Banks to increase home loan rates this month

Several of Japan’s mega-banks plan to increase home loan interest rates this month. The Bank of Tokyo-Mitsubishi UFJ will increase the prime interest rate on their 10-year fixed-rate home loan by 0.10 points to 1.35% for loans approved in July, while Mizuho plan to increase their rate by 0.05 points to 1.30%. Sumitomo Mitsui Trust Bank also plan to increase their prime rate by 0.05 points to 0.95%.

This is the second month to see an increase in interest rates The three banks have no plans to change their variable rates.

Sources:

The Nikkei Shimbun, June 26, 2015.

Jiji Press, June 26, 2015.

PanaHome unveils 6-storey house

PanaHome have opened three 6-storey model homes in Tokyo and Yokohama. These are said to be the tallest model homes to be built in Japan.

The display homes are part of their Vieuno PRO series that includes both residential homes with retail and office space. A change to the inheritance tax laws in January 1, 2015, has caused wealthy landowners in Tokyo to seek ways to reduce their future inheritance tax burden. A residence with a portion that is leased out may be eligible for additional inheritance tax deductions.

The Vieno PRO homes allow for floors with high ceilings (up to 3.15m on the 1st floor), which can appeal to retail tenants, such as convenience stores. The homes can be built up to 7-storeys tall.Read more

College to buy Daikanyama land for 7 billion Yen

The Tokyo Metropolitan Government and Meguro Ward are moving ahead with plans to sell a vacant 8,000 sqm site in Daikanyama to the Tokyo College of Music. The sale price has been estimated at approximately 7.77 billion Yen (63 million USD), or around 970,000 Yen/sqm.Read more

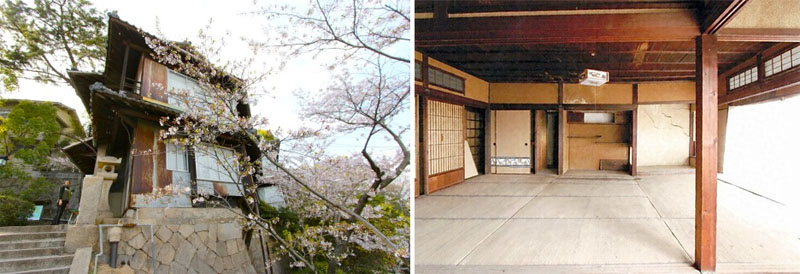

New life for old homes in Onomichi

On the hillside leading up to Senko-ji Temple in Onomichi City, Hiroshima, sits an old wooden house built between 1921 ~ 1923. Despite being registered as a national tangible cultural property in 2013, the historic home had been left empty to rot on the hillside for decades.

Luckily, a local non-profit organisation has stepped in to restore the old property and convert it into a guesthouse. Repairs will start this month, with completion expected by February 2016.

Nagoya says arrivederci to Italian Village

On June 2, the Nagoya Port Authority announced plans to remove the last remaining structures from the former Italian Village. Demolition is expected to cost 330 million.

The Italian Village shopping mall opened in Nagoya’s port side area in 2005, the same year that Turin was announced as one of Nagoya’s sister cities. The 31,000 sqm site included a reproduction of a Venice canal complete with authentic gondolas imported from Italy, a replica of the San Marco Square, a replica of the Statue of David, and a replica of the Bocca della Verita. Many of the 80 specialty stores featured Italian goods and groceries.

The mall was developed under a private finance initiative between the Nagoya Port Authority and Cest la vie Holdings Corporation. In its first year of operations, it had over 4.2 million visitors. By 2008, this number had halved and the operators filed for bankruptcy.Read more

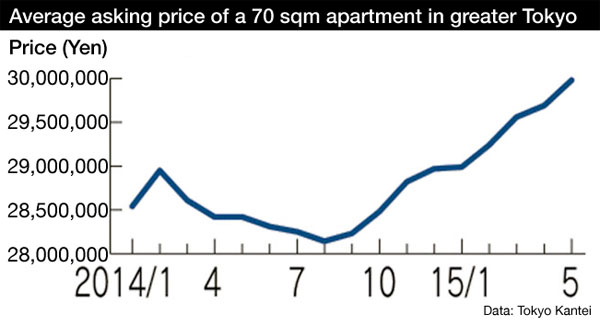

Secondhand apartment prices in May 2015 - Tokyo Kantei

According to Tokyo Kantei, the average asking price of a 70 sqm (753 sq ft) apartment in greater Tokyo in May was 29,980,000 Yen, up 1.0% from the previous month and up 5.5% from last year. This is the 9th month in a row to see an increase from the previous month. The average building age was 22.0 years.

The increasing cost of buying a brand new apartment is causing buyers to shift their attention to the resale market. With the average price of a new apartment over 10 times the average annual income, and far exceeding the normal multiple of 6, more and more buyers are becoming priced out of the new apartment market.Read more

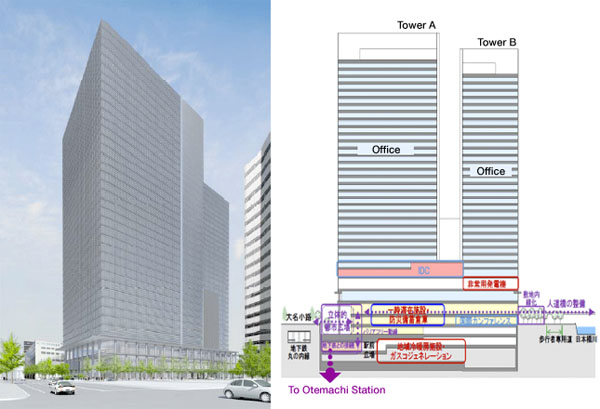

Otemachi 2 Chome Project expected to sell for 200 billion Yen

The Japanese government is redeveloping a state-owned site in the Otemachi district near Tokyo Station.

The Urban Renaissance Agency, a semipublic housing company, will build a two office towers which will then be sold to a real estate company or fund once it has been filled with tenants. The sale price is expected to be over 200 billion Yen (1.62 billion USD), which, if achieved, would make it the highest price ever seen for government property.

To date, the most expensive recorded sale of state-owned land was for the former Japan Defense Agency land in Roppongi (now Tokyo Midtown). The land sold to a consortium of real estate developers in 2000 for 180 billion Yen.Read more