Kyoto carries out first forced demolition

June 15, 2015Demolition,All,Kyoto

On April 30, Kyoto City began procedures to carry out a forced demolition of an abandoned house in Kamigyo-ku. This is the first case of a forced demolition to be carried out by proxy by the city.

The single-storey wooden structure, which was over 65 years old, was at the brink of collapse. It had once been a house with a workshop space that was used for the production of Nishijin-ori textiles. There were two owners listed on the property title, one of whom had since died, and another who could not be contacted.Read more

Central Tokyo apartment transactions up 50% from last year

June 12, 2015Real Estate News,Market Information,All,Tokyo

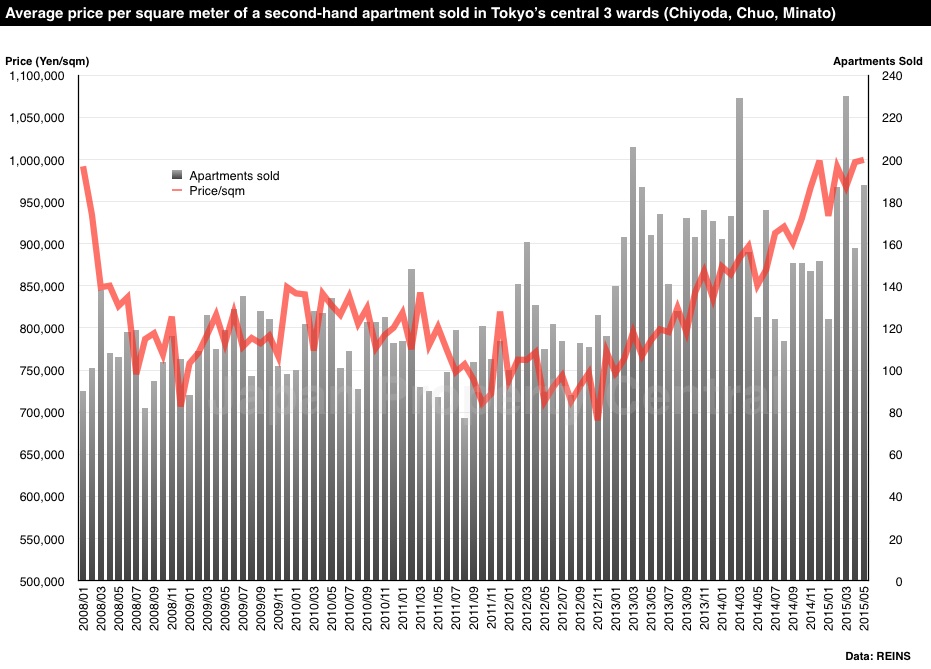

According to REINS, 3,008 second-hand apartments were sold across greater Tokyo in May, up 7.1% from the previous month and up 14.0% from last year. This is the second month in a row to see a year-on-year increase in transactions.

The average apartment sale price was 28,870,000 Yen, up 2.1% from the previous month and up 8.7% from last year. The average price per square meter was 452,800 Yen, up 1.6% from the previous month and up 9.5% from last year. This is the 29th month in a row to see a year-on-year increase. The average building age was 20.18 years.

1,454 apartments were sold in the Tokyo metropolitan area, up 5.6% from the previous month and up 13.4% from last year. The average sale price was 36,170,000 Yen, up 3.6% from the previous month and up 11.8% from last year. The average price per square meter was 613,200 Yen, up 2.7% from the previous month and up 12.8% from last year. The average building age was 19.01 years.

In central Tokyo’s 3 wards (Chiyoda, Chuo and Minato), 188 apartments were sold, up 19.0% from the previous month and up 50.4% from last year. This is the 4th month in a row to see a year-on-year increase in sales. It is the highest number of transactions recorded for the month of May in the past 8 years.

Past transactions in May:

- 2015: 188

- 2014: 125

- 2013: 164

- 2012: 110

- 2011: 87

- 2010: 124

- 2009: 119

- 2008: 106

The average sale price was 53,650,000 Yen, up 0.1% from the previous month and up 14.6% from last year. The average price per square meter was 999,600 Yen, up 0.3% from the previous month and up 17.5% from last year. This is the highest sale price seen since record-keeping began in 2008. The average building age was 16.75 years.Read more

Resort condominiums seeing renewed demand but prices remain down

June 11, 2015Lake Biwa,Resort Apartments in JapanReal Estate News,Market Information,All

Resort condominiums built during the peak of Japan’s bubble economy in the late 1980s are finally starting to see renewed demand. This time around the buyers are not investors, but are people looking for a permanent residence in which to spend their retirement years.

Alongside Lake Biwa’s shoreline stands the Biwako Urban Resort. The resort condominium was built between 1989 and 1991 and contains 770 units in three 15-storey towers. When it was first built, Moriyama City guidelines prohibited the units to be used for personal residences. Owners could only use them as holiday villas. Because of the ‘resort condo’ designation, the developer received several allowances including only requiring car parking for up to 50% of the apartments. The non-residence rules were also written into the building’s management bylaws, although demand from some residents has seen this clause removed from one of the three towers.

The number of residents who call this building their permanent home now numbers over 300.Read more

SMBC restores 89-yr old office building in Osaka

June 10, 2015Historic properties in JapanHistoric Properties,Office/Retail News & Information,Real Estate News,All,Osaka

On May 19, Sumitomo Mitsui Banking Corporation (SMBC) completed the restoration of the 89-year old building that houses their Osaka head office.

The Sumitomo Building was built in 1926 as the headquarters of Sumitomo Bank. The 6-storey building was constructed by Obayashi Corporation and had a total floor area of 36,000 sqm. It was designed by architects Yutaka Hidaka, Eikichi Hasebe and Kenzo Takekoshi of Sumitomo’s construction division. Construction took five years. During construction, the greater Tokyo area was struck by the 1923 Great Kanto earthquake. As a cautionary measure, the building’s proposed floor count was reduced by one storey. A spanish-style private courtyard was built on the top storey.Read more

Land prices continue to climb in latest LOOK Report

June 9, 2015Tokyo Land PricesOffice/Retail News & Information,Real Estate News,Market Information,All,Tokyo

Land prices continue to climb in Japan’s major cities with 84% of survey sites recording an increase in land prices in the first quarter of 2015. 16% of the locations saw no change in land prices, and none of the locations saw a decrease in prices. Two retail locations saw prices rise by 3 ~ 6%: Ginza in Tokyo and an area near Nagoya Station.

Monetary easing and a bullish condominium market is behind the rise in prices in Tokyo, with 90.7% of locations seeing positive growth.Read more

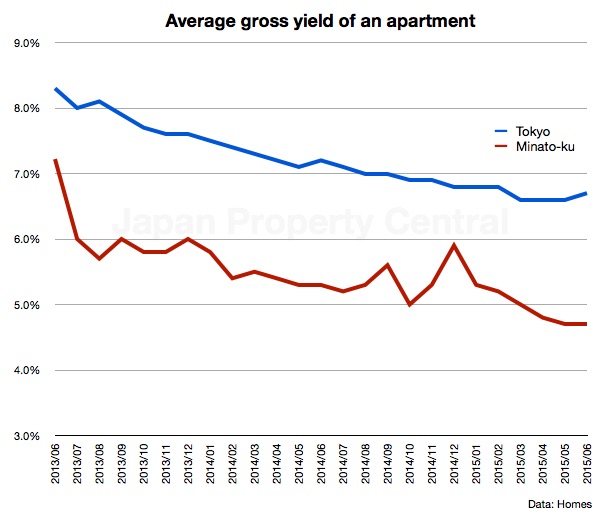

Residential yields in Minato-ku - June 2015

June 8, 2015Rental yield in TokyoReal Estate News,Rental Market,Market Information,All,Tokyo

According to real estate listing site Homes, the average gross yield on an apartment in Minato-ku in June was 4.7%, showing no change from the previous month and down 0.6 points from last year. The average gross yield across Tokyo was 6.7%, up 0.1 points from the previous month but down 0.5 points from last year.

The average asking price of a second-hand apartment in Minato-ku was 857,700 Yen/sqm as of June 1, down 1.4% from the previous month but up 8.2% from last year. The average asking price for land was 1,212,727 Yen/sqm, up 0.1% from the previous month and up 2.7% from last year.Read more

Foreigners buy 174 ha of forestry in 2014, down 10% from 2013

June 5, 2015Foreign buyers of real estate in JapanLand,Real Estate News,Hokkaido,All

According to the Forestry Agency, there were 13 cases of foreign funds acquiring a total of 174 hectares of forestry across Japan in 2014. The buyers, which were private individuals and corporations, were primarily from the British Virgin Islands, Hong Kong and Singapore, and the reasons for purchase were either asset holding or development.

Buyers from Hong Kong accounted for just 8% of the land acquired by foreigners, while buyers registered in the British Virgin Islands accounted for 78% of the land acquired.

Hokkaido is the main destination of foreign funds

Over 99% of the forestry was located in Hokkaido. Buyers from the British Virgin Islands acquired 135 hectares of forestry in Hokkaido’s Iburi sub-prefecture for the purpose of real estate development. The British Virgin Islands is a popular tax haven that may also be used by Japanese investors, so the actual nationality of these buyers is unknown.Read more