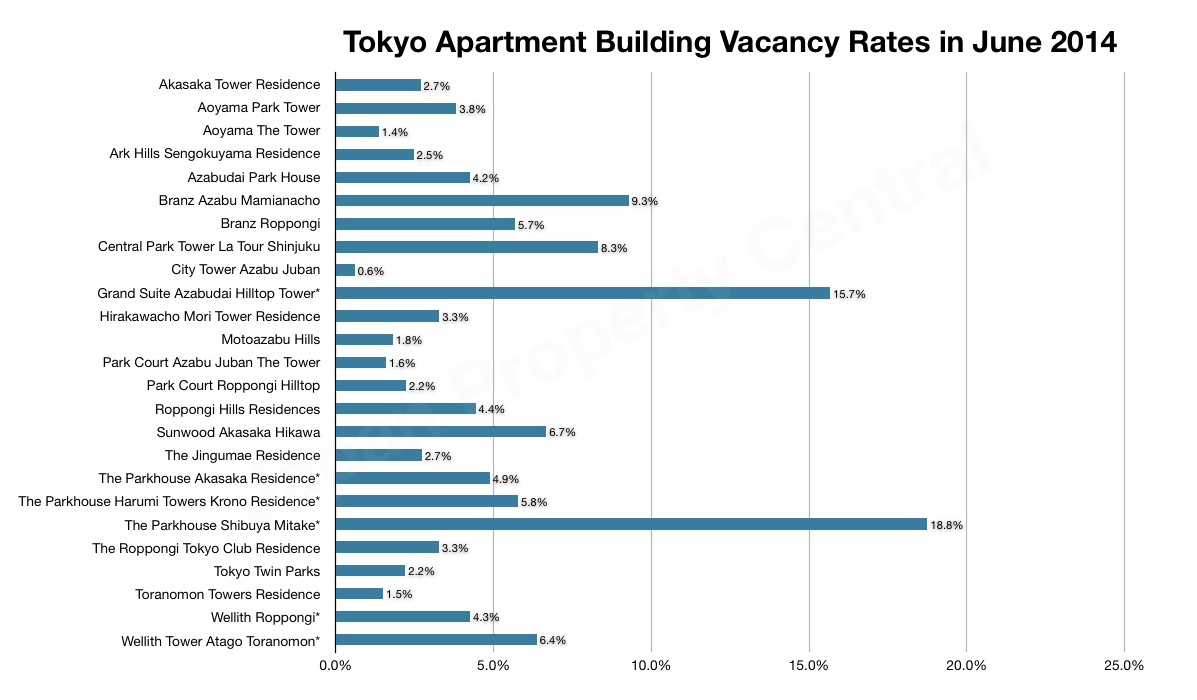

About the data:

- Vacancy rate = The number of apartments currently advertised for rent in that building as a percentage of the total number of apartments in the building.

- These figures are estimates only and Japan Property Central does not guarantee that they are 100% accurate. The data may include apartments that have already been leased but are still being advertised, and may not include apartments that are available for rent but not advertised publicly.

- In recently completed buildings you may see a large number of apartments up for rent in the first few months after completion. This indicates that a lot of the apartment buyers were investors, or that a large number of apartments were given to a landowner/s as part of the redevelopment. It may take a few months before these apartments are rented out.

June rental data - Tokyo Kantei

According to Tokyo Kantei, the average monthly rent of a condominium apartment in greater Tokyo was 2,609 Yen/sqm in June, down 0.5% from the previous month but up 2.7% from last year. All areas within greater Tokyo saw rents decline from the previous month.

The average apartment size was 59.37 sqm and the average building age was 18.7 years.

The average rent in Tokyo’s 23-ku was 3,174 Yen/sqm, down 0.7% from the previous month but up 2.4% from last year. The average apartment size was 56.38 sqm and the average building age was 16.9 years.Read more

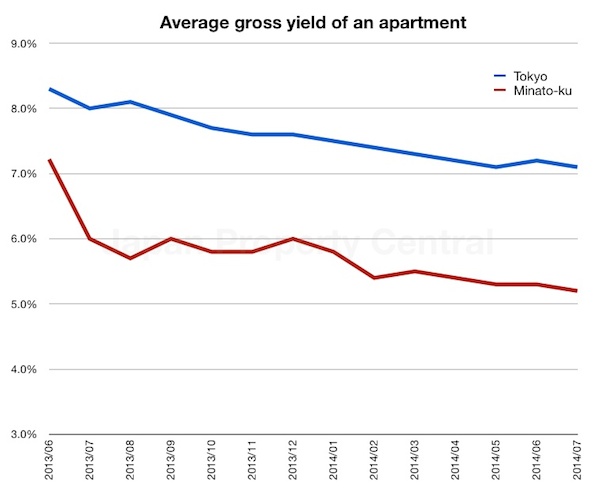

Residential yields and vacancy rates in Minato-ku - July 2014

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in July was 5.2%, down 0.1 points from last month and down 0.8 points from July 2013. The average gross yield across Tokyo was 7.1%, down 0.1 points from last month and down 0.9 points from last year.

The vacancy rate remains unchanged at 9.9% in Minato-ku and 11.0% across Tokyo.

The average asking price of a secondhand apartment in Minato-ku was 785,957 Yen as of July 1, down 0.86% from June. The price growth seen in 2013 appears to have stalled and asking prices have started to decline slightly. The average asking price for land was 1,250,303 Yen/sqm, up 5.9% from last month.Read more

Vacancy rates by apartment building in Tokyo – June

The following is a list of apartment buildings in Tokyo and their estimated vacancy rates in June: